Image source: Getty Images

With gold prices near record highs, investors should be looking elsewhere for long-term wealth creation. And the FTSE is probably one of the best place to look.

Today’s UK stock market is packed with fallen shares trading at low valuations. Many of these pay generous dividends. For those with patience and discipline, this environment offers a rare chance to harness the power of compounding and potentially accelerate the path to early retirement.

Opportunity in the UK

The FTSE 100 is forecast to deliver over £83bn in dividends in 2025, up 6.5% from last year. Many blue-chip stocks, such as British American Tobacco, Phoenix Group, and M&G, offer yields of 8% or more. This can be great for compounding.

What’s more, many UK stocks have simply been trading sideways since the end of the pandemic. Legal & General, for example, is up 16% over five years, but is essentially flat against the end of the pandemic.

Low valuations also provide a margin of safety. When quality companies trade at discounts to their intrinsic value, the risk of permanent capital loss falls and the potential for share price appreciation rises.

This is particularly true for firms with strong cash flows and resilient business models, such as National Grid and Legal & General, which have maintained or grown dividends through challenging periods.

Of course, risks remain. Dividends are never guaranteed, and some high yields may reflect underlying business challenges. However, a diversified approach will likely allow investors to harness the FTSE’s unique blend of value and income.

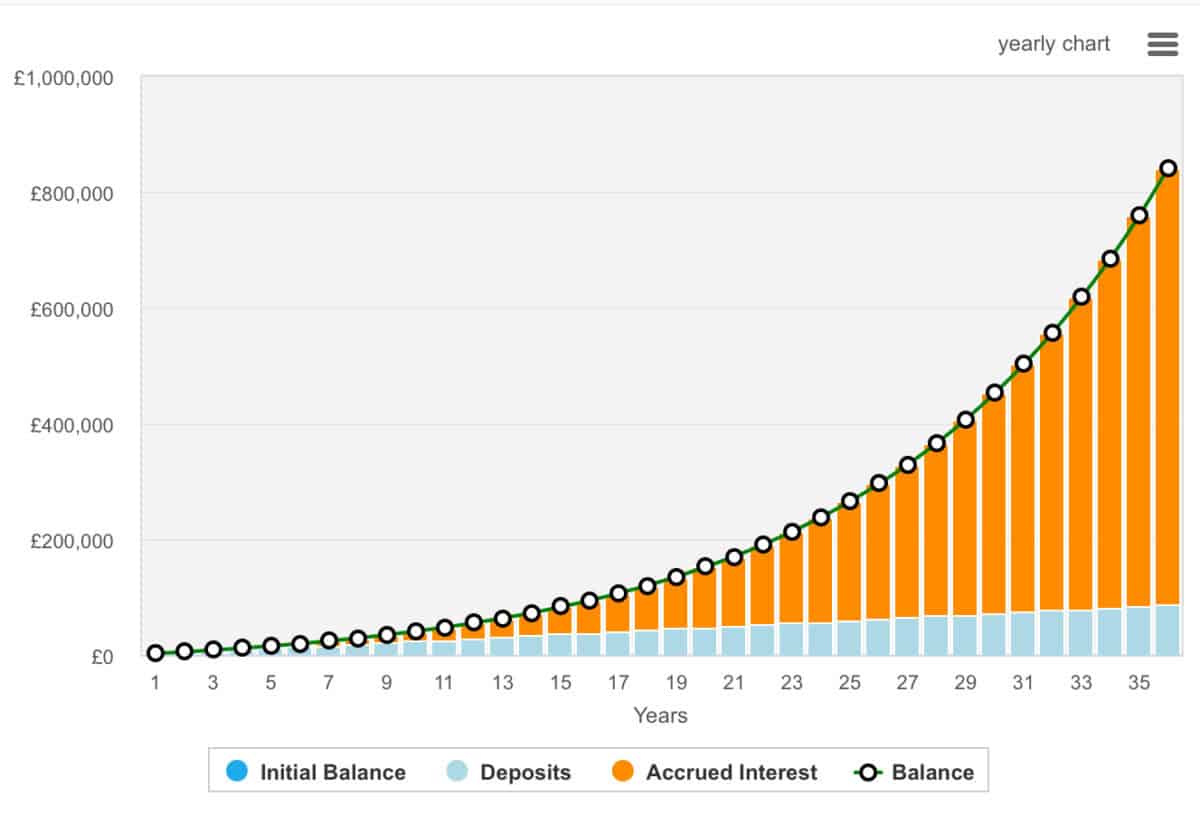

Here’s how a modest monthly investment of £200 could grow at 10% annually.

A potential turnaround

Melrose Industries (LSE:MRO) could be seen as a fallen FTSE stock. While peer Rolls-Royce has surged 1,000% to new highs, Melrose shares have moved sideways or even declined. The aerospace manufacturing stock is actually down 15% over eight years.

This divergence with Rolls is striking given Melrose’s robust fundamentals. In 2024, adjusted operating profit rose 42% to £540m, and the dividend was hiked by 20%. Yet, the market focused on short-term disappointments, such as lower-than-expected free cash flow and revenue slightly missing forecasts, rather than the company’s ambitious five-year growth targets and improving margins.

Melrose trades at a forward price-to-earnings (P/E) of just 14.1. That’s far below Rolls-Royce (34.8) and other aerospace peers, despite its balanced exposure to both civil aviation and defence, and its technology being present in over 100,000 flights daily.

The company is targeting high single-digit annual revenue growth and expects free cash flow to quadruple by 2029. If Melrose delivers on these targets and investor sentiment shifts, the shares could re-rate sharply, closing the gap with sector leaders.

However, risks remain. Net debt has risen to £1.3bn, and ongoing supply chain constraints could pressure margins or delay growth. Nonetheless, for those willing to look past short-term volatility, Melrose offers the rare chance to buy a quality FTSE business at a discount.

This is a stock I’ve been adding to my portfolio, and I think it deserves broader consideration.