Ethereum’s value is but to get better from the drop it has been experiencing these days. Due to this fact, extra draw back may very well be anticipated within the coming weeks.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

On the each day chart, the value has been making decrease highs and lows since getting rejected from the resistance at $4,000. A number of assist ranges have been misplaced in the previous few months, particularly the 200-day transferring common, positioned across the $3,000 mark.

Whereas the value has already dropped to the $2,200 assist and rebounded, there’s nonetheless the possibility for the market to say no decrease so long as the cryptocurrency stays under the 200-day transferring common.

The 4-Hour Chart

Wanting on the 4-hour timeframe, the value has progressively declined inside a big falling wedge sample. Whereas the market broke the sample to the draw back on Monday, it recovered, reclaiming the $2,800 degree. But, the RSI nonetheless exhibits values under 50%, indicating that the momentum remains to be bearish.

Due to this fact, if the value doesn’t break again above the $3,000 degree quickly, a deeper correction or an extended consolidation may very well be anticipated within the coming weeks.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Ethereum Open Curiosity

As Ethereum’s value is in a steep downtrend, market contributors marvel the place the value will lastly discover assist. Analyzing the futures market sentiment may present useful insights into this example.

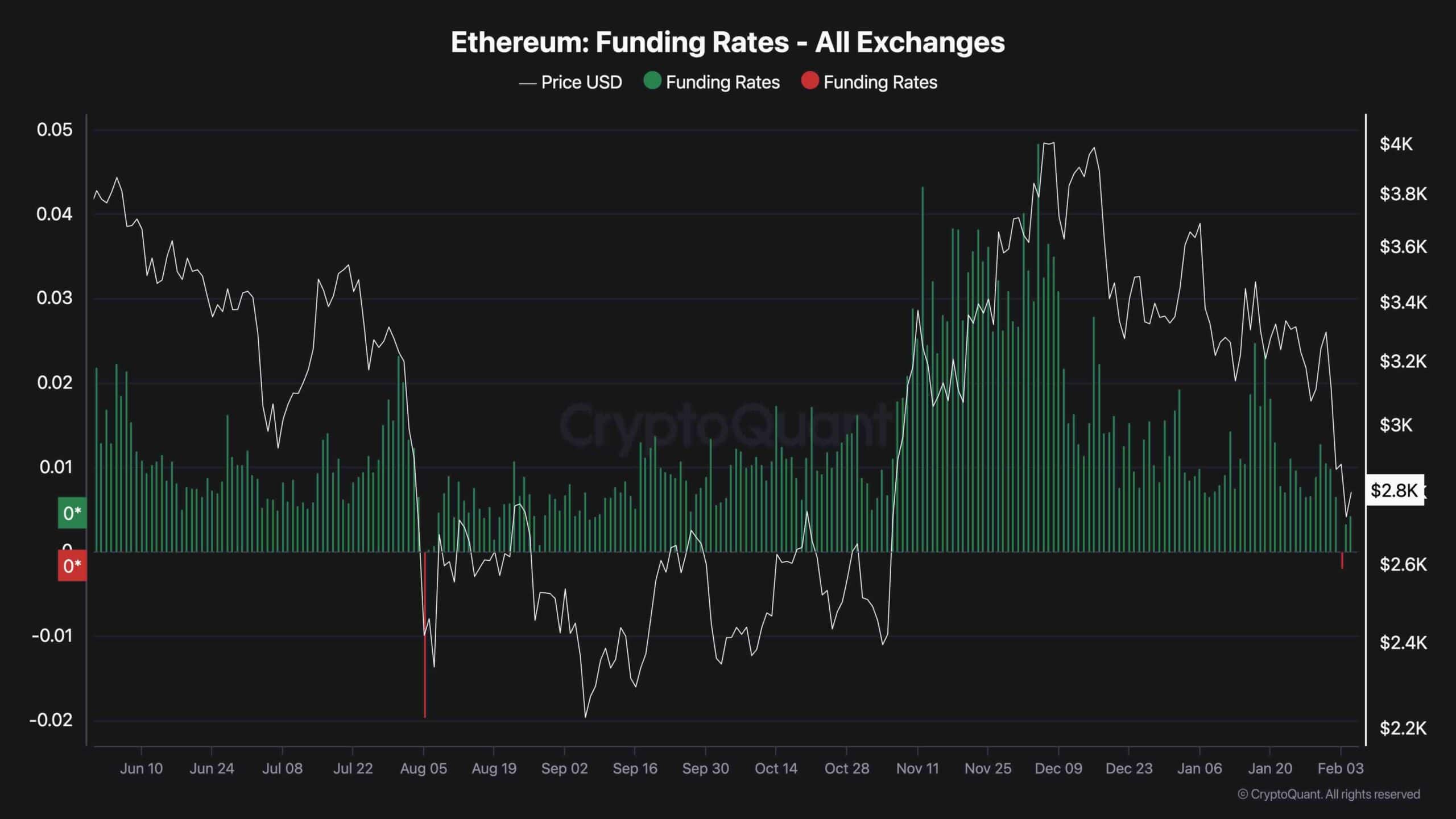

This chart presents the Ethereum funding charges metric, which measures whether or not the consumers or the sellers are executing their orders aggressively (utilizing market orders) on combination. Beneficial funding charges point out bullish sentiment, whereas unfavourable values present bearish sentiment.

Because the chart suggests, the funding charges have dropped considerably following the latest crash. Judging by its present values, it’s secure to say that the futures market is not overheated. Nevertheless, with out adequate demand within the spot market, the market will be unable to get better any time quickly.

The submit Ethereum Price Analysis: ETH Plunges 10% Weekly, What’s the Next Target? appeared first on CryptoPotato.