AI-agent token AIA surged to a fresh record this week, capping an overnight surge that vaulted the new coin into the market’s most-traded assets. Here’s the AIA price prediction. Will it sustain its bullish momentum?

DeAgentAI has positioned itself as a crypto infrastructure project focused on bringing autonomous “AI agents” directly on-chain. Its whitepaper frames the mission as building “a trusted and autonomous on-chain intelligence network.”

The project is starting with Sui and BNB Chain integrations, offering tools for agent identity, memory, lifecycle, and agent-to-agent communication.

Its roadmap includes AlphaX, a signal-driven trading platform the team says already has hundreds of thousands of daily users, along with CorrAI, a no-code quant strategy builder, and Truesights, an upcoming information-finance product.

DeAgentAI has secured backing from Web3.com Ventures, SNZ Capital, KuCoin Ventures, Vertex Capital, and Valkyrie Fund.

Technical integrations include Binance Wallet, OKX Wallet, and Sui Network support, placing it in a growing circle of major crypto infrastructure players.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in October2025

What Is DeAgentAI’s Mission With the AIA Token?

As of the latest update, the AIA price was changing hands near $1.50, within a daily range of $1.00 to $2.49. Its all-time high of $2.49 was recorded on October 2.

Spot trading volume reached about $200.8 million, with a market cap of roughly $149.7 million and a fully diluted valuation of $1.5 billion.

CoinGecko data showed centralized exchanges Bitget, Gate, and MEXC as the main venues for liquidity

According to PAnewslab, AIA perpetual futures volume jumped to nearly $2.04 billion, briefly overtaking XRP. The spike shows strong speculative demand and heavy market interest.

Binance listed AIA spot pairs on Alpha at 08:00 UTC on Sept. 18. Thirty minutes later, it added AIAUSDT perpetuals with up to 50x leverage.

A 24-hour Alpha airdrop window accompanied the rollout, a common liquidity boost for new listings.

The token set fresh all-time highs on Oct. 2, while surging derivatives turnover drove sharp intraday swings into Oct. 3. The volatility attracted both systematic traders and retail momentum players.

A Binance Square note on tokenomics said investors hold 21% and the team 18%, with a one-year cliff followed by linear releases through 2028.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

AIA Price Prediction: Is AIA Showing Signs of a Blow-Off Top Pattern?

DeAgentAI’s token, AIA, has drawn heavy trading interest after a sharp price rally and equally fast correction.

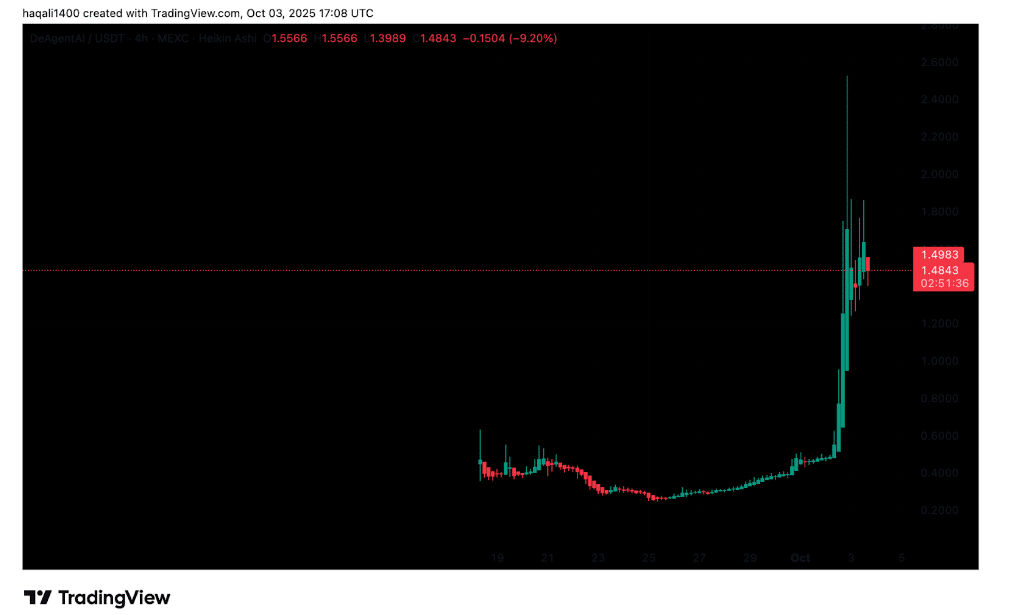

On the 4-hour USDT chart, AIA broke out from a base between $0.20 and $0.40 in late September.

(Source: AIA USDT, TradingView)

The move accelerated into October, lifting the token above $1 and peaking at more than $2.60 on October 2. At its highest point, it printed an all-time high of $2.49 before sliding back.

By the latest update, AIA was changing hands near $1.48, down 9.2% on the session.

The pattern on the chart resembles a classic “blow-off top.” Strong green Heikin Ashi candles showed overbought conditions during the run-up. The subsequent drop below $1.50 signals profit-taking by early holders.

Even with the pullback, the larger trend still looks bullish. Clearing the long-term base around $0.40 suggests the token has shifted into a higher range.

Current resistance sits near $1.80 to $2.00, where sellers have stepped in multiple times. Support has formed around $1.20. Holding above that level could bring new buyers, while slipping below it risks a deeper test toward $0.80 to $1.00.

Trading activity shows momentum remains strong. Liquidity is flowing into both spot and derivatives markets, though volatility is high.

If bulls push past $1.80, a retest of the $2.40–$2.60 zone is possible. Continued selling, on the other hand, could drag prices closer to $1.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post What is DeAiAgent? AIA Price Prediction After 190% Overnight Pump appeared first on 99Bitcoins.