Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

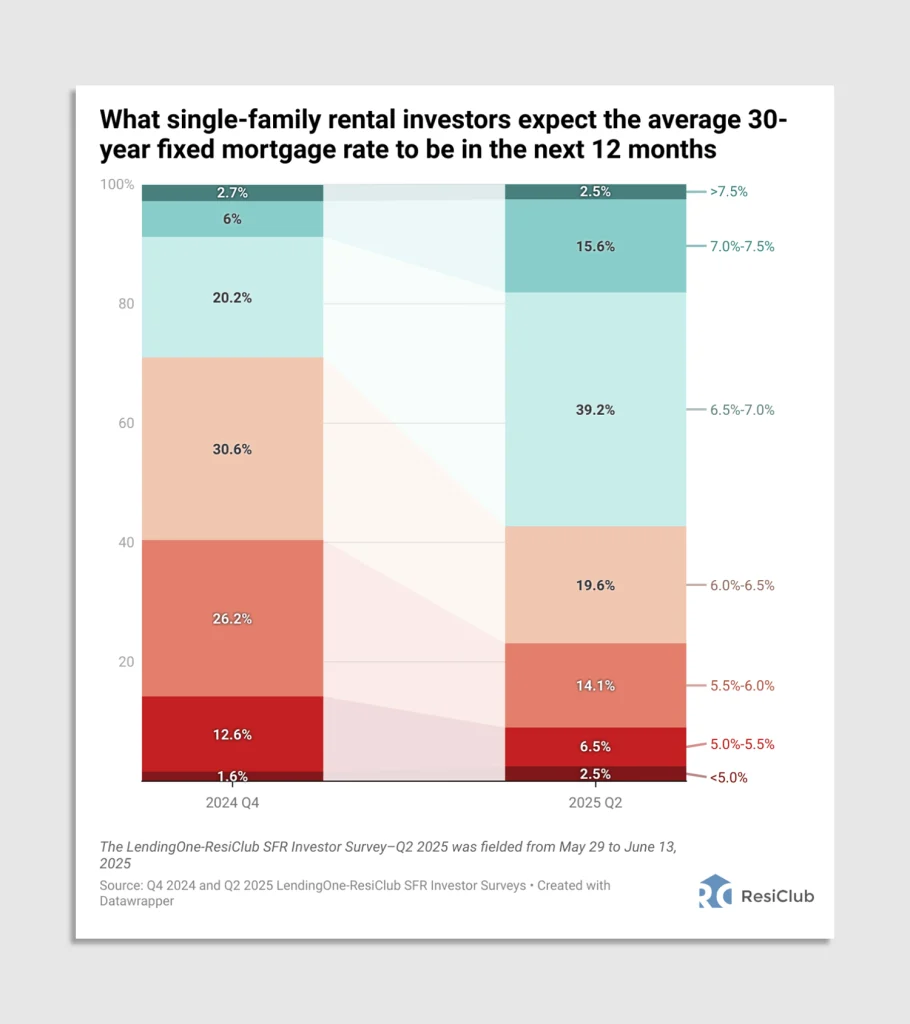

Real estate investors no longer think a material drop in mortgage rates is on the near-term horizon.

That’s one of the main takeaways from the latest survey conducted by ResiClub and LendingOne, among the fastest-growing private real estate lenders in the country.

To participate in the Q2 2025 LendingOne-ResiClub SFR Investor Survey, investors had to own at least one single-family investment property. The survey was fielded between May 29 and June 13. In total, 222 single-family landlords completed the survey.

Topline findings:

