BlackRock spot Bitcoin and Ethereum ETFs saw $14.1B in Q2 2025 inflows, pushing digital assets under management to $79.6B. With Bitcoin hitting $123,000 and institutional adoption soaring, more is expected.

With crypto prices soaring and Bitcoin breaching $123,000 this week, HODLers and traders are riding a wave of optimism. The surge in spot valuation, nearing record highs, is partly due to the institutionalization of crypto following the approval of spot Bitcoin and Ethereum ETFs in 2024.

BlackRock, the world’s largest asset manager, is a major player in the spot Bitcoin and Ethereum ETF market. It issues billions in digital asset-backed shares to institutions, primarily in the United States.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

BlackRock Sees $14.1 Billion in Inflows to Spot Ethereum and Bitcoin ETFs in Q2 2025

According to their recent earnings report, BlackRock, which focuses solely on spot Bitcoin and Ethereum ETFs and does not offer products for other altcoins, reported $14.1 billion in net inflows into its spot Bitcoin and Ethereum ETFs in Q2 2025.

This influx boosted its digital assets under management (AUM) to $79.6 billion. The growth signals that crypto assets are becoming a big part of global finance, buoying capital flow into some of the best meme coin ICOs. Wall Street is increasingly monitoring the space, and institutions are eager to gain exposure to these non-yielding assets.

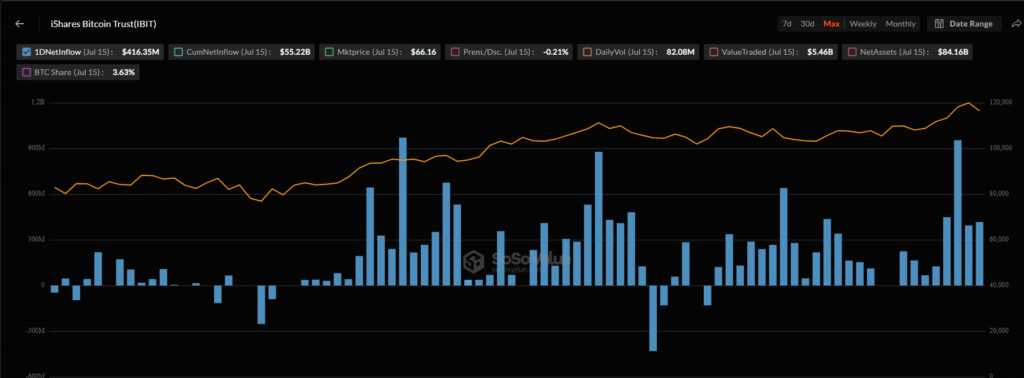

As expected, BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounted for the majority of inflows, driving growth and redefining the global ETF landscape as the fastest-growing ETF in history.

Data shows IBIT currently manages $84.16 billion as of July 15, with steady inflows since June 9. Meanwhile, its ETHA product for spot Ethereum ETFs manages $6.6 billion, with consistent inflows since July 3.

Their spot Bitcoin and Ethereum ETF products collectively manage over $90 billion. However, according to official SEC filings, their total stood at $79.6 billion in Q2 2025, representing just 1% of BlackRock’s $12.5 trillion in assets under management (AUM).

In Q2 2025, BlackRock earned $40 million in fees as net inflows rose by $14.1 billion.

The Trend Will Only Continue

With rising crypto prices, including those of the top Solana meme coins, investors are increasingly exploring regulated assets like spot Bitcoin and Ethereum ETFs.

On July 15, spot Bitcoin ETFs saw inflows of over $402 million, while spot Ethereum ETFs recorded over $192 million in net flows.

As BTC ▲2.02% prices rally, IBIT will only continue to break records. It became the first ETF to reach $80 billion in AUM in less than two years.

In comparison, the Vanguard S&P 500 ETF (VOO) took nearly six years to reach this milestone.

