Image source: Getty Images

At 344.4p per share, International Consolidated Airlines (LSE:IAG) shares have risen a healthy 13.4% in the year to date. Despite turbulence emerging on transatlantic travel and geopolitical upheaval in other destinations, the FTSE 100 business has continued to climb.

Broader weakness in consumer spending and reduced business activity on ‘Trump Tariffs’ haven’t disrupted the British Airways owner either. The post-pandemic travel boom remains in play, and revenues at IAG, as it’s known, popped 9.6% higher in quarter one. Operating profit surged 191%, beating forecasts.

Given this resilience, can investors expect the company’s shares to continue rising?

Price forecasts

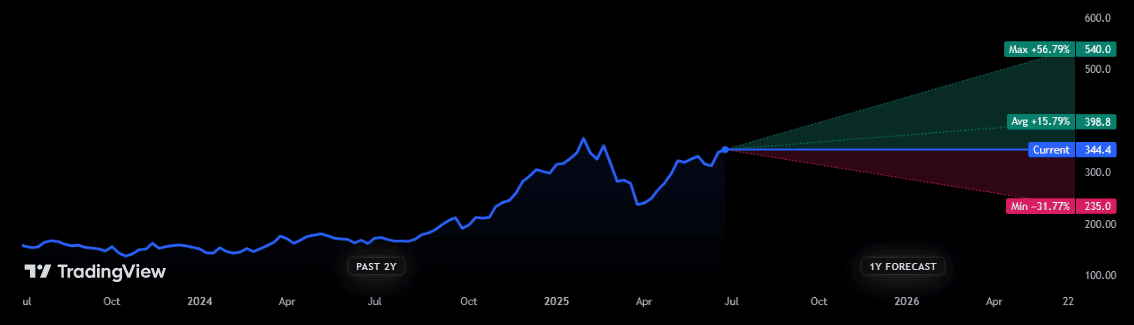

City analysts broadly think so. Of the 25 analysts with ratings on IAG, the consensus is that they will rise to within a whisker of 400p within the next year.

As with any stock, there are a range of views on how the Footsie company will fare. Still, investors should be mindful that the differences between some forecasts are substantial.

On the plus side, the most optimistic broker reckons the business will rise as high as 540p over the period. But a particularly bearish analysts thinks they’ll plummet all the way back to 235p.

Dividend estimates

With profits growth being sustained and its balance sheet mended, IAG paid its first dividend for four years in 2024, of 0.09 euro cents per share. On the strength of recent strong trading City analysts are expecting cash payouts to continue rising over the short term.

They predict:

- A total dividend of 1.09 euro cents per share in 2025.

- A cash reward of 1.25 euro cents in 2026.

These projections mean the dividend yields on IAG is 2.7% and 3.1% for 2025 and 2026, respectively.

Is IAG a buy?

Should individual and business confidence begin to decline, the brand power of IAG’s carriers like British Airways could still allow it to keep growing profits. The company’s exposure to both lucrative transatlantic routes and the low-cost segment may also help support earnings.

Yet I’m not yet convinced enough to buy IAG shares for my portfolio. I feel the company’s habit of reporting impressive profits may be running out of road, with consumer spending worsening in key markets and travel to the US from Europe weakening.

Arrivals to the US from the UK dropped 15% year on year in March, according to the US Department of Commerce.

There’s also the prospect of a fresh surge in oil prices amid simmering tensions in the Middle East. Fuel costs account for around 28% of IAG’s total costs. Those geopolitical issues also threaten disruption on its routes.

The business also has other more lasting problems to contend with as well. These include intense competition in the airline industry, and the threat this poses to passenger numbers and profit margins, and severe operational disruptions at airports and air traffic control systems.

Just today (3 July), Ryainair and easyJet cancelled 400-plus flights due to air traffic controller strikes.

So while I wouldn’t be surprised to see IAG’s share price continued rising, the risks it still faces mean I’d rather buy other stocks instead.