Key Points

Netflix (NASDAQ: NFLX) has been one of the best investment stories this century. It has delivered impressive shareholder returns since its 2002 IPO, but it has run into a bit of trouble lately. The stock is trading down about 43% from its July 2025 all-time high, and its recent performance prompts an obvious question: Should investors buy the dip?

Image source: Getty Images.

Netflix’s latest acquisition is coming under scrutiny

Netflix’s stock has tanked largely on investor concern about its efforts to acquire multiple media assets from Warner Bros. Discovery (NASDAQ: WBD). The acquisition transaction will cost Netflix a whopping $82.7 billion. This is structured as an all-cash transaction, which means Netflix, which has about $9 billion in cash and short-term investments on hand, will need to take on a substantial amount of debt to finance the deal.

That level of debt has investors a bit worried about the health of Netflix. It’s not yet clear how these assets will be integrated into Netflix’s services, and Warner Bros. Discovery apparently didn’t think enough of them to spin them off into a stand-alone company (which is why Netflix is attempting to purchase them). However, Netflix has an excellent track record of maximizing the value of the assets it owns and creates, and I think this acquisition makes sense, though it may take some time for it to absorb the initial cost.

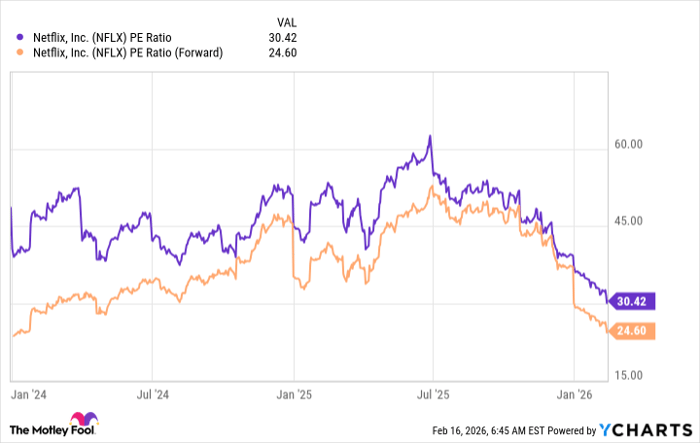

But back to the main question: Is this 40% share price drop a buying opportunity? Before the drop, Netflix’s valuation was rather expensive, with the stock trading for more than 60 times trailing earnings and nearly 50 times forward earnings.

Data by YCharts.

At that stock valuation, Netflix as a company should have been growing at an unbelievable pace, but its revenue growth was only in the mid-teens. Now, that’s solid growth, but I think that’s far too expensive a price to pay for the stock, especially when there are artificial intelligence companies that are growing at 50% or greater and trade for a cheaper price tag.

Today, Netflix trades at about the same valuation as its big tech peers. As a result, I think it’s a viable stock to buy now if you think that Netflix can integrate the assets from the acquisition appropriately. If it can’t, then it could take a while for Netflix to dig itself out of the hole. But if it can, then Netflix looks like an excellent value here.

Should you buy stock in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.