Officials from Shenzhen have issued cautionary advice to the public, recommending that they pay maximum attention when operating with stablecoins due to mounting reports of abuse from certain schemes.

As these assets become more widely adopted and discussed, this appears to be a step back from the country’s plans to introduce a yuan-backed stablecoin.

The Hype Around a Product Does Not Mean Legitimacy

China’s government has released a notice, stating that certain bad actors are exploiting the public’s limited knowledge of stablecoins, using flashy terms to lure in their victims. Slogans such as “financial freedom” and “digital wealth” are used to tempt people into various scams.

In this notice, the Office of the Special Working Group for Preventing and Combating Illegal Financial Activities advised of the following:

“These entities exploit new concepts such as stablecoins to hype up so-called investment projects involving ‘virtual currencies,’ ‘virtual assets,’ and ‘digital assets”

The perceived lower volatility compared to other cryptocurrencies may make stablecoins a driving force behind the increasing connections to illicit activities associated with them. The authorities went further by stating:

“They engage in false public advertising to solicit funds from the public, giving rise to illegal activities such as fundraising, gambling, fraud, pyramid schemes, and money laundering.”

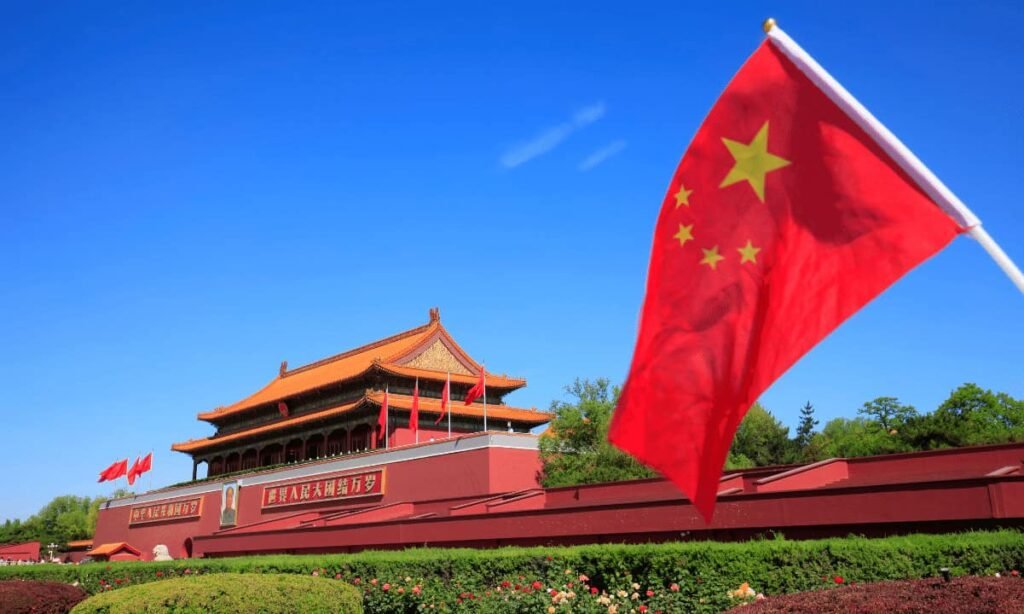

This is a worrying trend, considering that cryptocurrency trading has been banned in China, in addition to other prohibitions on mining.

All the while, this is happening as the country attempts to move forward with its own state-backed stablecoin plans.

Circle’s CEO, Jeremy Allaire, was optimistic during the Binance Blockchain Week about the overall global adoption levels and leaned more towards people’s preference for stablecoins over central bank digital currencies (CBDCs).

How Stablecoins Are Faring Around The World

The stablecoin market cap has experienced significant growth recently, with approximately $50 billion added to a total of $255.6 billion this year alone, according to the most recent data from DefiLlama.

Tether’s flagship product (USDT) remains the leading stablecoin, with a market share of $159.4 billion, followed by Circle’s USDC with $61.9 billion.

The latter recently joined the New York Stock Exchange (NYSE) with the ticker symbol CRCL, bolstering a market capitalization of $45.7B as of the time of writing.

This widespread adoption is also likely sparked by increased regulatory frameworks, such as the GENIUS Act, which passed the Senate with a 68–30 vote last month.

Major retail names are also interested in launching their own stablecoins, aiming to reduce costs and enhance the customer experience.

Moreover, some of the biggest US banks are also not too far behind in similar projects.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!