Bitcoin’s muted volatility phase continues, with structural support holding firm. The market’s next decisive move will likely be shaped by reactions at the $114,000 and $111,000 support zones.

BTC Price Analysis: Technicals

By Shayan

The Daily Chart

Bitcoin continues to consolidate within the narrow $116K–$120K range, marked by low volatility and subdued price action. This sideways movement suggests an ongoing equilibrium between buying and selling pressure, possibly due to capital rotation into the altcoin markets.

A key concern is the emergence of a bearish divergence between the price and the RSI indicator, indicating a fading of bullish momentum. This divergence increases the likelihood of renewed selling pressure and suggests a possible continuation of the correction phase. If so, a move toward the $111,000 support level becomes probable.

Despite this, the broader market structure remains bullish as long as the $111,000 level holds. If this price point acts as a reliable demand zone, an eventual breakout above $120K could resume the larger uptrend.

The 4-Hour Chart

On the lower timeframe, BTC is forming a bullish flag pattern, a classic consolidation formation within an uptrend. The price has consistently printed higher highs and higher lows, supported by an ascending trendline acting as dynamic support, currently near the $114K level.

As long as this trendline remains intact, the market is likely to continue consolidating inside the flag, which aligns with a healthy correction.

However, a breakdown below this ascending support would likely trigger a sharper pullback toward $111K, forming a key liquidity zone.

On-chain Analysis

By Shayan

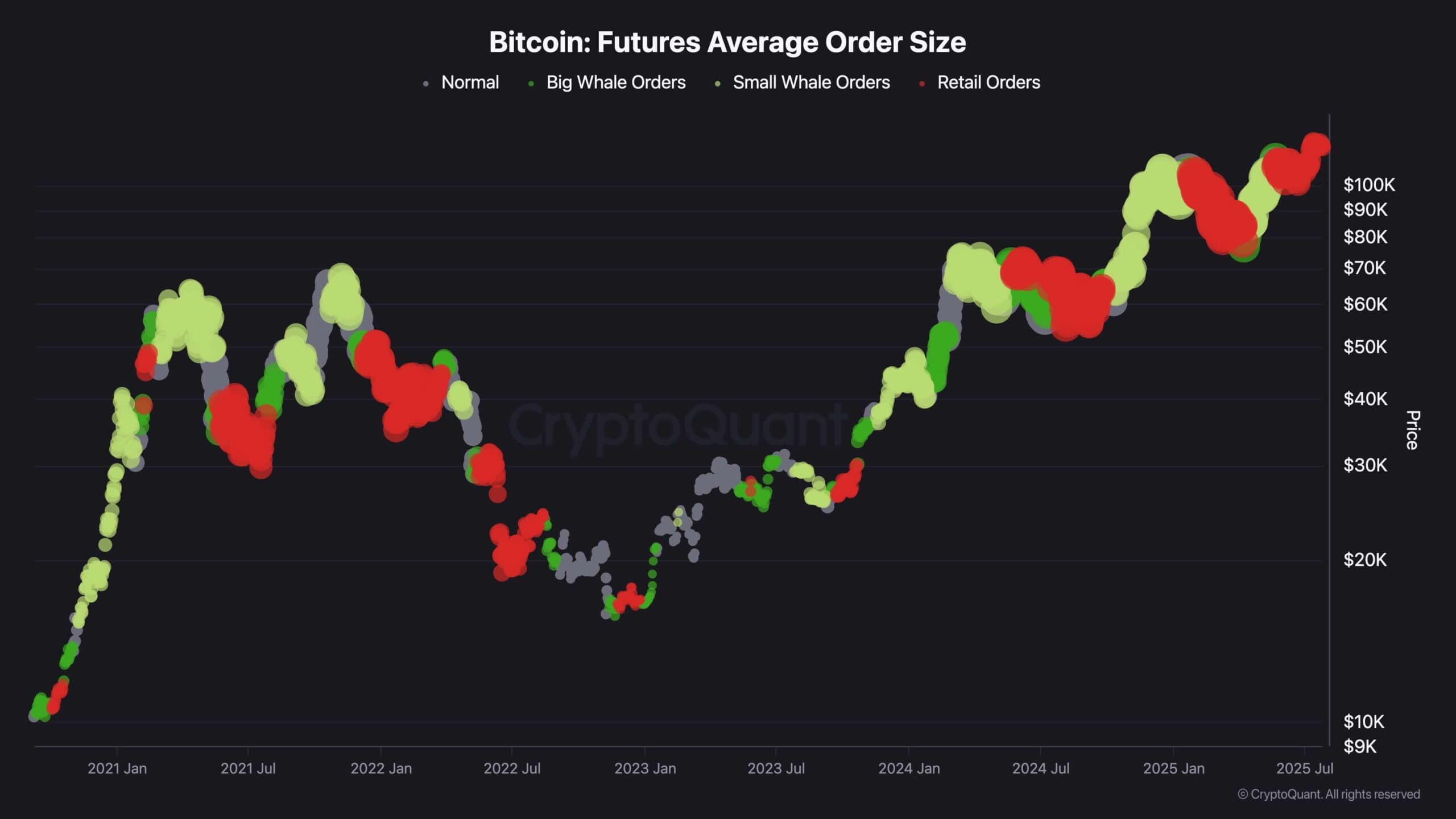

The latest futures order flow shows a noticeable surge in small-sized positions, a strong indication that retail traders are actively participating in the current price range. This spike reveals a high level of retail engagement, especially within the $116K–$120K consolidation zone.

Interestingly, large-scale sell-side activity (represented by green circles), typically associated with institutions or whales, is not present. These major players are not offloading their positions, suggesting that they remain confident in the ongoing bullish trend and do not expect a major reversal just yet.

This setup, with retail activity high and smart money quiet, has historically preceded major bullish moves. While the market may seem stagnant, this phase often serves as a cooling-off period before another leg of the upward trend. The lack of panic from whales adds weight to the theory that this is a healthy consolidation, not a trend reversal.

Once the current range resolves, a fresh wave of demand may enter the market, likely pushing Bitcoin toward new highs.

The post Bitcoin Price Analysis: Is a Crash to $111K Imminent for BTC? appeared first on CryptoPotato.