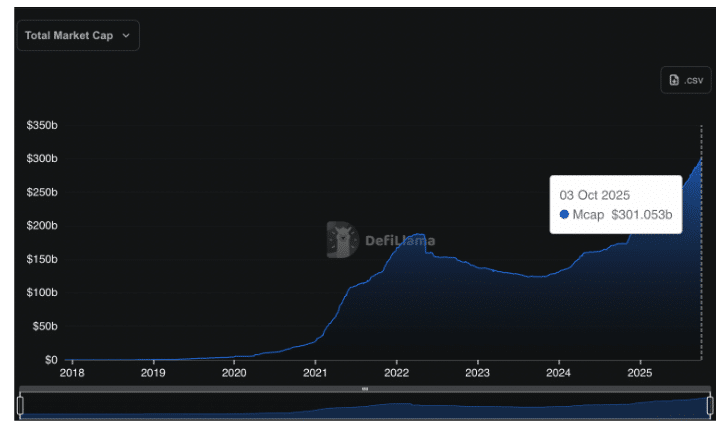

A $300Bn cash cushion just formed in crypto, and traders are asking when that “dry powder” will rotate into altcoins.

The value of dollar-pegged tokens in circulation has topped $300Bn for the first time, marking a milestone that often boosts liquidity across digital assets.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Does the Stablecoin Supply Ratio Reveal About Market Liquidity?

Data from DeFiLlama shows the total stablecoin market cap at about $301.6Bn today, a +2% gain over the past week.

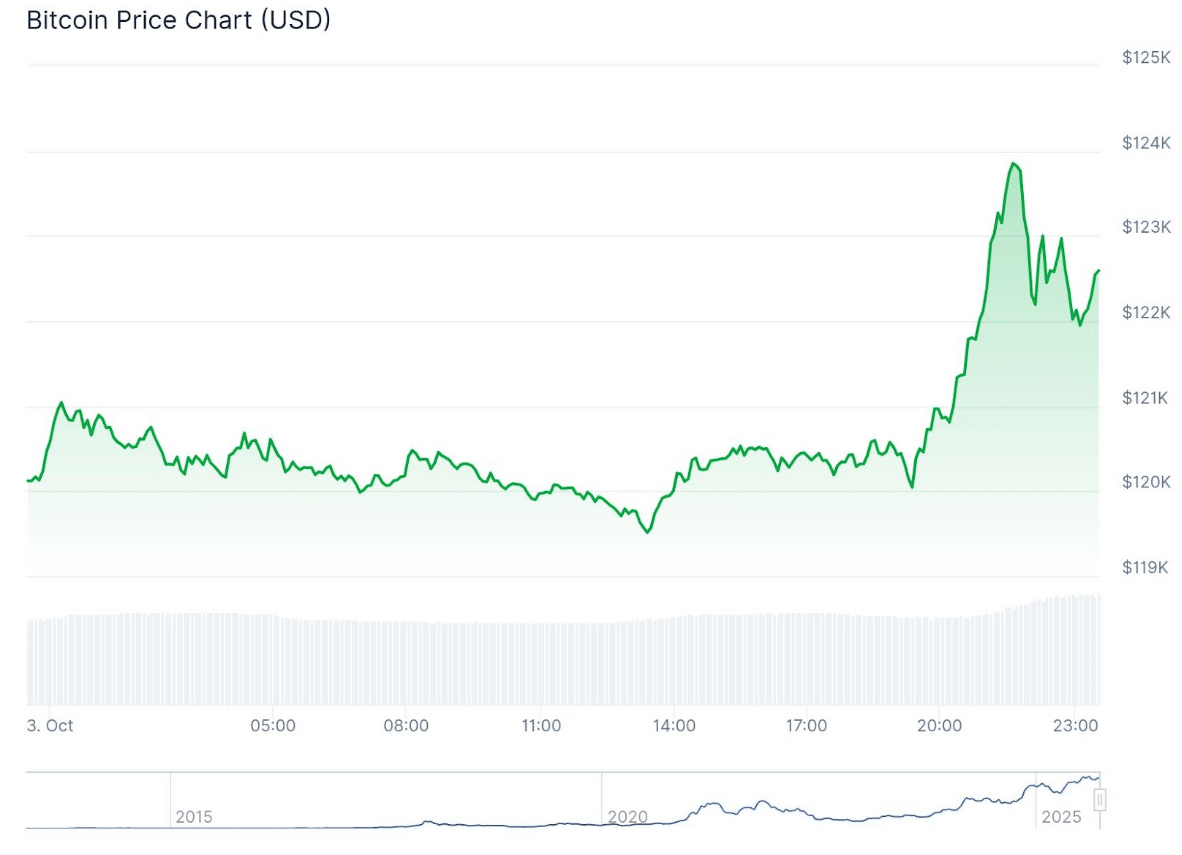

The increase is observed with Bitcoin trading as high as two months at around $120,000-123,000, which provides a favorable risk appetite atmosphere in October.

