The Bitcoin price kicked off the weekend in the worst way possible, falling beneath the $115,000 level for the first time since early July. Considering the supposed significance of this price mark, there have been questions about how much headroom the price of Bitcoin still has. The latest on-chain data suggests that the Bitcoin bull run might not be over just yet.

BTC Long-Term Holders Start Distributing

In an August 1st post on X, crypto analyst Joao Wedson reported that the Bitcoin cycle for the long-term holders seems to be coming to an end.

Related Reading

Wedson emphasized that, regardless of the ongoing excitement around ETFs, on-chain data shows a clear market shift. This shift signals that the cryptocurrency’s long-term holders are beginning to sell their coins, and, in large volumes, too.

According to the analyst, about 50% of the amount of Bitcoin held in exchange-traded funds has been sold by the LTHs. Regardless of this situation, however, Wedson expects the BTC bull market to go on for “at least 2 more months” and the altcoins’ bull cycle for three months.

Key Metrics Flash Warnings – But ‘Final Top’ Not Yet Seen

Wedson backed his claim with four on-chain indicators, starting with the Coin Days Destroyed Terminal Adjusted Metric, which shows aged coins moving after being dormant for a long period of time.

The analyst explained that there has been a significant movement of old BTC over the past two years. This, Wedson emphasized, triggered three major warning signs that coincide with a local top.

Wedson also referenced the Reserve Risk Indicators to gauge current LTH conviction. This metric, from analysis, has entered a warning zone, as there is increased selling activity and hand exchanges.

Next, the online pundit quoted results from the Spent Output Profit Ratio (SOPR) Trend Signal. The SOPR measures whether coins (in this case, Bitcoin) are moved at a profit or loss. Wedson pointed out that this indicator recently flashed a bearish signal, which implies increased profit-taking in the market.

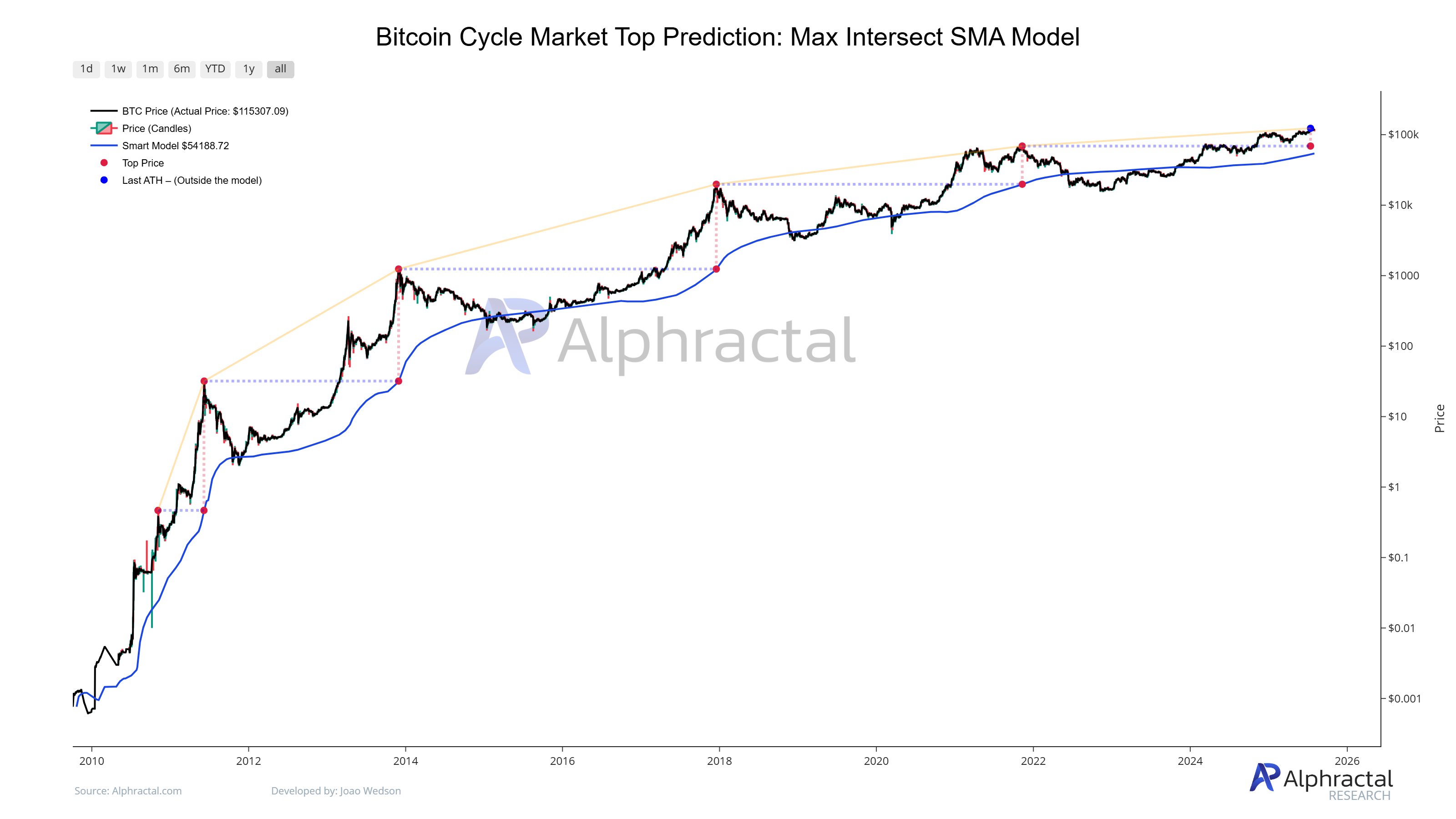

Referring to it as ‘the most accurate metric in the world’ used to identify Bitcoin’s macro tops, the Bitcoin Cycle Market Top Prediction: Max Intersect SMA Model was put out last. Wedson highlighted that this metric is yet to flash any bearish signal. Using the chart below, the analyst explained that until the blue line reaches the $69,000 level, the final top is yet to arrive.

Ultimately, the analyst preached caution against panicking, as historical cycle patterns suggest that the final market top has yet to arrive. As of this writing, Bitcoin is valued at about $113,052, reflecting a 1.2% price decline in the past 24 hours.

Related Reading

Featured image from iStock, chart from TradingView