World Liberty Financial’s token, WLFI, tied to the Trump family, has burned 7.89M WLFI (worth about $1.43M) following a $1.06M buyback funded through DeFi liquidity fees. But how is impacting the WLFI price prediction?

According to Lookonchain data, the project earned $1.01M by collecting 4.91M WLFI and $1.06M in liquidity earnings.

WLFI(@worldlibertyfi) has repurchased 6.04M $WLFI ($1.06M) and burned 7.89M $WLFI ($1.43M).

They collected 4.91M $WLFI($1.01M) and $1.06M in fees on Solana, BSC, and Ethereum, then spent $1.06M to buy 6.04M $WLFI.

They later burned 7.89M $WLFI ($1.43M) on BSC and Ethereum,… pic.twitter.com/UTWpsseAPw

— Lookonchain (@lookonchain) September 27, 2025

Those funds were then used to repurchase 6.04M WLFI from the open market, completing the cycle of accumulation and burn.

The transactions, carried out across BNB Chain and Ethereum within the past 24 hours, are part of a broader plan to shrink the circulating supply. Another 3.06M WLFI on Solana is still pending for burn.

The strategy follows a difficult September for the token and aims to stabilize price action in October.

Earlier this month, more than 99% of token holders backed a governance proposal to channel all treasury liquidity fees into buybacks and burns.

The latest round reflects the first execution under that plan, designed to reduce selling pressure and support market structure.

On Saturday, WLFI traded near $0.207, moving between $0.203 and $0.214 over the past 24 hours. Daily trading volume ranged from $300M to $360M, with market capitalization close to $5.1Bn.

WLFI maintains listings on major exchanges, including Binance and OKX, with most activity centered on WLFI/USDT pairs.

DISCOVER: 9+ Best Memecoin to Buy in 2025

WLFI Price Prediction: Is WLFI Preparing for a Breakout Above Its Consolidation Zone?

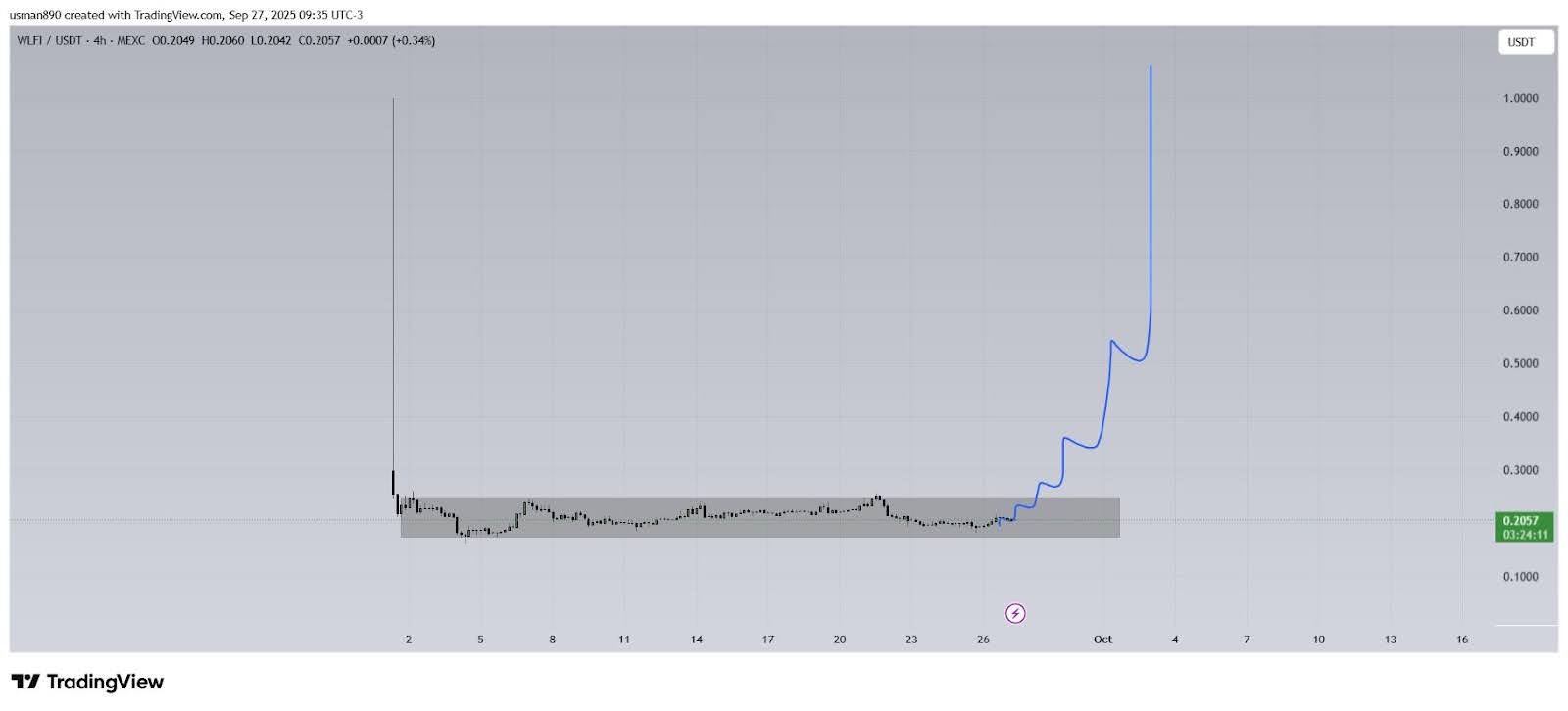

Knight, a crypto trader, shared the WLFI/USDT 4-hour chart, which shows the token trading at $0.2057, holding steady before a forecast that points to a potential sharp breakout.

$WLFI https://t.co/DxTOiyccRp pic.twitter.com/eONr9Z3jtz

— KNIGHT (@cryptoknight890) September 27, 2025

For the past three weeks, WLFI has moved sideways between $0.18 and $0.22. This range has acted as both support and resistance, suggesting the market is building a base after its early launch volatility.

The pattern reflects a period of accumulation, where neither buyers nor sellers have taken clear control.

The projection line on the chart outlines a possible bullish scenario. If WLFI maintains support near the lower band, the setup signals room for a rally.

Resistance levels appear around $0.30, $0.50, and $0.70, with a possible run toward $1.00 if momentum builds. The forecast also includes expected pullbacks, which would fit with a healthy uptrend rather than a straight rise.

From a technical view, this resembles the classic shift from accumulation to expansion. Extended flat trading often precedes strong moves, especially in low-liquidity tokens.

WLFI’s recent $1.4M buyback and burn adds to the pressure, creating conditions for a supply squeeze. Traders are watching closely to see if October brings the next upward leg.

For now, WLFI remains inside its consolidation band. A decisive close above $0.22-$0.23 could start a trend reversal, turning the current quiet range into a momentum-driven rally.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Trump Crypto Buybacks Just Burned $1.4M: WLFI Price Prediction For October? appeared first on 99Bitcoins.