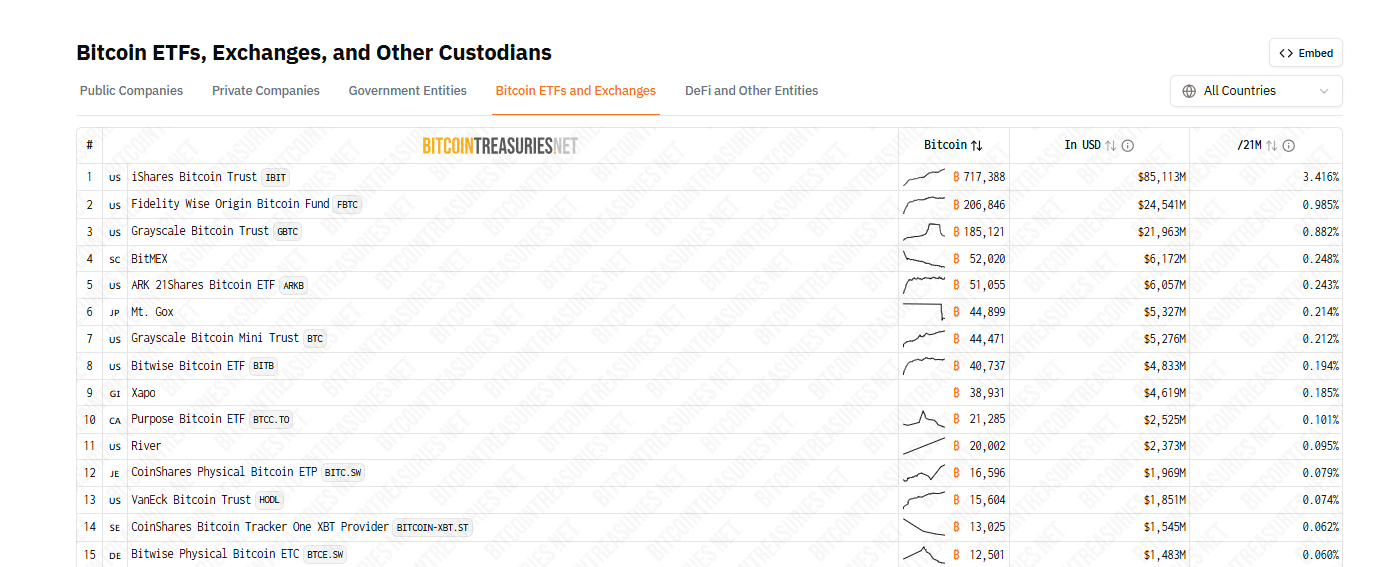

IBIT currently holds over 717,000 BTC, or 3.4% of the total Bitcoin supply, surpassing MicroStrategy’s 601,550 BTC but trailing Satoshi Nakamoto’s wallet, which holds 1 million BTC.

Beyond rising crypto prices, the Donald Trump administration’s policies encourage institutional investment in digital assets.

Proposals for a Bitcoin Reserve in the United States and reduced regulatory barriers are boosting investor confidence.

This is further supported by Donald Trump’s Trump Media & Technology Group (TMTG), which has taken steps to launch spot Bitcoin ETFs.

New filing for the Truth Social Crypto Blue Chip ETF, which will be a spot crypto basket holding Bitcoin, Ether, Solana, XRP and Cronos pic.twitter.com/Bs0cEGNbdb

— Eric Balchunas (@EricBalchunas) July 8, 2025

In early June, TMTG filed an S-1 registration statement with the SEC to launch the Trust Social Bitcoin ETF.

A month earlier, NYSE Arca filed a 19b-4 form for Yorkville America Digital, a close TMTG partner.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

BlackRock Bitcoin And Ethereum ETFs $14.1B Inflows In Q2 2025

- BlackRock spot Bitcoin and Ethereum ETFs attracted over $14 billion in inflows in Q2 2025

- Rising Bitcoin and crypto prices are driving inflows

- IBIT is the fastest-growing ETF in the world

- Supportive regulations under Donald Trump boost investor confidence

The post BlackRock Sets New Record: Digital Assets See $14.1B Inflows in Q2 2025, $79.6B AUM appeared first on 99Bitcoins.