Ethereum is undergoing a critical test after breaking above the key $2,850 resistance level and reaching a local high of $3,080. Since then, ETH has retraced by less than 5%, holding steady and showing signs of strength amid broader market volatility. The ability to maintain levels above $2,850 is being closely watched by traders and analysts as a potential launchpad for the next leg higher.

Related Reading

Market sentiment remains increasingly optimistic, fueled by strong fundamentals and signs of institutional accumulation. According to on-chain data, SharpLink Gaming—one of the first Nasdaq-listed companies to develop a treasury strategy centered on Ethereum—purchased another $73,210,000 worth of ETH yesterday. This marks another strong signal that smart money is confident in Ethereum’s long-term value.

As the crypto market awaits key developments from US regulators during “Crypto Week,” Ethereum’s price action and on-chain indicators remain aligned with a bullish outlook. If ETH can hold current levels and build momentum, the path toward $3,500 becomes increasingly realistic. With rising institutional demand and strong network fundamentals—including record ETH staking—Ethereum appears well-positioned to lead the next phase of the altcoin market rally.

SharpLink Becomes Largest Public ETH Holder With $611M in Ethereum

SharpLink Gaming has officially become the largest publicly known holder of Ethereum, with total holdings now reaching 205,634 ETH, valued at approximately $611 million. This milestone positions the Nasdaq-listed company at the forefront of institutional Ethereum adoption, setting a new benchmark for corporate treasury strategies in the crypto space.

Top analyst Ted Pillows confirmed the latest purchase through on-chain data, revealing that the transaction originated from a Coinbase Prime hot wallet, commonly used by institutions for large-scale acquisitions. This move signals increasing confidence in Ethereum’s long-term value, particularly as companies begin diversifying beyond Bitcoin to gain exposure to smart contract infrastructure.

Ethereum’s technical setup remains strong, with price holding well above the $2,850 support zone following its recent move to $3,080. At the same time, fundamentals continue to improve. The ETH supply staked has reached new all-time highs, indicating that more long-term holders are locking up their assets rather than selling into strength. Combined with increased institutional interest, this reflects growing conviction in Ethereum’s role as a foundational layer for Web3.

The coming weeks promise to be pivotal. With market sentiment turning bullish and Ethereum gaining traction in corporate circles, the stage is set for a sustained upward move, especially if broader macro and regulatory conditions remain favorable.

Related Reading

ETH Holds Above Key Breakout Zone

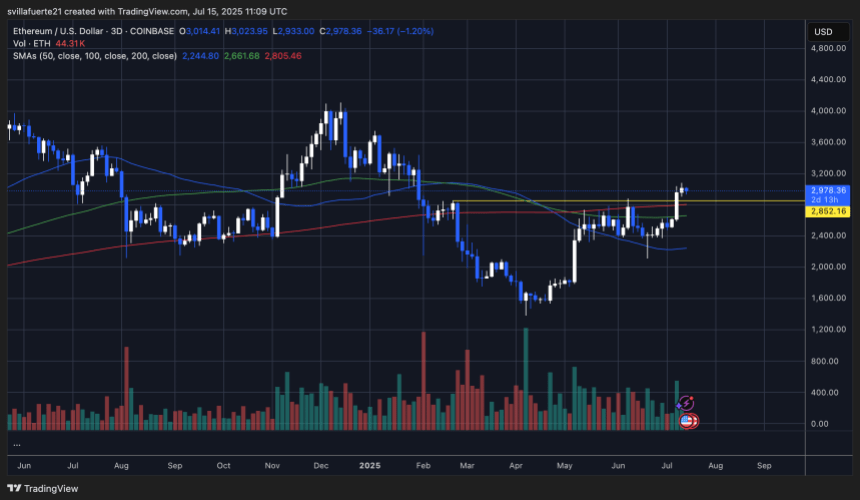

Ethereum’s 3-day chart shows a bullish continuation pattern, with price currently holding at $2,978 after recently breaking through a critical resistance zone at $2,850. The breakout marked a shift in momentum following a prolonged consolidation phase and pushed ETH to a local high of $3,041.41. Although a slight retracement followed, the current structure remains strong as bulls successfully defend the $2,850–$2,900 area.

This level is particularly important as it aligns with multiple technical indicators. The 200-day simple moving average (SMA) sits at $2,805.46, now acting as dynamic support. ETH also remains well above the 50-day and 100-day SMAs, currently at $2,244.80 and $2,661.68, confirming that the broader trend has turned bullish.

Related Reading

Volume remains elevated, suggesting continued buying interest on dips. If ETH holds above $2,850 in the coming sessions, the next logical target is the $3,300–$3,500 zone, where previous highs and psychological resistance converge.

Featured image from Dall-E, chart from TradingView