Ethereum crypto is firm and breaking out. With ETH rallying, traders are targeting $3,500 amid institutional demand from Wall Street.

On a day when Bitcoin surged above $118,000 and printed fresh all-time highs above $113,500, many expected altcoins and some of the best cryptos to buy to follow suit. The good news is that most did rise. XRP crypto climbed nearly 7% to trade above $2.55, while Solana crossed $160, adding 9% in the past week. Among the assets investors and traders were also closely watching was ETH ▲8.81%.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Ethereum Crypto Targets $3,500

Ethereum is slightly up after a relatively subdued first half of the year.

In the last day, the coin pushed above $2,600, racing to trade above $2,900, extending weekly gains to nearly 15%.

At this pace, analysts expect the coin to trade above $3,500 in the coming weeks, setting the pace for further gains to $4,100.

From the Ethereum price chart, the local resistance is around $3,000. If this liquidation level is broken, ETH could easily climb to $3,500 in a buy trend continuation pattern.

This rally, ideally with expanding participation, would confirm the gains of early May 2025, which pushed ETH above $2,000.

DISCOVER: 20+ Next Crypto to Explode in 2025

World Liberty Financial, Institutions Accumulating ETH

Behind these refreshing higher highs are supportive fundamentals that position ETH among the next cryptos to explode in Q3 2025. There may be political links to the recent surge.

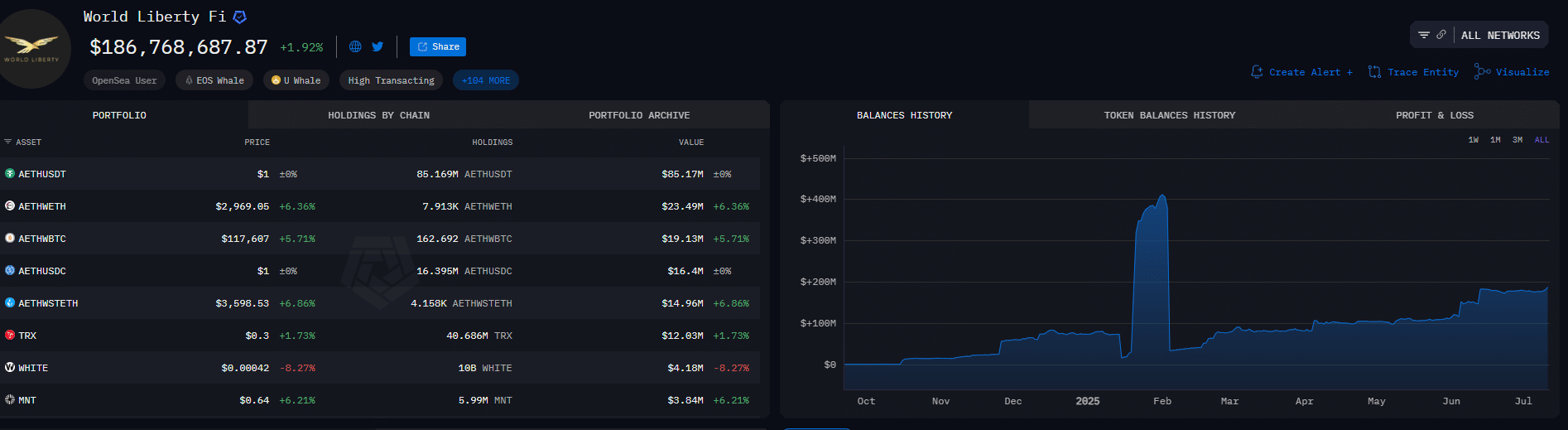

According to Artemis Intelligence, the Trump family has been heavily accumulating Ethereum and Ethereum-based tokens through their DeFi project, World Liberty Financial.

This accumulation comes as no surprise.

Eric Trump, who is behind World Liberty Financial, has previously posted on X endorsing ETH. As of July 11, the DeFi protocol holds over $150 million worth of ETH, supplying it to Aave, a decentralized money market, to earn yield.

