What if you get in a trade and can’t get out? Inception-kind of dream “stuck.” That’s precisely what’s happening to one rather small Lighter vault. Crypto prices might have recovered after the deleveraging on October 10, but not the Kanye West YZY vault on Lighter. The hangover remains.

Unlike Binance, Bybit, and other big boys like Coinbase One, perpetual DEXes lean more on the community to stay competitive. Yes, they allow 10x leverage, and all trades are public, but without a pool of funds deposited by the community, it can get pretty hard to match CEX offerings.

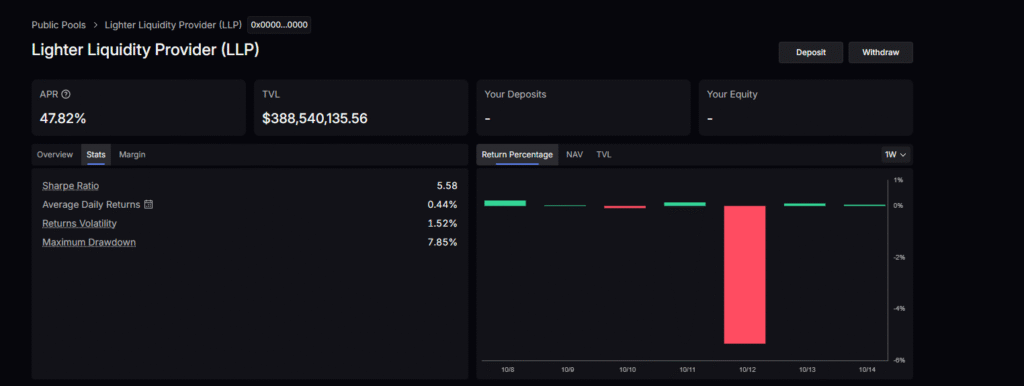

For this reason, Lighter, Hyperliquid, and all other perpetual DEXes offering leverage trading have created vaults. Anyone can deposit funds into the pool and earn a percentage as revenue, depending on how actively traded the pool’s pair is. The more leveraged positions opened, the more revenue the vault receives. As of October 14, the Lighter Liquidity Provider (LLP) cumulatively manages over $388M, of which the Ethereum vault is the largest with over $11M in position value.

(Source: Lighter)

DISCOVER: Best Meme Coin ICOs to Invest in 2025

How Perpetual DEX Vaults Work: Who’s More Aggressive?

The Lighter Liquidity vault will continue to provide liquidity, always posting bids and asks on the order book while ensuring tight spreads and deep markets.

At the same time, the same pool will handle all liquidations since whenever a trader is deep in red, the vault will step in, acting as a counterparty and shielding the exchange from bankruptcy.

In extreme cases, like on Friday, a vault, as seen in Hyperliquid, can manage risk by auto-deleveraging, forcibly closing profitable trades to cover losses.

However, for Lighter, there were no reports of auto-deleveraging. As the liquidator of last resort, the vault stepped in, taking the other side of the trade to prevent further losses for the trader and the vault.

In Hyperliquid, the risk exposure is low, but since Lighter vaults chase higher yields, they tend to be more aggressive, and the vault will handle liquidations directly. Auto-deleveraging will only kick in whenever the vault depletes.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Lighter Vault Behind YZY Meme Coin In Trouble: The Short Squeeze

Because of this aggression and the failure to auto-deleverage, the YZY vault on Lighter is now in trouble.

Instead of going the Jelly Jelly way as Hyperliquid did to manage risk, the YZY vault didn’t close positions and now finds itself deep in red, and bleeding from funding rates.

The YZY vault remains trapped since Friday’s apocalyptic liquidation cascade, and there is no sign of an easy exit after piling in on a hefty short position only for YZY USDT prices to recover from October 10 lows.

Interesting hangover from Friday night's liquidation, and one that goes to the discussion about the difference between HLP and LLP…

The Lighter vault appears to be trapped in a YZY short since Friday night. LLP makes up nearly 100% of the OI in the market. Even if it tried to… pic.twitter.com/eC32rE4maI

— Doug Colkitt (@0xdoug) October 14, 2025

Overall, the YZY vault is holding over $143,000 in bad debt, or nearly half its current value of over $321,000. In addition to the loss, the vault must pay funding, which is currently over $53,000. As long as the vault fails to deleverage, the deeper the hole becomes.

(Source: Lighter)

If the short squeeze continues and YZY USDT ticks higher (especially once savvy speculators smell blood), the vault might be depleted, forcing the vault to close all positions.

Top 10 most gainers – 14 Oct 2025 at 1.30pm UTC @Lighter_xyz

– while market trying hard to recover, some coins are having crime pump, $MYX up 12.62%

– $SYRUP up 8.16%, what's cooking? i longed this few hours ago, but its still far from my TP level

– $YZY da hell man? pic.twitter.com/aNr9AV6XYr

— compoundo (@compound0x) October 14, 2025

How Lighter will handle the situation remains to be seen. For now, eyes are on this small vault, with lessons to be learned, assuming the vault managed $100Bn in blue-chip altcoins, where the risks of an auto-deleverage could take down the exchange.

DISCOVER: 10+ Next Crypto to 100X In 2025

Kanye West YZY Meme Coin Vault On Lighter Short Squeeze

- YZY meme coin vault short-squeezed

- Will YZY USDT rally to fast-track auto-deleveraging?

The post Kanye West YZY Meme Coin Vault On Lighter Getting Short Squeezed: Will YZY USDT 10X? appeared first on 99Bitcoins.