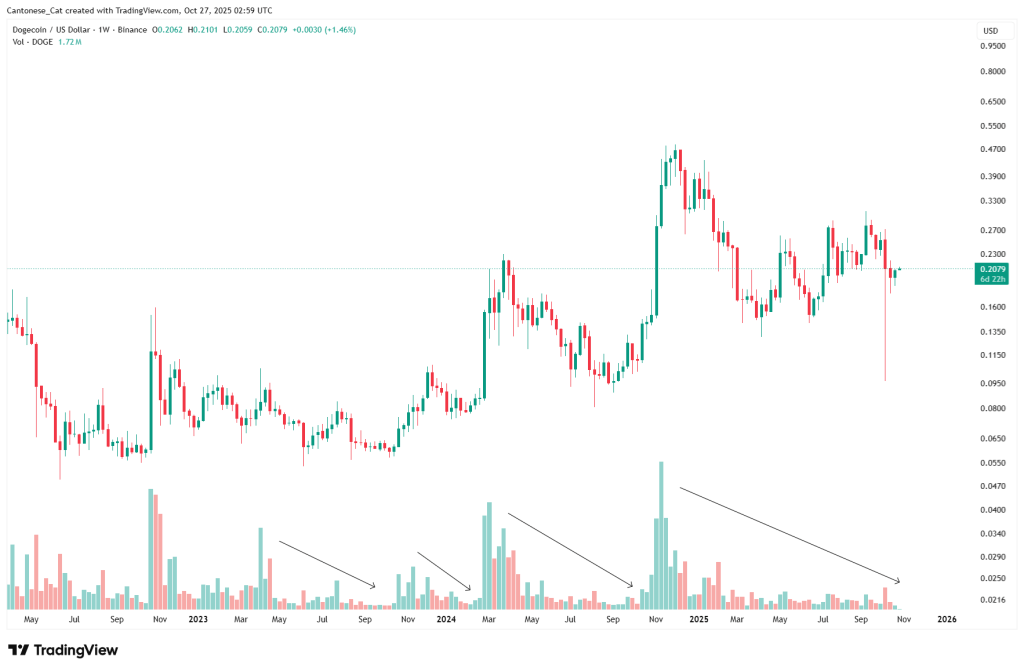

The Dogecoin weekly chart is flashing a cluster of technically constructive signals, according to crypto analyst Cantonese Cat (@cantonmeow), who published a four-panel weekly read on DOGE on Oct. 27. Price is currently hovering near $0.208 on Binance spot, and the setup he highlights pivots on four independent checks: the cycle-high anchored VWAP, Ichimoku “Katana” support, a 0.5 log-scale Fibonacci hold, and conspicuously light sell-side volume during the recent drawdown.

4 Reason To Be Bullish On Dogecoin

In his post, Cantonese Cat wrote: “Attempting to reclaim cycle high AVWAP as support. Claiming Ichimoku Tenkan + Kijun fusion (blue and red lines fused together), AKA Katana, as support so far. Holding 0.5 log fib from cycle high–cycle low as support so far. There’s been no volume so far during this downturn on multiple exchanges including Coinbase and Binance, and all it takes is just some volume to come in and we could reverse any downtrend in a hurry.”

On the anchored VWAP chart, the teal line measured from Dogecoin’s cycle peak tracks the market’s volume-weighted cost basis since the 2021 top. DOGE is pressing that band from above/at parity, attempting to convert it into support after a failed breakdown earlier this month.

Related Reading

On a weekly basis, closing and subsequently holding above the cycle-high AVWAP tilts risk-reward positively because it implies the marginal participant who bought since the peak is no longer underwater. Notably, the most recent weekly wick that probed below the band—printing a sharp stab toward the low-$0.09s—was retraced swiftly, with subsequent candles clustering back around ~$0.21. That rejection of lower prices right at the anchored VWAP argues against sustained distribution at current levels.