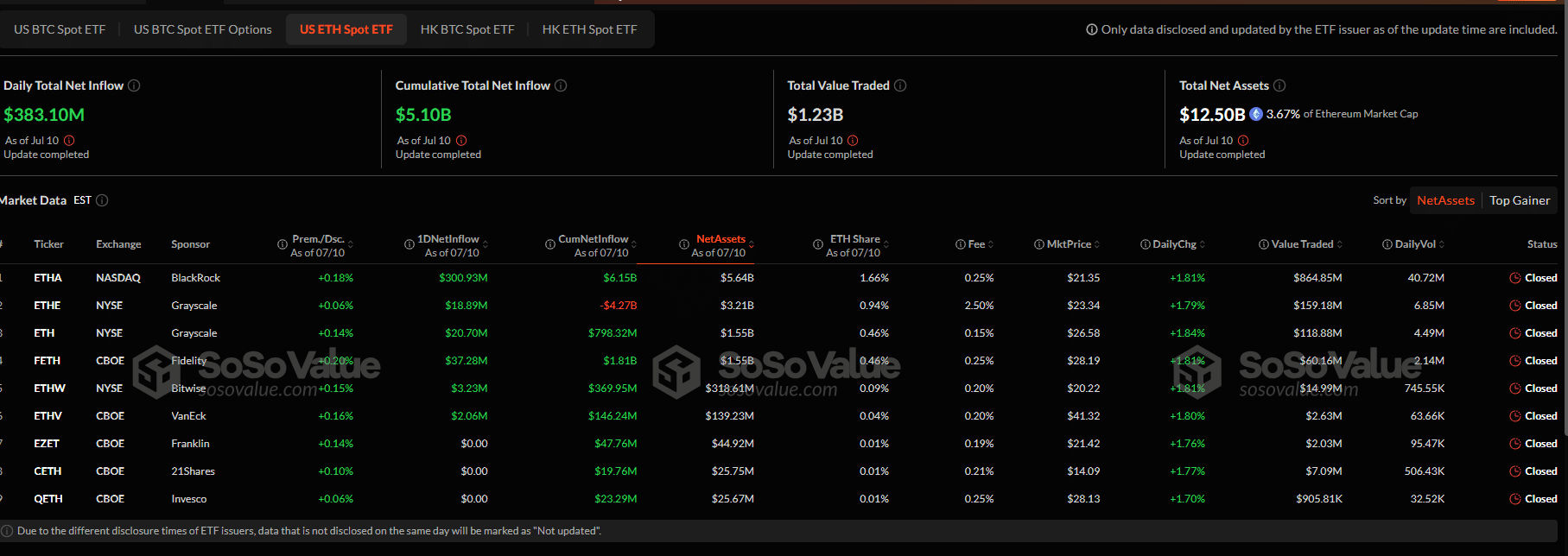

Additionally, there has been sharp interest in spot Ethereum ETFs. According to Soso Value, institutions currently hold nearly 4% of the total ETH supply, or over $12.5 billion in Ethereum-backed shares.

Recent trends show millions in institutional flows into ETH over the last four trading days.

On July 10 alone, institutions scooped up $383 million worth of spot Ethereum ETF shares, primarily through BlackRock and Grayscale.

Interestingly, this wave of demand for ETH comes despite the U.S. SEC not permitting issuers to stake investors’ ETH deposits.

If the regulator lifts this restriction, billions of dollars could flow into spot Ethereum ETFs as institutions scramble to earn a near risk-free yield on their ETH.

