Image source: Getty Images

Cash ISAs had slipped out of the headlines recently. But they’ve bounced back into the spotlight this week, amid news that changes to annual allowances are just around the corner.

On Monday (30 June), speculation that the £20,000 yearly limit will be sliced back gained momentum. On that day, government officials said a shake-up could come later in July.

Chancellor of the Exchequer Rachel Reeves will announce changes at her upcoming Mansion House speech on 15 July, these sources told the Financial Times.

A rebasing in the allowance to around £5,000 a year is widely tipped, though sources said a final figure hasn’t yet been settled upon.

Good idea?

Personally, I don’t like the ‘stick’ approach the Chancellor is taking to reduce Brits’ reliance on savings accounts. I think the ‘carrot’ is a better way to encourage people to invest, through better incentives (like the elimination of Stamp Duty on most UK shares) and wider financial education.

However, the rationale to make people think more about investing is sound. Like Reeves, I believe savings accounts like the Cash ISA serve an important role in portfolio diversification, and as a way to hold temporary cash.

But prioritising cash savings as part of a retirement plan can be disastrous. Over the last decade, the average Cash ISA investor has reported an average annual return of 1.21%, according to Moneyfacts.

That’s far below the 9.64% that Stocks and Shares ISA users have typically enjoyed.

Based on those figures, someone investing £300 a month in a Cash ISA would have £130,127 after 30 years (excluding trading fees). If they’d put that in an investing ISA instead, they could have turned that into £628,215.

Talking trusts

The main problem here seems to be misconceptions around the danger to individuals’ capital. People fearing ISA changes might not want to be frogmarched into taking on unacceptable levels of risk.

The good news is that we don’t have to, given the range of investments on offer with a Stocks and Shares ISA.

Individuals can diversify across hundreds of investments to spread risk across regions and sectors if they want to. They can also achieve exposure to different asset classes like gold, cash, and bonds as well as equities.

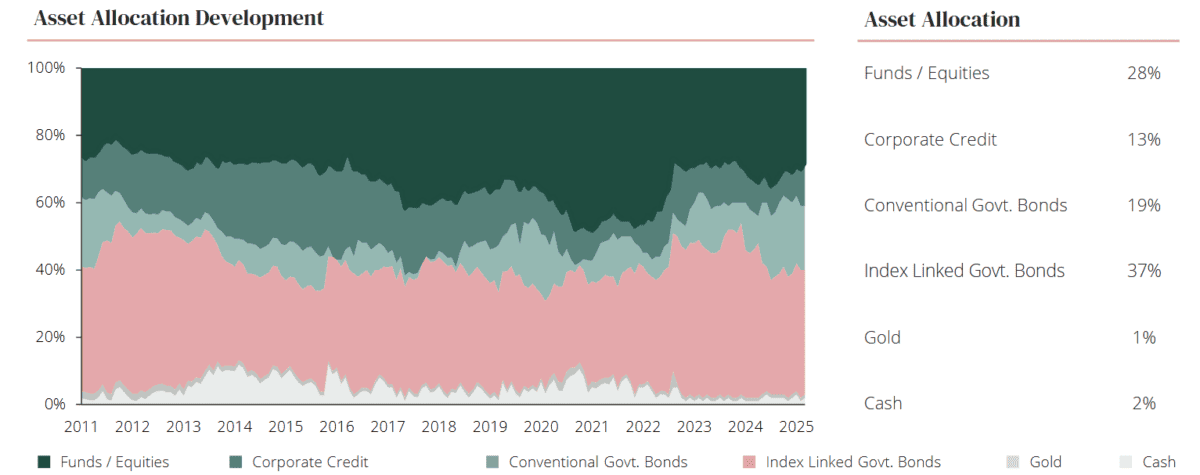

Investment trusts like the Capital Gearing Trust (LSE:CGT) are set up for this purpose. With a mission statement “to preserve and over time grow shareholders’ real wealth“, it invests in equities, bonds, commodities, and cash. And it doesn’t entertain risky strategies like using gearing (borrowed funds) or short selling to achieve it.

Today, the trust has 190 different holdings. These include higher-risk shares and equity-based funds. But as you can see, less than 30% of its capital is tied up in such assets. The lion’s share is in corporate and government bonds, with some gold and cash added in for extra diversification.

Since 2015, Capital Gearing Trust has delivered an average annual return of 4.6%. That’s below the average returns that Stocks and Shares ISA investors have enjoyed. But it still sails above the 1.21% that a Cash ISA would have provided.

This is just one of many trusts and exchange-traded funds (ETFs) Brits can buy to target strong returns whilst still limiting risk. It’s why I don’t think cash savers need to fear upcoming changes to the ISA regime.