For a long time, cryptocurrency prices moved quickly. A headline would hit, sentiment would spike, and charts would react almost immediately. That pattern no longer holds. Today’s market is slow, heavier than before, and shaped by forces that do not always announce themselves clearly. Capital allocation, ETF mechanics, and macro positioning now influence price behaviour in ways that are easy to overlook if you only watch short-term moves.

That change becomes obvious when you look at XRP. The XRP price today reflects decisions made by institutions, fund managers, and regulators as much as it reflects trading activity. AI tools are used increasingly to track such inputs – but they are often misunderstood. They do not predict outcomes. They organise complexity.

Understanding that distinction changes how you read the market.

How AI reads an ETF-driven market

AI systems do not look for narratives, but for relationships. In cryptocurrency markets, that means mapping ETF inflows and outflows against derivatives positioning, on-chain activity, and movements in traditional assets. What has changed recently is how much weight those signals now carry.

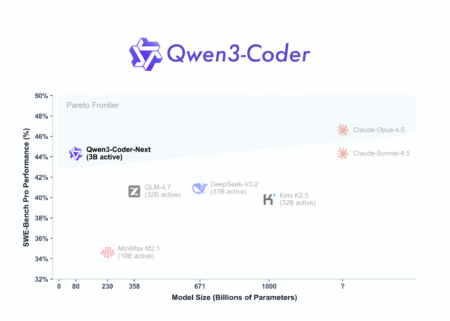

Binance Research has reported that altcoin ETFs have recorded more than US$2 billion in net inflows, with XRP and Solana leading that activity. Bitcoin and Ethereum spot ETFs have seen sustained outflows since October. This is not a classic risk-on environment. It is selective, cautious and uneven.

AI models are good at identifying such behaviour, detecting rotation not momentum. They highlight where capital is reallocating even when prices remain range-bound. This is why markets can appear quiet while meaningful positioning takes place underneath.

AI only shows the movement, yet doesn’t explain the reasons behind it.

What AI can tell you about XRP

XRP does not always move in step with the rest of the market. When conditions change, its price often reacts to access, regulation, and liquidity before sentiment catches up. That pattern has shown up more than once, and it is one reason AI systems tend to weigh fund flows and market depth more heavily than short-term mood shifts when analysing XRP.

Binance Research has pointed to early 2026 as a period where liquidity is coming back without a clear return to risk-taking. Capital has rotated away from crowded trades, but it has not rushed to replace them. AI picks up on that imbalance quickly. It helps explain why XRP has seen ETF interest even while broader momentum in cryptocurrency has felt restrained.

That does not imply a forecast. It is closer to a snapshot of conditions. Market conversations may slow, headlines may thin out, and price can drift, yet positioning continues to evolve in the background. This is easy to miss if you focus only on visible activity.

AI is useful here because it stays indifferent to attention. Instead of responding to engagement spikes or sudden narrative shifts, it tracks what investors are actually doing. In markets where perception often moves ahead of reality, that distinction matters more than it first appears.

Where AI constantly falls short

For all its analytical power, AI has blind spots. Regulation is one of the most important. Models are trained on historical relationships, while regulatory decisions rarely follow historical patterns.

Richard Teng, Co-CEO of Binance, addressed this challenge after the exchange secured its ADGM license in January 2026. “The ADGM license crowns years of work to meet some of the world’s most demanding regulatory standards, and arriving in days of the moment we crossed 300 million registered users shows that scale and trust need not be in tension.” Developments like this can alter market confidence quickly, yet they are difficult to quantify before they happen.

AI responds well once regulatory outcomes are known. It struggles beforehand. For XRP, where regulatory clarity has played a central role in past price behaviour, this limitation is significant.

Another weakness is intent. AI can measure flows, but it cannot explain why investors choose caution, delay, or restraint. Defensive positioning does not always look dramatic in data, but it can shape markets for long periods.

Why human judgement still shapes the outcome

AI does not replace interpretation but supports it. Binance Research has described current conditions as a phase of liquidity preservation, with markets waiting for clearer catalysts like macro data releases and policy signals. AI can flag these moments of tension. It cannot tell you whether they will resolve into action or extend into stagnation.

Rachel Conlan, CMO of Binance, reflected on the broader maturity of the industry when discussing Binance Blockchain Week Dubai 2025. She described a market that is more focused on building than spectacle. That mindset applies equally to AI use. The goal is not prediction. It is informed judgement.

What this means when you look at price

When used properly, AI helps see forces that are easy to miss, especially in ETF-driven conditions. It highlights where liquidity is moving, where narratives fail to align with behaviour, and where patience may be a rational choice.

What it cannot do is remove uncertainty. In markets shaped by regulation, macro shifts, and institutional decision-making, judgement still matters. The clearest insight comes from combining machine analysis with human context.