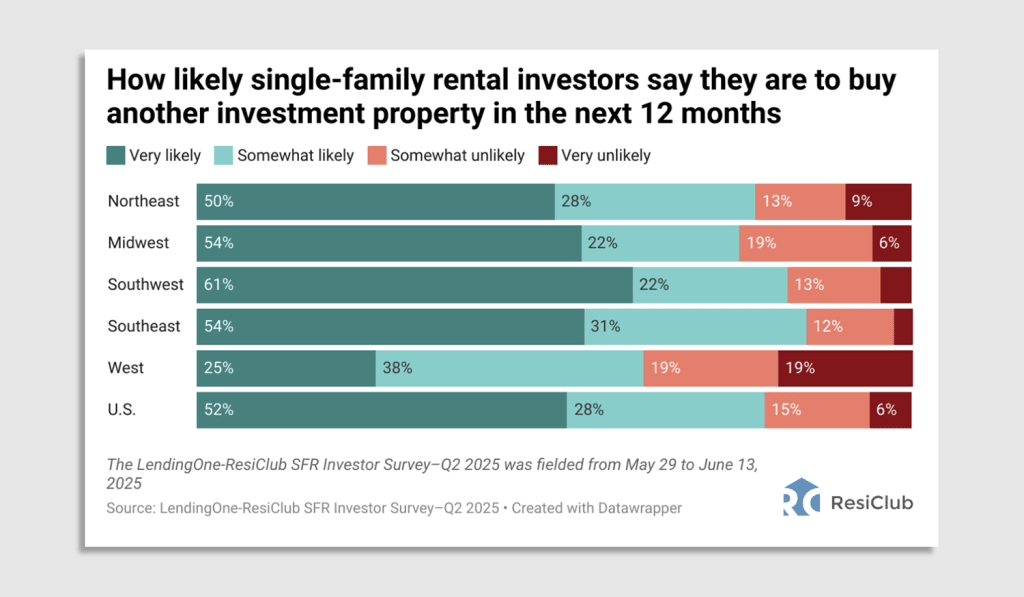

- 79% of single-family investors say they are “somewhat likely” or “very likely” to buy at least one property in the next 12 months. That’s up from 76% in Q4 2024 and 61% in Q2 2024.