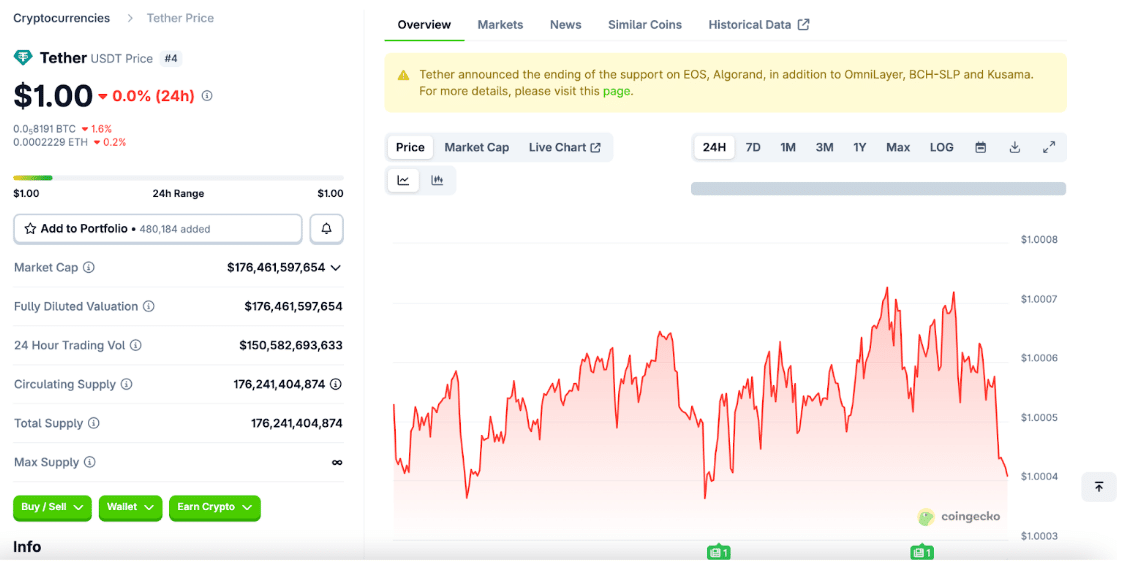

Tether (USDT) is the leader of the issuers, and its market cap is almost $176Bn.

USD Coin (USDC) ranks next with an approximate value of $74-$75Bn, and synthetic stablecoin USDe is close to the value of $14.8Bn. These three tokens made up most of the net issuance of 2025.

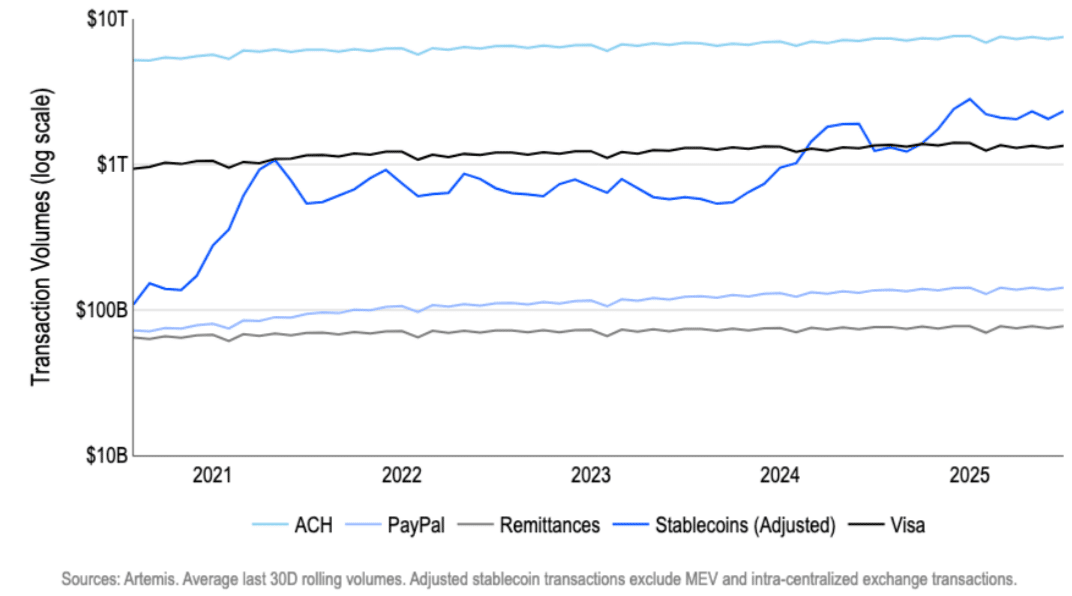

This year’s growth marks the fastest stablecoin expansion since early 2021. Even so, analysts say the market must accelerate further to meet long-term forecasts.

Coinbase projects $1.2 trillion in supply by 2028, while Standard Chartered sees $2 trillion and Citi as much as $4 trillion by 2030.

At the current pace of about $10Bn added each month, it would take more than five years to reach the lower end of those estimates.

Circle’s push toward the public market and reports of a large Tether funding round are seen as key drivers that could expand the sector’s role in global liquidity.

