Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

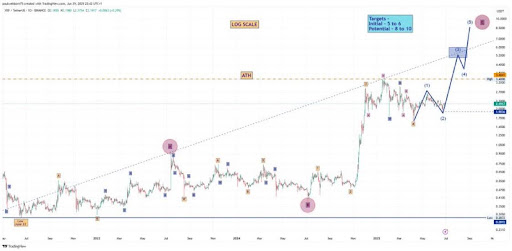

XRP is starting to draw attention again as signs of a potential breakout begin to take shape. With market sentiment gradually shifting and XRP holding key support levels, analysts suggest that the stage may be set for the next impulse wave. If momentum continues to build and critical resistances are cleared, XRP could be on the verge of an explosive price rally to $8.5.

Elliott Wave Points To Major XRP Price Breakout

Paul Webborn, a crypto analyst on X (formerly Twitter), has released a new XRP forecast update, reinforcing his bullish stance on the third-largest cryptocurrency. In his analysis, the market expert reveals that XRP may be entering a powerful impulse phase, with projected targets potentially reaching or even surpassing $8 in the current cycle.

Related Reading

Webborn’s analysis applies Elliott Wave Theory to track XRP’s price movements from its June 2022 low, identifying that point as the start of a new bullish cycle. The chart provides a visual roadmap of XRP’s next moves based on the impulse wave structure.

The cryptocurrency is expected to experience a short-term rise to initial targets below $8, followed by a brief pullback before a final rally that could push XRP to new all-time highs. Notably, the chart shows that primary Waves A and B have already played out, and XRP is now progressing through Wave C, which is unfolding in five intermediate waves.

Intermediate waves 1 through 4 appear complete, with Wave 5 still forming. Webborn notes that this final fifth wave is expected to break down into five smaller minor waves. Minor wave 3 is projected to push XRP toward the $5 and $6 range, while the full extension of Wave C could carry it to between $8 and $10.

The analyst has set an invalidation level at $1.90, meaning any move below that would break the current bullish structure and possibly lead to further downward pressure on the XRP price. Webborn predicts that if the $1.90 level is broken, XRP could potentially experience a crash toward new lows around $0.287, marking more than an 87% decline from its present market price.

However, the chart suggests that this low has already been reached, further reinforcing the bullish narrative that the altcoin may be on the verge of a major upward breakout. While Webborn has provided no specific timeline for his optimistic forecast, the analyst believes that the coming few months could be explosive as the market enters the next phase of the impulse.

Update On Price Action

Lately, the XRP price has maintained strong support above $2, showing strength despite an extended consolidation period. CoinMarketCap data shows that the cryptocurrency is currently trading at $2.22, reflecting a modest 1.35% rise over the past day.

Related Reading

Although XRP is still priced significantly below its all-time high, data from CoinCodex shows that market sentiment remains highly bullish. The cryptocurrency’s Fear and Greed Index also currently sits at 64, firmly in the ‘Greed’ zone.

Featured image from Getty Images, chart from Tradingview.com