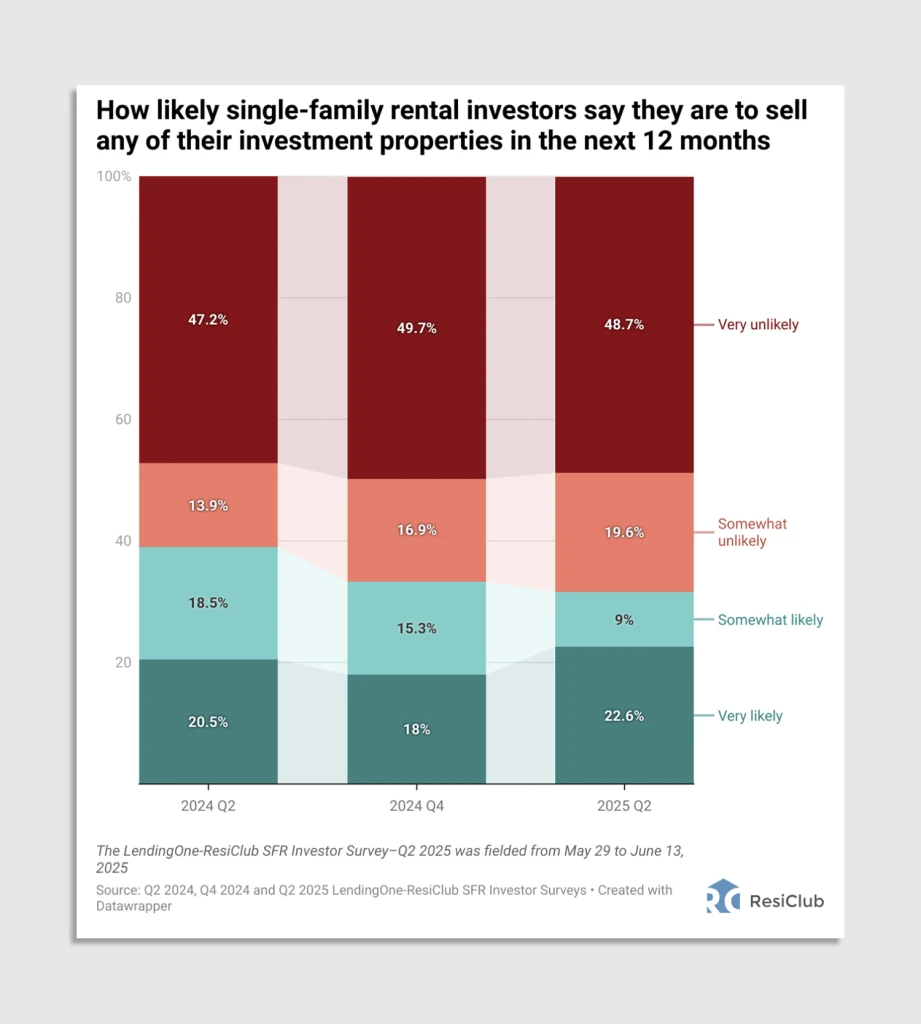

- 32% of single-family investors say they’re likely to sell at least one property in the next 12 months. That’s down from 33% in Q4 2024 and 37% in Q2 2024.

- 57% of single-family investors believe mortgage rates will remain above 6.5% over the next 12 months—up sharply from 29% in Q4 2024 who expected the average 30-year fixed rate to stay above that level.

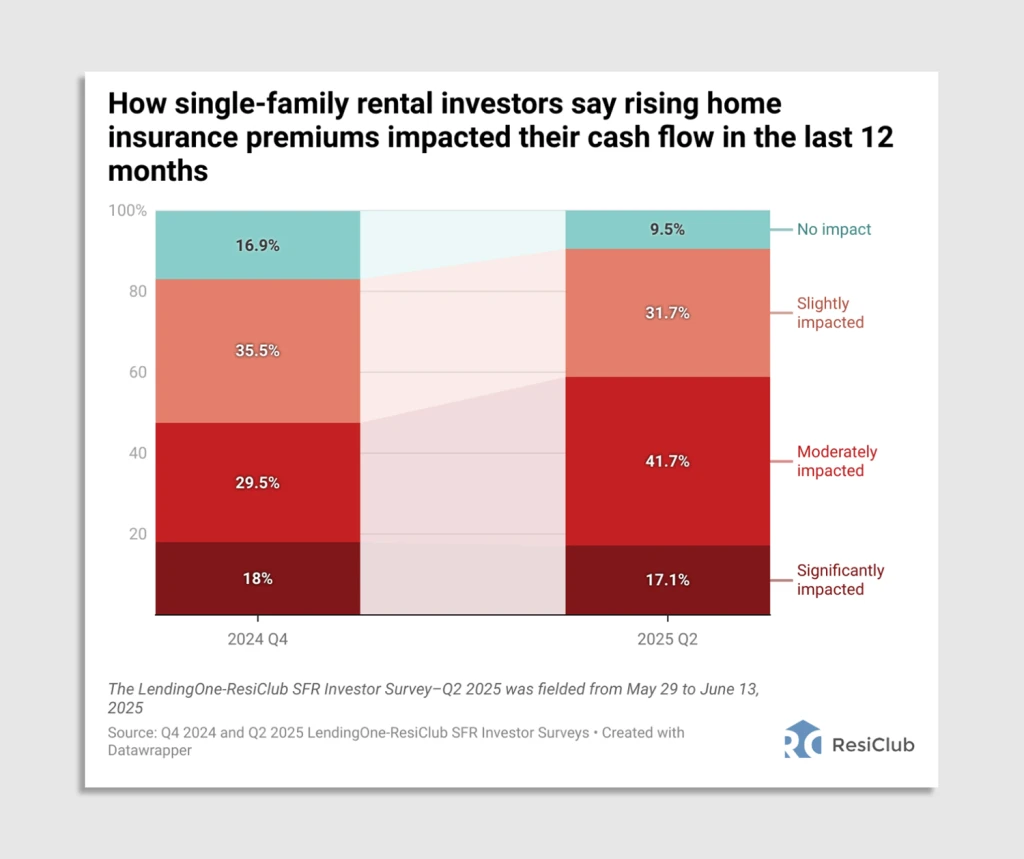

- 59% of landlords say higher insurance premiums have moderately (42%) or significantly (17%) reduced their cash flow over the past year.

