China‘s leaders are vowing to reduce reliance on foreign advanced technology and spur stronger domestic demand as it weathers “high winds” amid elevated trade tensions with the U.S.

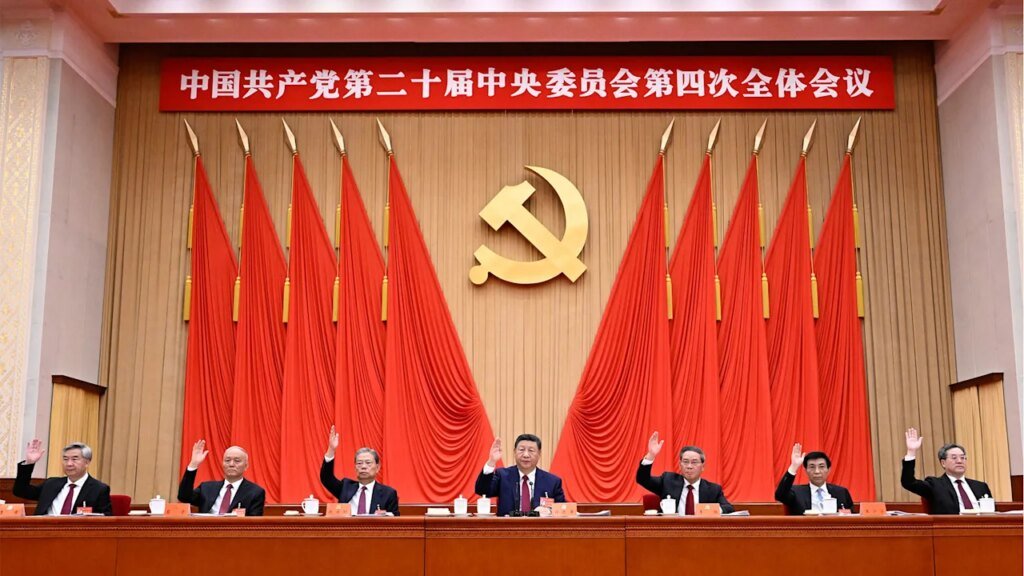

An outline of the ruling Communist Party’s blueprint for the next five years was laid out in a 5,000-word communique released Thursday after a four-day top level meeting in Beijing, just days ahead of planned talks between Chinese leader Xi Jinping and U.S. President Donald Trump.

Five-year plans are a throwback to the days of Soviet-style central planning. China still relies heavily on them to map out policy priorities and decide on funding. Party “plenum” meetings like the one held this week are also used to rally the party rank-and-file around Xi’s leadership.

Thursday’s announcement signaled no major policy shifts. Despite mounting trade tensions, China intends to remain a global manufacturing power while building stronger economic growth at home.

China gains confidence in the trade war

The communique does not refer directly to the trade war between Beijing and Washington, but warns of rising “uncertainties and unforeseen factors.”

Han Wenxiu, a senior party official in financial and economic policy, told reporters Friday that China is well placed to handle such risks in an era when great-power competition is becoming more complex and “the international balance of power is undergoing profound adjustments.”

He predicted China’s strength and international status would grow in the next five years. “There is always opportunity in crisis and crisis can be turned into opportunity,” Han said.

Chi Lo, an Asia Pacific senior market strategist at BNP Paribas Asset Management, said an emphasis in the communique on substantial improvements in scientific and technological self-reliance likely reflects confidence that China is less vulnerable to pressure from the trade war.

The party vowed to achieve “markedly stronger” international influence by 2035 and to safeguard the multilateral trading system, portraying Beijing as a defender of free trade, noted Leah Fahy, a China economist at Capital Economics.

Domestic economic challenges remain

A downturn in the property sector that began while China was still in the midst of disruptions from the COVID-19 pandemic has sapped consumer confidence, reducing household wealth and leading to widespread layoffs.

China’s communique emphasized the strategic need to expand domestic demand. The government has already encouraged investment to modernize factories and paid subsidies to people who replace old appliances and vehicles with new ones.

“The economies of major countries are all driven by domestic demand and the market is the most scarce resource in today’s world,” said Zheng Shanjie, head of the National Development and Reform Commission, Beijing’s main planning agency.

But manufacturing capacity exceeds demand in many industries. That has caused damaging price wars and led companies to boost exports, adding to trade tensions with the U.S., the European Union and others.

Even with strong government support, the economy grew 4.8% in the last quarter, the slowest pace in a year. Factory activity shrank for the sixth consecutive month in September, as domestic demand remained sluggish.

China’s leaders have stuck to their goal of attaining the status of a “mid-level developed country” and doubling the size of the economy in 2020 by 2035.

That implies an average annual growth rate of about 4-5% in the next decade, said Lynn Song, chief economist for Greater China at ING Bank.

China will remain a manufacturing juggernaut

China is the world’s biggest manufacturer, accounting for roughly 30% of global production and about a quarter of its overall economy. The new 5-year plan calls for keeping manufacturing at an “appropriate level” with advanced industries as the backbone.

China’s focus on the manufacturing sector “will remain a top priority, even in the face of overcapacity (and) price wars,” said Fahy of Capital Economics.

Over the years, Chinese manufacturing has progressed from labor-intensive, low-cost production to higher-value products including electric vehicles, robots and batteries. In coming years, the emphasis will be on advanced manufacturing, said Robin Xing, chief China economist at Morgan Stanley.

That includes areas such as quantum technology, biomanufacturing, hydrogen and nuclear fusion energy, artificial intelligence and next-generation mobile communications, said Zheng, the planning agency chief.

“These industries are ready to take off,” he said. “It means that in the next 10 years we will build another high-tech industry in China and this will inject continued impetus to our efforts to achieve Chinese modernization.”

It’s unclear if China’s commitment to catalyzing more consumer spending and domestic investment will make much of a dent in its exports.

Chinese companies like BYD and CATL have become global leaders in EV battery technology and production. China plays a pivotal role in global supply chains and has shown it can control access to rare earths, materials used in many products.

“The Chinese government sees manufacturing as a core issue in security and geopolitical leverage over other countries,” added Gary Ng, a senior economist at Natixis.

Xi continues to centralize power

The four-day plenum was marked by relatively low attendance.

Out of 205 full members in the elite Communist Party central committee, only 168 were there, according to the communique. Many have been purged in anti-corruption campaigns that also enforce loyalty to Xi within the party.

An “unprecedented proportion of central committee members are in political trouble,” said Neil Thomas, a fellow at the Asia Society Policy Institute’s Center for China Analysis.

The meeting appointed Gen. Zhang Shengmin as China’s second highest ranking general. He replaced He Weidong, who was ousted from the party along with eight other senior officials in a recent anti-corruption drive.

As the party continues to centralize power, “the political position faced by Xi and his dominance within the party is still relatively secure” said Xin Sun, a senior lecturer in Chinese and East Asian business at King’s College London.

—Chan Ho-Him, Huizhong Wu, and Ken Moritsugu, Associated Press

Associated Press researchers Yu Bing and Shihuan Chen in Beijing contributed.