Image source: Getty Images

Founded in 1996, Polar Capital Technology Trust‘s (LSE:PCT) a stock that won’t appeal to those on the lookout for passive income opportunities. That’s because it doesn’t pay a dividend. In fact, it never has. And it’s the only current member of the FTSE 100 that adopts this approach to shareholder distributions.

Instead, it focuses on capital growth.

Recent performance

During the five years to 31 May, the trust’s share price has increased 71% and its net asset value’s risen 119%.

This compares favourably to another FTSE 100 technology-focused trust – Scottish Mortgage Investment Trust – that’s seen its share price rise by 38% during this period. However, this fund invests heavily in unquoted companies, which can be difficult to value.

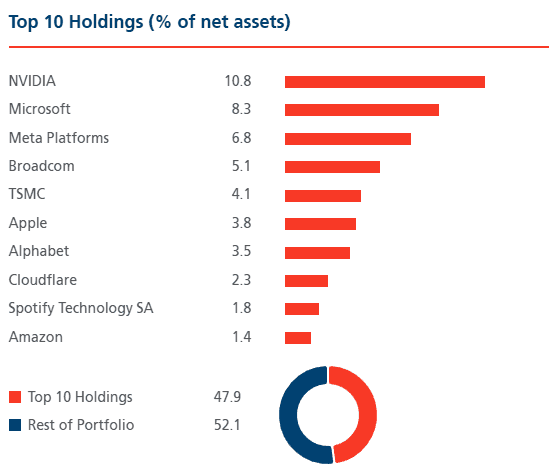

By contrast, much of Polar Capital’s growth can be attributed to having positions in each of the ‘Magnificent 7’. At the end of May, six of these stocks were in the trust’s top 10 holdings. However, it should be pointed out that an equal investment in all seven would have generated a return of over 300% since June 2020.

Diversification’s key

But it’s wise to have a diversified portfolio. By spreading risk across multiple positions, it’s possible to mitigate some of the volatility that arises from investing in the stock market.

And that’s one of the advantages of an investment trust. By owning one stock, an investor will have exposure to multiple companies often in different jurisdictions.

However, although Polar Capital has positions in 98 stocks, they’re all in the same sector. Its manager is particularly keen on artificial intelligence (AI). Indeed, it describes itself as an “AI maximalist”.

Also, over 30% of its exposure is to the semiconductor industry. This could be a concern because history tells us that these types of stocks can be volatile. The tech-heavy Nasdaq dropped 75% between March 2000 and October 2002.

My view

But the trust’s currently (27 June) trading at a near-10% discount to its net asset value. In theory, this means it’s possible to gain exposure to the world’s biggest tech stocks for less than their market value.

However, over 70% of its value comes from North American stocks. Here, there’s still a significant degree of uncertainty as to how President Trump’s approach to tariffs will affect the economy. According to JP Morgan, there’s a 40% chance of a recession this year. And due to their lofty valuations, a downturn’s likely to affect the tech sector — and the Magnificent 7 in particular — more than most.

For those who believe technology stocks will continue to deliver over the long term, I think Polar Capital Technology Trust’s a share to consider. But only as part of a well-diversified portfolio. And anyone taking a position shouldn’t expect to receive a dividend any time soon.