Bitcoin has extended its rally after a clean breakout from the descending channel, reclaiming primary structural levels and driving toward the $122K–$124K all-time high.

While momentum remains strongly bullish, the market is still exposed to a brief pullback toward $114K–$118K to rebalance before any potential continuation toward new highs.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin has continued its upward expansion, breaking through the mid-range resistance and invalidating the prior descending structure that defined September’s price action. The breakout was followed by a rapid move into the upper boundary of the macro range, likely targeting the buy-side liquidity just above the all-time high around $124K.

The price is now holding above the breakout level around $116K–$118K, with the previous decision point at $112K–$114K serving as key support in case of a retracement. Holding above this zone maintains the bullish structure, keeping the $124K–$125K region, where the next liquidity pool sits, as the primary upside target.

Momentum indicators, however, suggest the potential for a short-term corrective move before continuation, allowing the market to build a healthier base for another impulsive leg higher.

The 4-Hour Chart

The recent surge from the $108K demand zone triggered an impulsive rally that left behind several unmitigated areas of interest. The breaker block at $115K–$117K and the Fibonacci retracement cluster between $114.4K and $113.1K now mark the nearest re-entry zones for buyers.

A controlled pullback toward these levels would likely attract renewed demand for continuation toward $124K, where the next major buy-side liquidity cluster lies. If price maintains its current momentum, a sweep above $124K could occur before a corrective phase, aligning with the broader bullish expansion structure as long as the market holds above $111K–$112K.

Sentiment Analysis

By Shayan

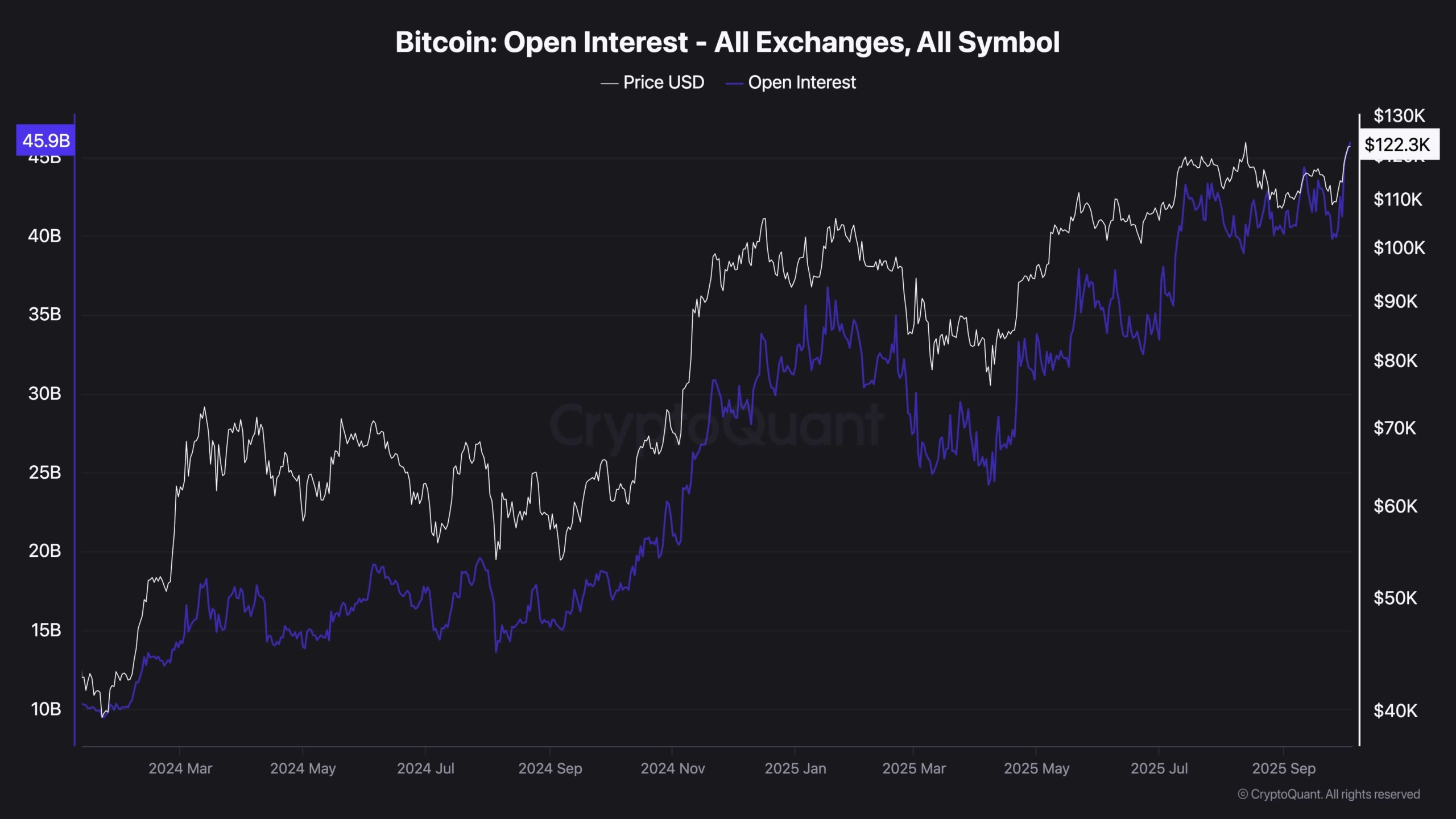

Bitcoin’s open interest on Binance has reached a new record, edging past the August peak of $14.306B. This surge coincides with the latest rally, as BTC has climbed from $108K to $124K, while open interest has expanded from $11.5B to $14.3B in just a few weeks. The parallel rise in both price and open interest confirms that the move has been powered by fresh inflows and new position openings, rather than a short-covering squeeze.

This expansion highlights strong conviction from traders on both sides, with institutional and retail participation adding depth to the market. However, the sheer scale of leverage now in play introduces risk. Elevated open interest often acts as a double-edged sword: it can amplify upside moves as trapped shorts unwind, but it can just as quickly trigger liquidation cascades if price momentum stalls.

For now, the structure favors continuation, with BTC pressing into new liquidity zones between $125K and $130K. Yet, the danger lies in the market’s fragility. If Bitcoin fails to extend higher and consolidates while open interest stays elevated, the likelihood of a sharp flush grows, potentially dragging price back toward key demand zones before the broader bullish trend resumes.

In short, record-high open interest reflects both confidence and vulnerability. Traders should closely watch whether open interest continues rising or starts to unwind, as this will determine if the next leg extends smoothly into $130K or if a leverage-driven shakeout interrupts the rally.

The post Bitcoin Price Analysis: is BTC About to Explode to $130K This Week? appeared first on CryptoPotato.