Michael Saylor is back at the Bitcoin buffet, and this time he brought a bigger plate. Strategy Inc. has expanded its preferred equity raise from $500 million to $2 billion, doubling down (or should we say quadrupling down) on its BTC ▼-1.27% accumulation campaign.

The Series A Perpetual Stretch Preferred Shares are set to price at $90 with a 9% dividend, according to Bloomberg.

“The company is poised to price the shares at $90 each, the bottom of a marketed range,” – Unnamed source, Bloomberg

The move reflects both persistent demand for Bitcoin-linked exposure and Saylor’s ongoing conviction that BTC belongs at the core of modern treasury strategy.

Michael Saylor: ‘Why This Matters for Bitcoin and Institutional Investors’

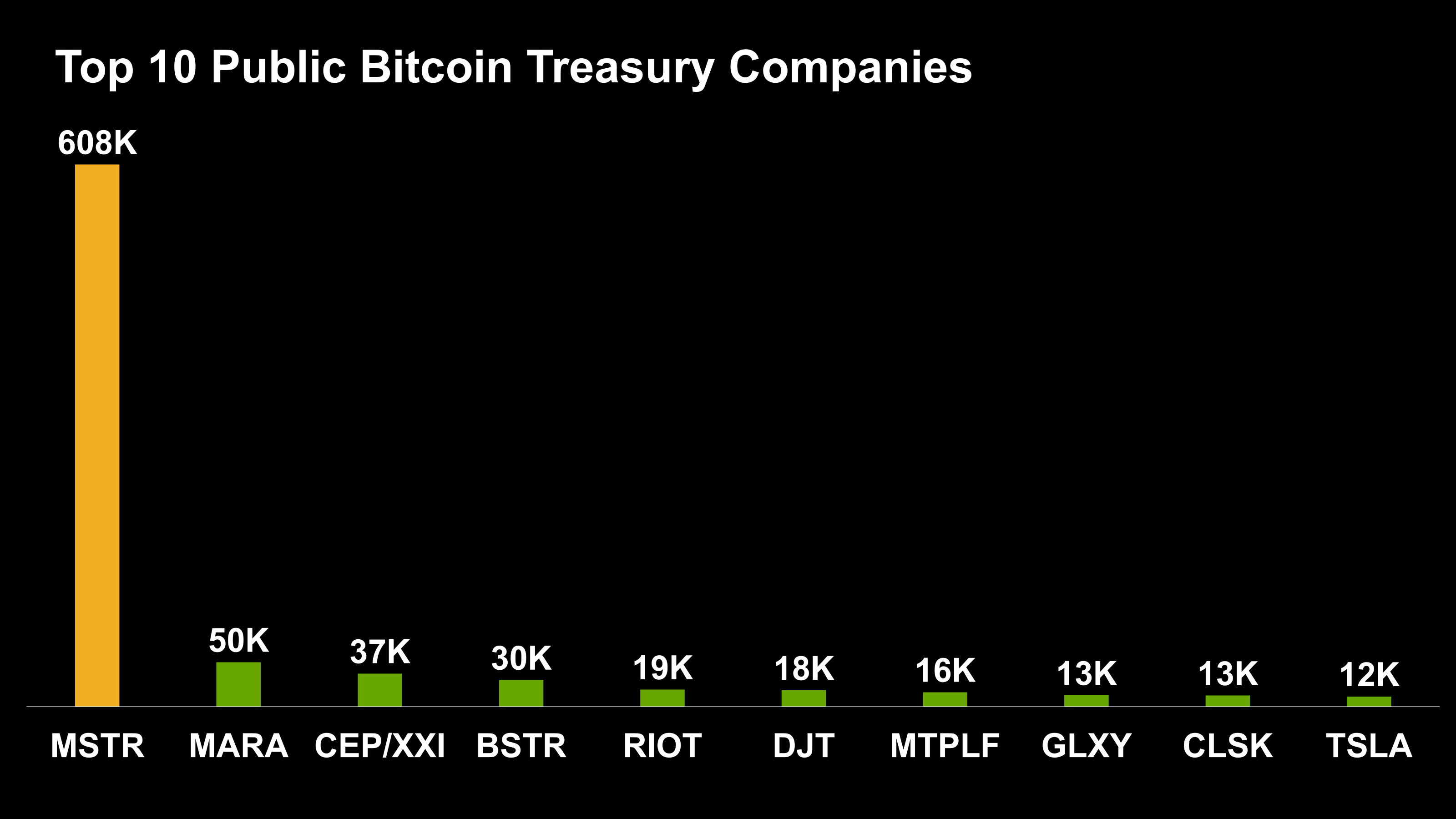

Strategy already holds 607,770 BTC, valued at roughly $72.4 billion, which represents over 3% of Bitcoin’s total circulating supply. The fresh $2 billion in preferred equity could push that number even higher.

The offering is being led by Morgan Stanley, Barclays, Moelis & Co., and TD Securities and includes 5 million shares that rank senior to most of Strategy’s existing preferred and common shares, but remain junior to its convertible debt and “Strife” preferred class.

Michael Saylor has described Strategy’s fundraising mechanism as a “quadratically reflexive, engineered instrument” that allows the company to buy Bitcoin at favorable prices using capital raised at high valuations.

The idea is simple: raise funds through preferred stock or bonds when Strategy stock is riding high, then deploy that capital to accumulate Bitcoin, which may boost the company’s valuation even further. Rinse, repeat. Saylor is a mad lad.

BTC Market Reaction and Outlook

At the time of writing, Bitcoin (BTC) trades near $115,300, down slightly on the day. Shares of Strategy hovered near even during Thursday’s session but slipped 0.44% in after-hours trading. Despite the dip, momentum remains strong, and institutional sentiment continues to lean bullish.

Whether this approach continues to reward investors depends largely on one variable: the price of Bitcoin. But in the world of crypto maximalism, Saylor is primed to become the next Warren Buffett.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

DISCOVER: Best Meme Coin ICOs to Invest in Today

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Strategy Inc. has expanded its preferred equity raise from $500 million to $2 billion, doubling down on its BTC gamble.

- Bitcoin (BTC) trades near $115,300, down slightly on the day. Shares of Strategy hovered near even during Thursday’s session but slipped 0.44%.

The post Michael Saylor’s Strategy Secures $2 Billion to Fuel Bitcoin Accumulation appeared first on 99Bitcoins.