Revised lawsuit claims Chow’s group used popular names to lure investors into Solana-based pump-and-dump schemes.

Benjamin Chow, a well-known crypto developer and co-founder of the Meteora decentralized exchange on Solana, has been fingered as the driving force behind a plan to cheat investors through 15 different token schemes.

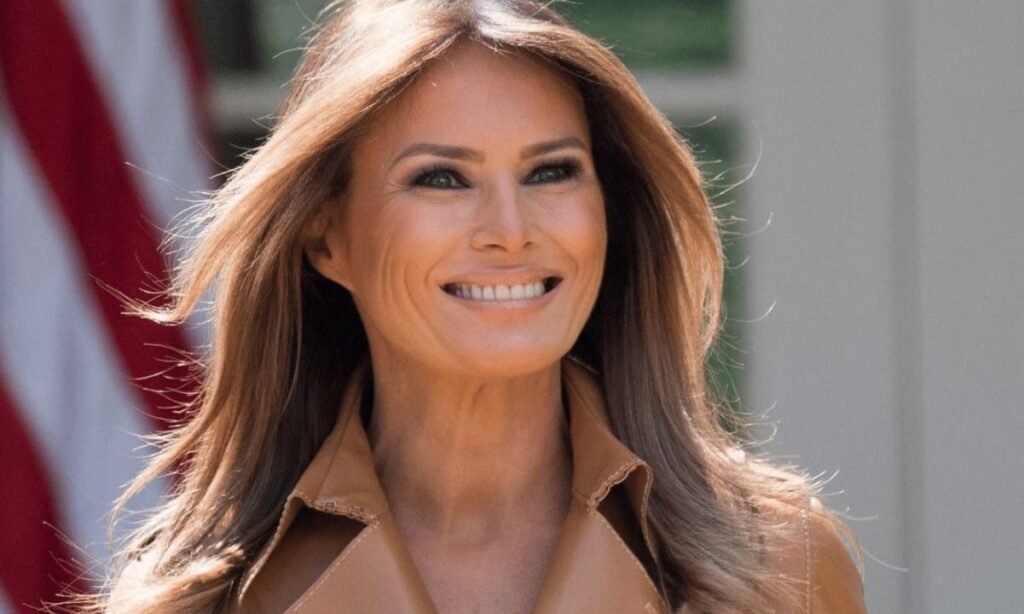

A revised version of a class-action lawsuit that was first filed in a New York federal court on April 21, 2025, says that Chow, Meteora, and Kelsier Ventures, a firm run by Hayden Davis and some of his family members, used the names of famous people like U.S. First Lady Melania Trump and Argentine President Javier Milei to give credibility to coordinated scams meant to milk money from unwitting crypto investors.

Mechanics of the Alleged Scheme

The initial complaint accused Chow, Meteora, and members of the Davis family of lying to crypto investors. It said they made money at the expense of the public by manipulating the price of a Solana-based token called M3M3, which had as much as 95% of its supply controlled by a group of insiders.

The amended document now claims that fraud may have happened with as many as 15 cryptocurrencies, including the controversial MELANIA and LIBRA meme coins, which were promoted by Mrs. Trump and President Milei, respectively. This information is said to have come from private messages shared by a whistleblower, in which Davis allegedly admitted to carrying out “at least fifteen token launches at Chow’s direction.”

Those suing say that Chow and the other defendants “borrowed credibility” from public figures and used them as “window dressing” to make their plans seem more legitimate. For this reason, they are not holding Melania or Milei responsible; instead, they are focusing on Meteora, its co-founder, and the Kelsier management.

The new filing claims that the alleged plot was carried out in a highly organized way, with each participant having a clear role. Chow was supposedly in charge of the technical side because of his “unique knowledge of the code and the ability to manipulate liquidity, fee routing, and supply controls.” As such, the complainants say it was possible for him to control the supply and prices of the new tokens, creating situations where their values could be artificially pushed up and then collapsed without the knowledge of ordinary traders.

For the marketing side, the lawsuit points to Kelsier Ventures, where Hayden, Charles, and Gideon Davis used paid influencers and social media campaigns to make it look like there was real public demand for meme coins like MELANIA and LIBRA. The group reportedly used the same formula for all 15 tokens: they created artificial scarcity, flooded the internet with paid promotions, and then, when prices went up, the insiders sold all their holdings at once, which made the asset’s value drop and left other investors with huge losses.

You may also like:

A Pattern of Denial and Mounting Evidence

According to the lawsuit, after the LIBRA token crashed in February 2025, Meteora pretended to blacklist Kelsier, a move the plaintiffs called “performative.” Chow and members of the Meteora leadership are said to have made sworn declarations describing themselves as “passive developers of autonomous software,” suggesting they had nothing to do with the price behaviors of the crypto assets in question.

The programmer quit Meteora in February, still insisting on his innocence, but data from blockchain analysis companies like Bubblemaps tell a different story. Their report from February 17, 2025, followed wallet addresses that clearly showed financial ties between those who made MELANIA and LIBRA, while revealing that insiders made more than $100 million in profits.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!