Bitcoin’s value actions have all the time been a topic of debate amongst buyers and analysts. With current market retracements, many are questioning whether or not Bitcoin has already reached its peak on this bull cycle. This text examines the information and on-chain metrics to evaluate Bitcoin’s market place and potential future actions.

For an in-depth full evaluation, discuss with the unique Has The Bitcoin Price Already Peaked? full video presentation obtainable on Bitcoin Magazine Pro‘s YouTube channel.

Bitcoin’s Present Market Efficiency

Bitcoin lately confronted a ten% retracement from its all-time excessive, resulting in considerations in regards to the finish of the bull market. Nevertheless, historic traits recommend that such corrections are regular in a bull cycle. Sometimes, Bitcoin experiences pullbacks of 20% to 40% a number of occasions earlier than reaching its remaining cycle peak.

Analyzing On-Chain Metrics

MVRV Z-Rating

The MVRV Z-score, which measures the market worth to realized worth, presently signifies that Bitcoin nonetheless has appreciable upside potential. Traditionally, Bitcoin’s cycle tops happen when this metric enters the overheated purple zone, which isn’t the case presently.

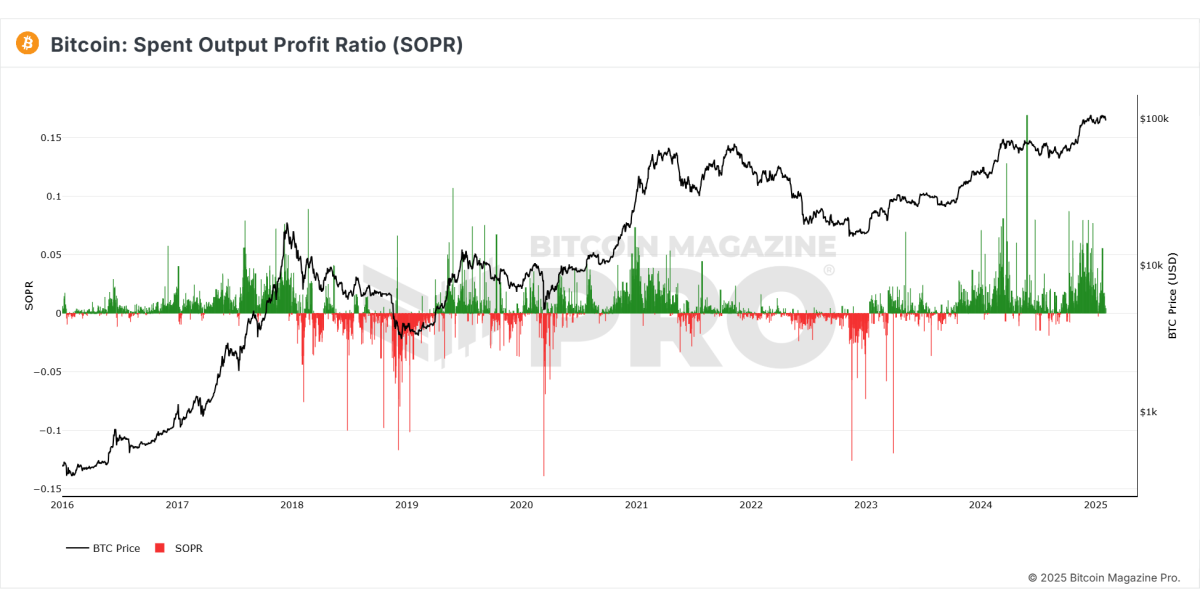

Spent Output Revenue Ratio (SOPR)

This metric reveals the proportion of spent outputs in revenue. Lately, the SOPR has proven lowering realized income, suggesting that fewer buyers are promoting their holdings, reinforcing market stability.

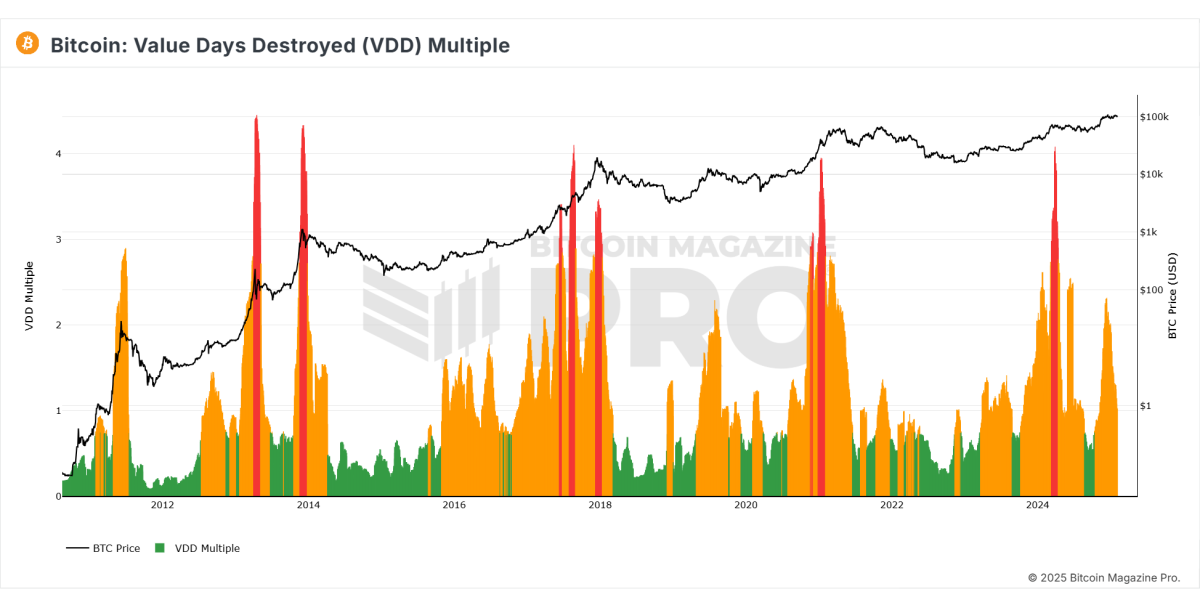

Worth Days Destroyed (VDD)

VDD signifies long-term holders’ sell-offs. The metric has proven a decline in promoting stress, suggesting that Bitcoin is stabilizing at excessive ranges quite than heading into a protracted downtrend.

Institutional and Market Sentiment

- Institutional buyers akin to MicroStrategy proceed accumulating Bitcoin, signaling confidence in its long-term worth.

- Derivatives market sentiment has turned detrimental, traditionally indicating a possible short-term value backside as over-leveraged merchants betting in opposition to Bitcoin might get liquidated.

Macroeconomic Elements

- Quantitative Tightening: Central banks have been decreasing liquidity, contributing to the short-term Bitcoin value decline.

- World M2 Cash Provide: A contraction in cash provide has impacted danger belongings, together with Bitcoin.

- Federal Reserve Coverage: There are indications from main monetary establishments, together with JP Morgan, that quantitative easing might return by mid-2025, which might possible enhance Bitcoin’s worth.

Related: Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Future Outlook

- Bitcoin’s value motion is exhibiting indicators of coming into a consolidation part earlier than one other potential rally.

- On-chain knowledge suggests there’s nonetheless important room for progress earlier than reaching cycle peaks seen in earlier bull markets.

- If Bitcoin experiences additional pullbacks to the $92,000 vary, this might current a powerful accumulation alternative for long-term buyers.

Conclusion

Whereas Bitcoin has skilled a short lived retracement, on-chain metrics and historic knowledge recommend that the bull cycle just isn’t over but. Institutional curiosity stays sturdy, and macroeconomic circumstances might shift in favor of Bitcoin. As all the time, buyers ought to analyze the information rigorously and think about long-term traits earlier than making any funding choices.

In case you’re considering extra in-depth evaluation and real-time knowledge, think about testing Bitcoin Magazine Pro for worthwhile insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding choices.