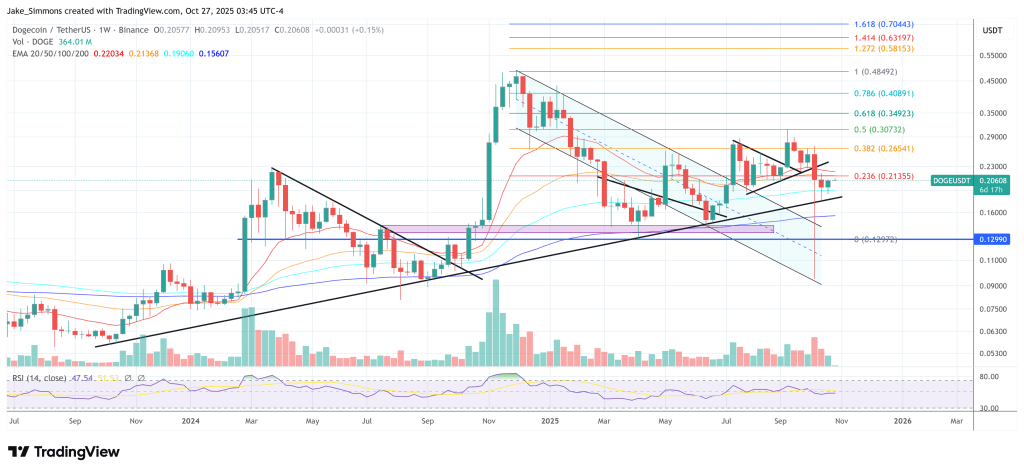

The Ichimoku frame reinforces the same idea. Tenkan-sen and Kijun-sen are fused around ~$0.2009 on the weekly (a configuration the analyst labels “Katana”), and price is currently riding that confluence as support. The cloud (Senkou span) remains red and overhead, spanning roughly the $0.24s into the ~$0.29 region, which defines the near-term supply zone that would need to be cleared on a weekly close to confirm trend resumption.

Until then, the Katana acting as a shelf at ~$0.20 is the near line in the sand; lose it decisively and the bias flips back to testing deeper supports, but sustain it and the path of least resistance shifts to re-engaging the cloud’s lower boundary.

Fibonacci context adds precision to those levels. Measured log-scale from the cycle high to the cycle low, DOGE has so far defended the 0.5 retracement at $0.19070 on multiple weekly closes.

That 50% line is the pivot of the current structure: a confirmed weekly close and acceptance below would hand momentum to bears toward the 0.382 at $0.13847, while continued defense keeps the market pointed at successive retracement ceilings overhead—the 0.618 at $0.26261, the 0.707 at $0.33430, the 0.786 at $0.41416, and the 0.886 at $0.54318—before the full retrace to the cycle high marker around $0.73995.

Price has been oscillating in a broad $0.16–$0.27 corridor for months; sitting above the 0.5 while probing the AVWAP strengthens the case that the mid-$0.20s could be revisited if buyers can reclaim momentum.

Related Reading

Volume is the wild card—and the fourth reason the analyst cites for optimism. The weekly histogram across multiple years shows that persistent selloffs have been accompanied by contracting volume, with downward arrows on the chart denoting successive periods of declining activity into lows.

By contrast, the last major impulsive advance in late 2024 printed the cycle’s heaviest weekly turnover. The current downturn lacks that distribution signature; bins on Coinbase and Binance have thinned rather than expanded. In market-structure terms, falling volume on pullbacks is textbook corrective behavior, and it leaves the door open for a sharp reversal if/when demand returns.

Put together, the four lenses describe a market sitting on top of a stacked support cluster: the cycle-high AVWAP roughly at the current price, the Ichimoku Katana fused near ~$0.2009, and the 0.5 log Fibonacci at $0.19070 just below. The invalidation path is clear enough—a decisive weekly loss of the $0.19 handle would expose the $0.13847 (0.382) shelf—while the upside path is equally mapped: first reclaim the lower edge of the cloud in the low-$0.20s, then test $0.26261 (0.618), with any weekly close through that level shifting focus to $0.33430 and beyond.

At press time, DOGE traded at $0.206.

Featured image created with DALL.E, chart from TradingView.com