A key metric to watch is the Stablecoin Supply Ratio (SSR). It compares the supply of Bitcoin to that of stablecoins, measured in BTC terms. A lower SSR means there’s more stablecoin liquidity, often described as “dry powder” ready to flow into crypto.

According to Glassnode data, a simple public proxy using Bitcoin’s market cap divided by the total stablecoin market cap sits around 8.1.

That’s roughly $2.45 trillion in Bitcoin against $301.6Bn in stablecoins. Methodologies can differ, but this ratio gives a directional view. A lower or steady reading tends to show stronger buying power on the sidelines.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in October2025

How Are Stablecoins Acting as a Hedge Before the Fed Meeting?

The backdrop looks supportive. Stablecoin issuance has been expanding, with the market recently crossing a fresh round-number milestone.

At the same time, Bitcoin’s price near $120,000 keeps attention on the broader crypto market. If flows rotate beyond Bitcoin, mid-cap tokens are usually the first to benefit.

According to Glassnode’s framework, a sustained low SSR or further decline in the proxy ratio would indicate that stablecoins still retain significant buying power for future market moves.

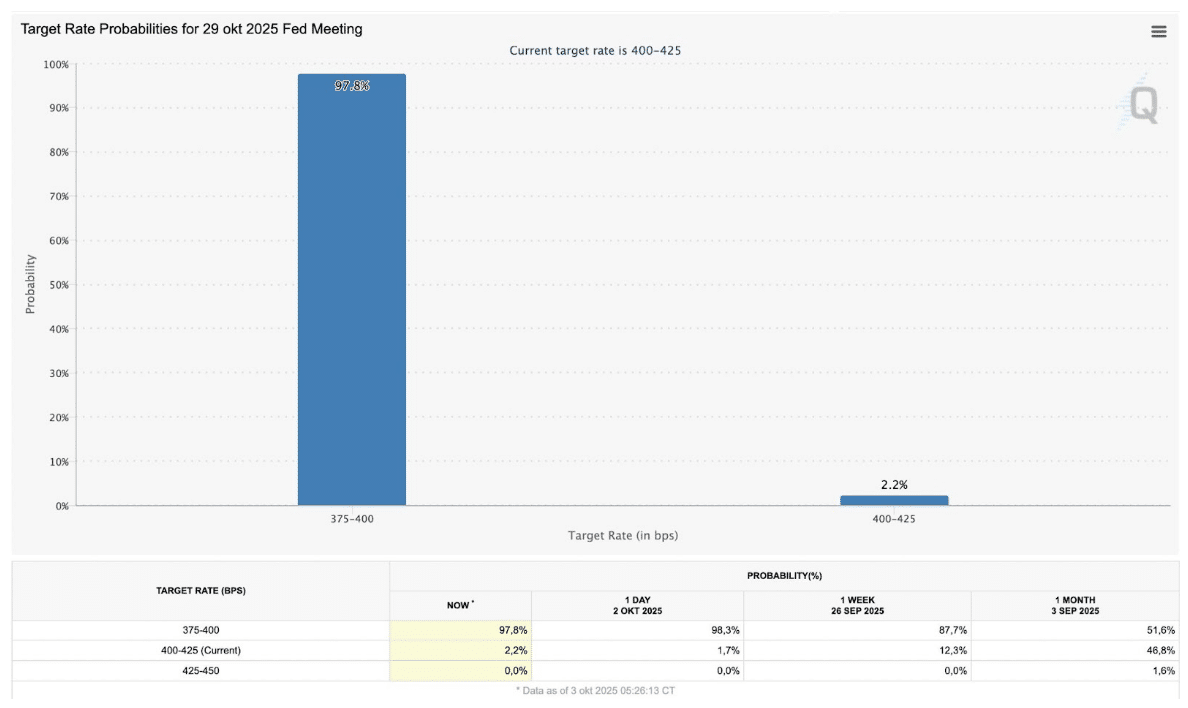

The latest FedWatch data indicates that markets are almost fully expecting the Federal Reserve to cut rates at its October 29, 2025, meeting.

Current pricing points to a 97.8% chance that rates will fall to the 375-400 basis point range, leaving just 2.2% odds that the Fed holds steady at 400-425 bps.

Expectations shifted sharply from last month, when traders had been nearly split.

Crypto analyst Ted tied this shift to stablecoin flows. He said retail traders are piling in with bullish bets, while institutional investors seem to be trimming positions.

Unpopular opinion: October rate cuts are already fully priced in.

Retail is piling in with extreme bullishness.

Institutions are quietly offloading.

You connect the dots.

I may be wrong, but I’m risk-managing with 70% in stablecoins. pic.twitter.com/E7dkhNDWH4

— Ted (@TedPillows) October 3, 2025

“October rate cuts are already fully priced in,” Ted said, and he added that he has moved 70% of his portfolio into stablecoins as part of his own risk management.

The Fed’s decision could shape liquidity across markets and influence risk appetite.

For now, traders are treating easing as a near certainty, with stablecoins serving as a favored hedge before the policy call.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Stablecoins Hit $300Bn Valuation: When Will It Pump Altcoin Markets appeared first on 99Bitcoins.