Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The cryptocurrency market — specifically Bitcoin and Ethereum — has performed quite well in the second quarter of 2025, which is a stark contrast to the first quarter’s performance. The premier cryptocurrency capitalized on this bullish momentum, jumping to a new all-time high above the $111,000 mark.

Similarly, the price of Ethereum started its own resurgence and reclaimed the $2,000 mark in early May, albeit the altcoin has been stuck in a consolidation range over the past month. Despite the brewing market uncertainty due to the escalating tensions between Israel and Iran, Bitcoin and Ethereum have managed to stay afloat.

US Investors Keep Crypto Prices Afloat

In a new post on the X platform, on-chain analyst Burak Kesmeci revealed that United States investors have been active in the market over the past few weeks. The crypto analyst explained that this correlates with the Bitcoin and Ethereum prices withstanding bearish pressure in recent weeks.

Related Reading

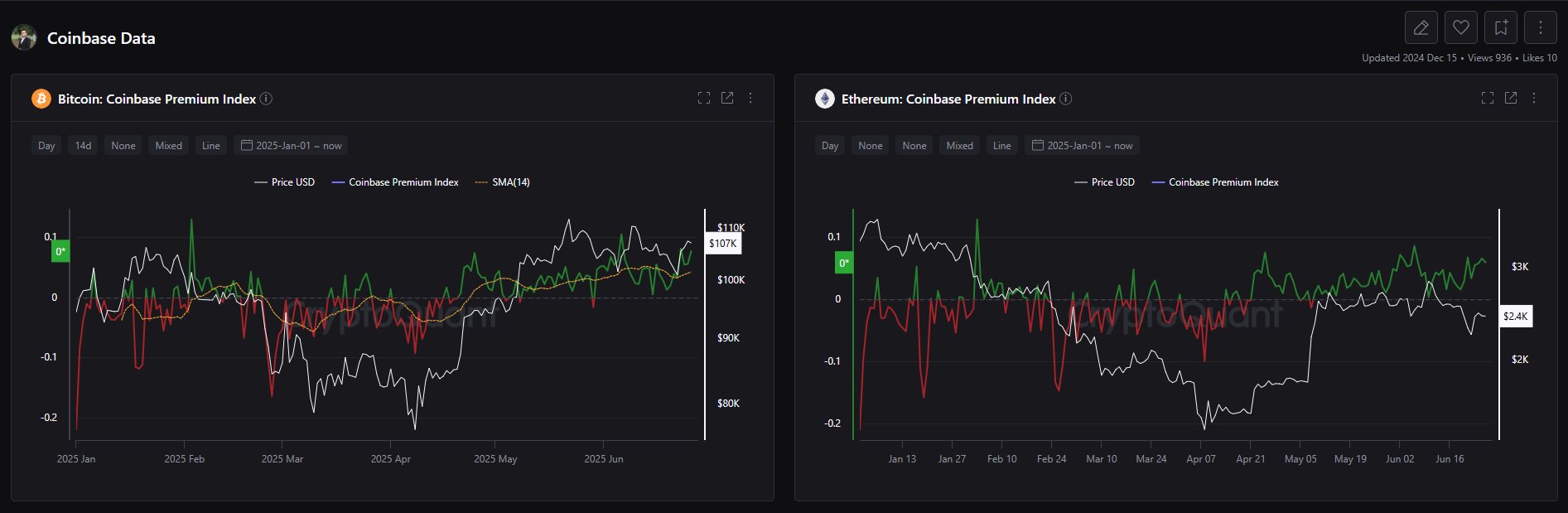

This on-chain observation is based on the Coinbase Premium Index, which tracks the difference between the crypto prices on the US-based Coinbase exchange (USD pair) and global Binance exchange (USDT pair). This metric reflects the sentiment of the US institutional entities (the major players on Coinbase) compared to those on global exchanges.

Typically, when the price premium on Coinbase has a positive value, it implies increasing demand from US investors, who are willing to spend more than other global investors to buy cryptocurrencies (Bitcoin and Ethereum, in this case). On the flip side, the Coinbase Premium Index falling beneath the zero mark signals that US investors are buying less compared to the global traders.

According to Kesmeci, the Bitcoin and Ethereum Coinbase Premium Index (excluding the abrupt dip in BTC on May 29) has been in the positive territory since May 9, 2024. This 47-day streak suggests high buying activity from US institutional investors despite geopolitical tensions.

Kesmeci added:

In the U.S., institutional investors and Bitcoin & Ethereum ETF investors (except for Fidelity) continue their heavy purchases through Coinbase (and have been for weeks). This is why Coinbase Premiums are showing strong positive momentum. Because of this (in my opinion), despite the crises, we haven’t seen a sharp drop in Bitcoin or Ethereum in the market.

In essence, the on-chain analyst believes the Bitcoin and Ethereum prices have been able to weather the storm with the rising tensions in Asia because US investors have been active in the market. Naturally, risk assets tend to succumb to bearish pressure during unstable conditions like wars, global pandemics, and so on.

Bitcoin & Ethereum Price

As of this writing, the price of BTC stands at around $107,100, reflecting no significant movement in the past 24 hours. Meanwhile, the Ether token is valued at around $2,420, with a mere 0.6% price jump in the past day.

Related Reading

Featured image from iStock, chart from TradingView