Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is trading around a key demand zone as the entire crypto market battles renewed selling pressure. Among the hardest-hit segments are meme coins, which have seen sharp pullbacks in recent days. Dogecoin, the original and most recognized meme token, continues to follow a persistent bearish trend — one that may not reverse unless current levels hold firm.

Related Reading

Investor sentiment across the space remains cautious, with rising macroeconomic uncertainty and weakening momentum dragging prices lower. For Dogecoin, this moment is especially critical, as its price action now hovers just above the lower boundary of a long-term parallel channel.

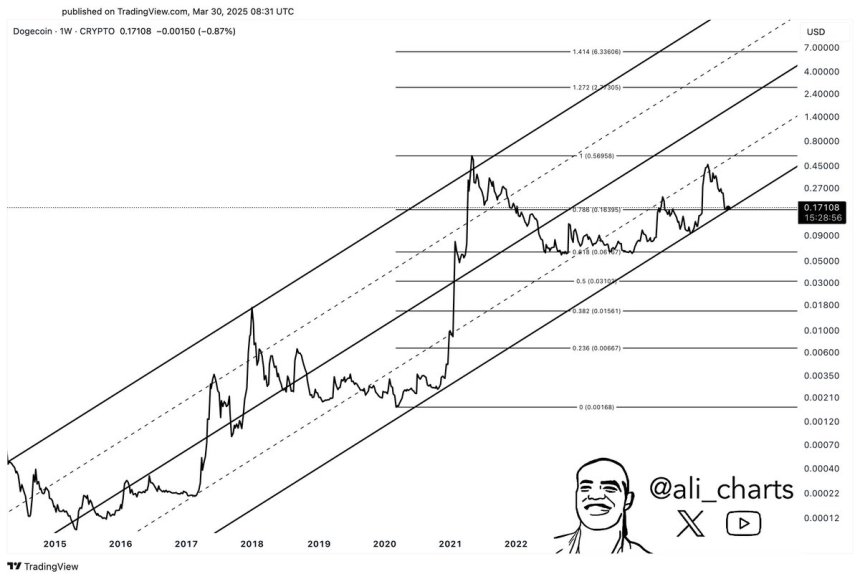

Crypto analyst Ali Martinez shared technical insights revealing that Dogecoin is still holding above this crucial support level. According to Martinez, a spike in demand from this zone could act as the launchpad for a rally toward the mid or upper range of the channel — potentially offering much-needed relief for DOGE holders.

While broader market conditions remain fragile, Dogecoin’s structure suggests it still has room to rebound — but only if buyers step in soon. As price compresses near support, the next move could define the token’s short-term trend in a market filled with uncertainty.

Dogecoin Down 66% As Market Uncertainty Weighs On Sentiment

Dogecoin is currently trading under heavy pressure, down approximately 66% from its multi-year high near $0.48. Despite brief attempts at recovery, underwhelming price action and bearish sentiment continue to drag DOGE lower, with bulls struggling to find momentum in an increasingly volatile market. The broader macroeconomic backdrop isn’t helping either — rising interest rates, geopolitical instability, and trade war tensions have all contributed to a high-risk environment across global financial markets.

This turbulence is having an outsized impact on speculative assets, and meme coins like Dogecoin remain some of the most vulnerable. The current conditions suggest that heightened volatility may become the new norm for the foreseeable future, increasing the risk of further downside for DOGE unless strong support holds.

Martinez’s technical outlook on X notes that the $0.15 level is now essential for Dogecoin bulls. According to his analysis, DOGE continues to trade just above the lower boundary of a long-term bullish channel — a structure that has held firm through multiple market cycles.

Martinez emphasizes that a spike in demand at this level could trigger a sharp rally, potentially pushing DOGE toward the mid or upper range of the channel, between $4 and $7. While this may seem ambitious given current sentiment, the long-term setup remains technically intact — but bulls must step in now to avoid a complete breakdown.

Related Reading

DOGE Bears Push Bulls to the Edge

Dogecoin is trading at $0.16 after facing intense selling pressure over the past several days, dropping more than 20% in under a week. The sharp decline has placed bulls in a difficult position, with momentum clearly favoring the bears. The price structure remains decisively bearish, and if DOGE fails to hold the critical $0.15 support level, a dramatic collapse could follow — potentially sending the meme coin into lower demand zones not seen in months.

The $0.15 mark now stands as the last line of defense for bulls, as it aligns with a key long-term support level within a broader bullish channel. Losing it would likely trigger panic selling and confirm a breakdown in market structure.

However, if Dogecoin can maintain support above $0.16 and attract renewed buying interest, there’s still potential for a short-term recovery. A bounce from current levels could spark a rally toward the $0.20–$0.25 range — a zone that previously acted as strong resistance and may offer the first real test of any upward momentum.

Related Reading

With market volatility high and sentiment shaky, DOGE’s ability to hold current levels will be key to determining whether this is just another dip — or the start of something worse.

Featured image from Dall-E, chart from TradingView