Asset management giant BlackRock is making its first formal move into decentralized finance by bringing its tokenized US Treasury fund to Uniswap, marking a milestone moment for institutional adoption of DeFi.

According to a Wednesday announcement, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will be listed on the Uniswap decentralized exchange, allowing institutional investors to buy and sell the tokenized security.

As part of the arrangement, BlackRock is also purchasing an undisclosed amount of Uniswap’s native governance token, UNI, the announcement said.

The collaboration is being facilitated by tokenization company Securitize, which partnered with the world’s biggest asset manager on the launch of BUIDL.

According to Fortune, trading will initially be limited to a select group of eligible institutional investors and market makers before expanding more broadly.

“For the first time, institutions and whitelisted investors can access technology from a leader in the decentralized finance space to trade tokenized real-world assets like BUIDL with self-custody,” said Securitize CEO Carlos Dominigo.

BUIDL is the biggest tokenized money market fund, with more than $2.18 billion in total assets, according to data compiled by RWA.xyz. The fund is issued across multiple blockchains, including Ethereum, Solana, BNB Chain, Aptos and Avalanche.

In December, BUIDL reached a key milestone, surpassing $100 million in cumulative distributions from its Treasury holdings.

Wall Street expands tokenized money market push amid stablecoin growth

Tokenized money market funds have gained traction on Wall Street, with several major financial institutions joining BlackRock in exploring the technology. Goldman Sachs and BNY, for example, have partnered to expand institutional access to tokenized money market products.

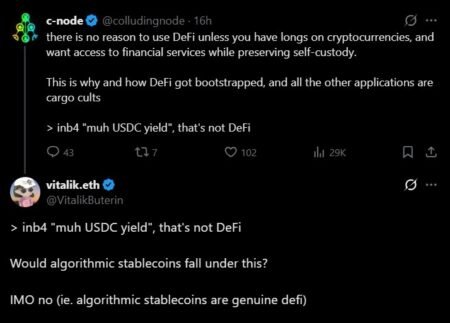

JPMorgan strategists have also highlighted the asset class as a potential counterweight to the rapid growth of stablecoins. While both rely on blockchain infrastructure, the GENIUS Act is widely expected to accelerate stablecoin adoption, potentially drawing liquidity away from traditional money market funds.

Tokenization could help offset that shift by allowing investors to post money market fund shares as collateral without sacrificing yield, JPMorgan strategist Teresa Ho said last year.

To be sure, the GENIUS Act could also accelerate the growth of tokenized real-world assets, according to Solomon Tesfaye, chief business officer at Aptos Labs, who previously told Cointelegraph that clearer stablecoin rules may spur broader on-chain adoption.