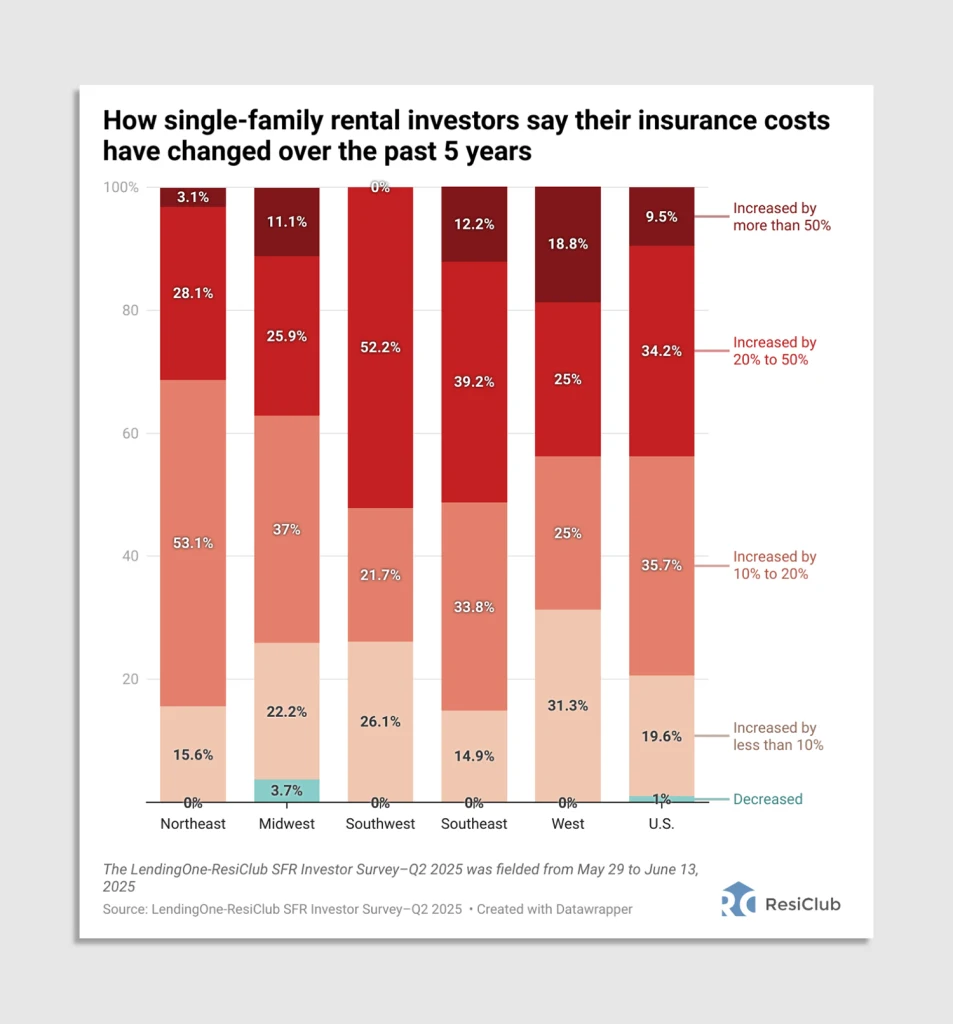

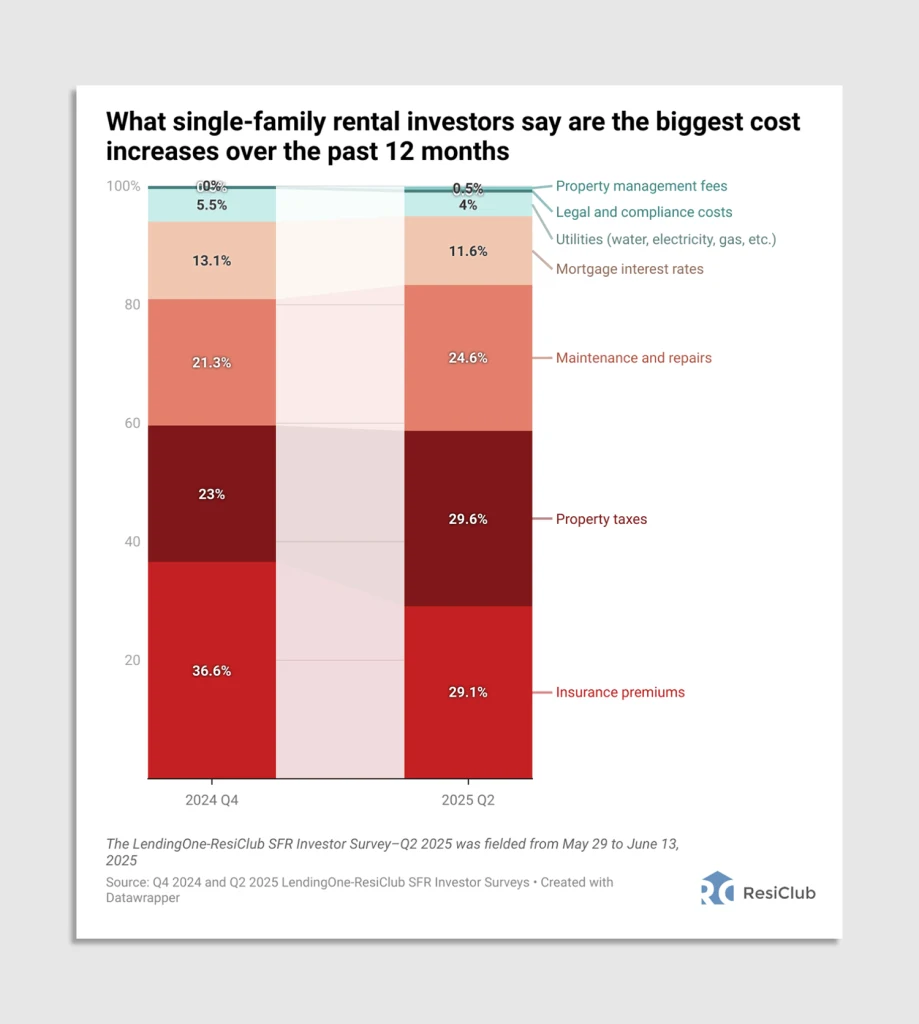

- 30% of investors said property taxes were their largest expense increase last year, followed closely by 29% who cited home insurance. In the West, 19% of landlords report