Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

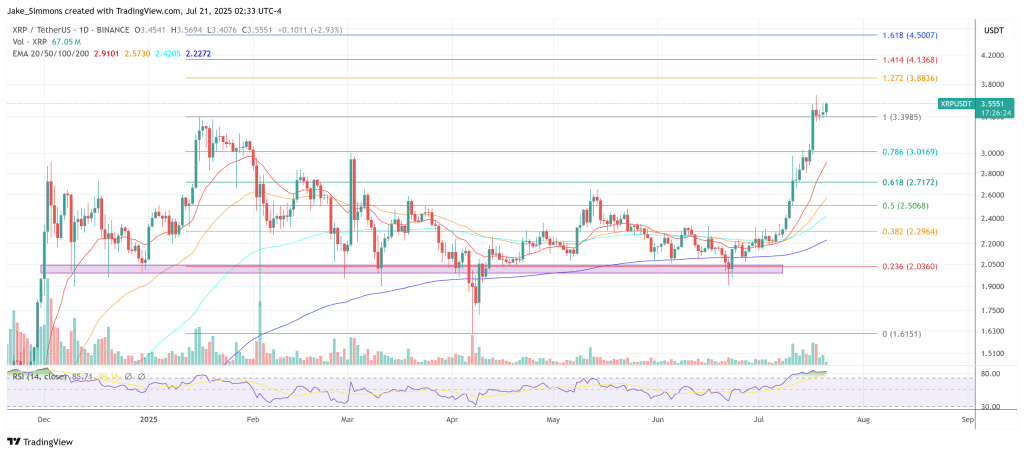

Pseudonymous market technician Dr Cat has laid out a tightly argued roadmap that would see XRP triple from its current range to between six and ten dollars within the next two months—provided Bitcoin’s ongoing advance carries the benchmark asset to $144,000.

XRP Poised For $10 If This Happens

In a series of posts over the weekend, the analyst noted that XRP’s monthly chart against BTC is “coiling” just beneath a crucial Ichimoku Cloud threshold at 2,674 satoshis. “If this month closes above 2 674 I think we should go at least to 4 135 in the next couple of months,” Dr Cat wrote, adding that such a close would deliver the first bullish monthly kumo twist for the pair since 2018 and place XRP in a “support‑and‑regain” configuration rarely seen in altcoins during the current cycle.

The 4,135–7,600 satoshi band marks what Dr Cat calls the “resistance / take‑profit zone.” He argues that price seldom reloads immediately after such a multi‑year breakout and that a wick to the upper end of the zone is likely once momentum ignites.

Related Reading

“All in all, if BTC goes to 144 K on this weekly move, this price range for XRP in USD translates to $6–$10,” the analyst told followers, pencilling the move in for August or September if Bitcoin’s trend steepens. Dr Cat conceded that the optimal risk‑reward evaporates above 7,600 sats—“Would you risk a 10× unrealised gain for another 0.7×?”—and said he would rotate out of the position even though longer‑term targets above $30 remain “plausible” into 2026.

On the XRP‑USD chart the picture is similarly constructive. Sunday’s weekly close above $3.37 turned both the cloud and the Kijun‑sen higher and produced a textbook Chikou Span breakout in week 27 of the Ichimoku time cycle, the so‑called Henka‑Bi candle.

Dr Cat’s price‑projection grid aligns traditional Fibonacci extensions with Ichimoku price‑measurement theory: the N‑wave objective sits at $4.53, the E‑wave at $6.31 and the 2E extension at $9.22. “With the condition of this weekly close all of them are on the table for the next one to two months and $4.5 should be the absolute minimum,” he wrote, recalling that the same $4.5 target had been floated as “minimum” when XRP traded at $1.89 in early April.

Market context lends partial support to the thesis. Bitcoin is trading just above $118,500 after a subdued weekend session, consolidating a 20 percent rally since the start of July, while ether holds near $3,760 and dominance continues to erode in favour of large‑cap altcoins. XRP itself is hovering around $3.55 following a 50‑percent weekly burst.

Related Reading

Technically, the “monthly close above 2,674 sats” remains the gating criterion. A failure to secure that level would postpone the kumo twist and risk another quarter of range‑bound drift versus Bitcoin. Conversely, a decisive move into the 4,135–7,600 satoshi band would confirm the first bullish market‑structure shift on the long‑term ratio chart in seven years and almost certainly drive speculative flows into the XRP‑USD pair.

Traders watching for additional confirmation will be tracking whether the Chikou Span can clear price on the weekly timeframe “this or next week”—a rare but powerful signal that the analyst warns could invalidate the “healthy cross” caveat and send the market vertical even before the textbook Tenkan‑Kijun crossover materialises.

For now, the path to $6–$10 hinges on Bitcoin’s ability to extend its breakout toward the six‑figure mark. If the flagship asset stalls below $120,000 the proportional upside for XRP compresses; should the rally continue, Dr Cat’s stacked Ichimoku‑Fibonacci objectives argue that $4.5 comes first, $6 follows quickly and the fabled $10 print is finally “on the table” as the trifecta of cloud twist, time‑cycle symmetry and momentum converge.

At press time, XRP traded at $3.55.

Featured image created with DALL.E, chart from TradingView.com