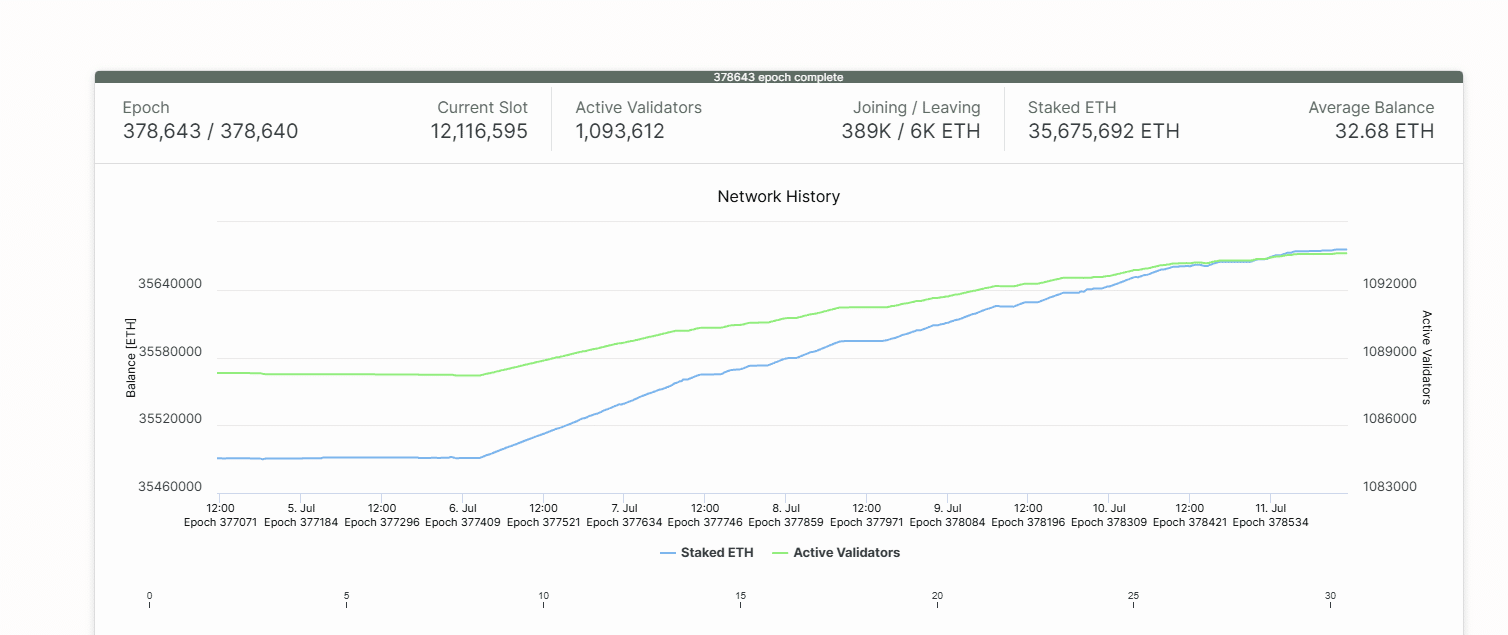

Currently, the Ethereum network offers a 3% APY yield for stakers.

Recent data reveals that over 35.66 million ETH have been staked by more than 1 million active validators. Each validator locks up an average of 32.68 ETH.

Wall Street Watching

Accompanying the current surge are comments from crypto influencers and founders.

Recently, Joseph Lubin of Consensys and Sharplink announced plans to buy tens of millions of ETH.

In an interview, Lubin said Ethereum is gaining traction in how traditional finance views digital assets.

Specifically, he noted the increasing number of companies holding ETH in their treasuries.

Because of the proof-of-stake consensus mechanism, ETH rewards stakers, and the built-in yield makes it attractive for long-term HODLers who want to earn yield on the asset.

In contrast, Bitcoin does not offer holders any yield, and the only way for holders to profit is through capital gains.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Ethereum Price Targets $3,500 Amid Institutional Demand

- Ethereum price firm, bulls targeting $3,500

- Ethereum recovery follows an underwhelming H1 2025

- Spot Ethereum ETF inflows are mostly positive

- Wall Street firms exploring ETH and yield-earning strategies

The post Ethereum Crypto Targets $3,500 Amid Strong Institutional Demand appeared first on 99Bitcoins.