insurance premiums have risen more than 50% over the past five years.

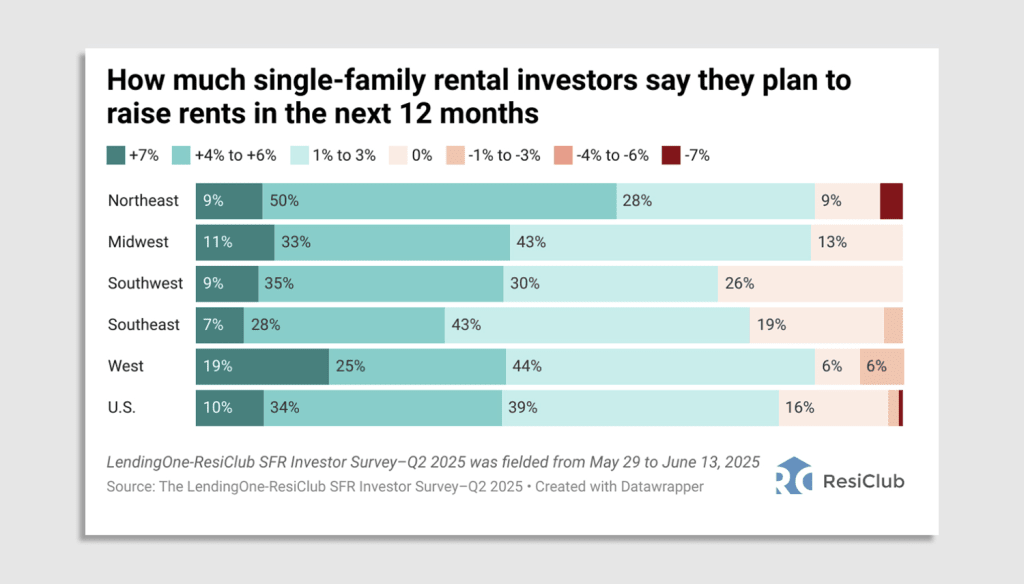

- 83% of landlords plan to raise rents in the next 12 months—but only 10% of landlords expect rent hikes of more than 7%.

Below are the full results.