Lombard said it plans to launch Bitcoin Smart Accounts, designed to allow Bitcoin held in institutional custody to be used as onchain collateral without moving the asset or transferring control to a third party.

According to an announcement shared with Cointelegraph, following a launch this quarter, custodied Bitcoin will be recognized onchain through a receipt token, BTC.b, enabling institutions to access lending and liquidity venues while retaining legal ownership and existing custody arrangements.

Lombard said the framework targets asset managers, corporate treasuries and other institutional holders whose Bitcoin (BTC) remains idle in qualified custody. Pilots are underway with select institutional clients, though Lombard has not disclosed customer names or transaction volumes.

Bitcoin does not natively offer yield, a constraint that has kept vast amounts of the token idle compared to proof-of-stake networks. That dynamic is beginning to shift as a growing set of protocols seek to put custodied Bitcoin to work onchain.

Seeking to unstick Bitcoin

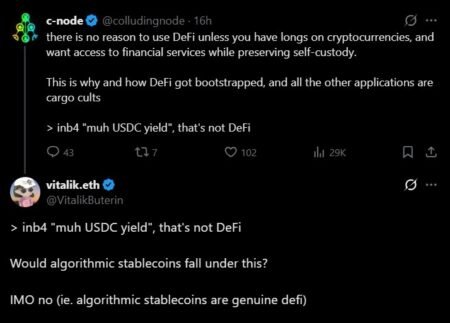

Lombard co-founder Jacob Phillips told Cointelegraph that decentralized exchanges now account for a meaningful share of crypto trading activity, with about half of lending and borrowing already taking place onchain. Phillips said:

But Bitcoin has been stuck. You’ve got roughly $1.4 trillion in BTC sitting idle, with only about $40 billion active in DeFi. Until now, if you wanted to put your Bitcoin to work onchain, you had to wrap it or move it into centralized services, which meant giving up the custody security institutional holders require. That’s the problem we’re solving.

Morpho will serve as the initial liquidity partner, with additional onchain protocols and custodian integrations expected over time.

Phillips said Morpho was selected for its institutional-focused lending infrastructure and experience supporting isolated Bitcoin-backed lending, adding that Bitcoin Smart Accounts are designed as open infrastructure rather than a closed integration, allowing Lombard to support additional DeFi protocols as demand emerges.

Founded in 2024, Lombard develops Bitcoin-focused onchain infrastructure and tokenized assets, including LBTC and BTC.b, designed to enable Bitcoin to be used in DeFi without leaving custody, according to the company.

Related: Bitwise to launch onchain vaults via Morpho

New products aim to put idle Bitcoin to work

On May 1, US-based crypto exchange Coinbase launched the Coinbase Bitcoin Yield Fund, targeting non-US institutional investors with an expected annual net return of 4% to 8% on Bitcoin holdings.

A few months later, Solv Protocol launched a structured yield vault for institutional investors, designed to deploy idle Bitcoin across multiple yield strategies spanning decentralized finance, centralized finance and traditional markets. Solv’s BTC+ vault includes strategies such as protocol staking, basis arbitrage and exposure to tokenized real-world assets.

On Feb. 4, institutional crypto infrastructure provider Fireblocks said it would integrate Stacks to give institutional clients access to Bitcoin-based lending and yield.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder