Image source: Getty Images

The London stock market is packed with top opportunities for SIPP investors to explore around the start of this new tax year.

Here’s a cheap FTSE 100 heavyweight, an underpriced investment trust, and a surging exchange-traded fund (ETF) to consider.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Standard Chartered

It’s my belief that Standard Chartered (LSE: STAN) is one of the FTSE’s best bargain stocks to look at currently.

For 2025, it trades on a forward price-to-earnings (P/E) ratio of 8.6 times. This is based on broker forecasts that annual earnings will rise 14% year on year.

On top of this, the company’s corresponding price-to-earnings growth (PEG) ratio is just 0.5. Any reading below 1 implies that a share is undervalued.

StanChart shares also look cheap based on the value of its assets. As with its PEG ratio, the bank’s price-to-book (P/B) multiple sits below the value watermark of 1, at 0.7.

Its low valuation reflects, in part, fears over how trade tariffs could impact profits. The threat is especially high in its key Chinese market.

Yet Standard Chartered’s resilience so far means I’m optimistic about its ability to ride out any volatility. Operating income and pre-tax profit rose 5% and 10%, respectively, in Q1.

Henderson European Trust

The Henderson European Trust (LSE:HET) — as the name implies — holds a portfolio of stocks that are based on the continent (but excluding the UK). More specifically, it targets “global leaders that happen to be based in Europe,” like semiconductor manufacturer ASML, defence giant Safran and bank BNP Paribas.

Today the trust trades at a 7.2% discount to its net asset value (NAV) per share of 203.3p. I think this represents an attractive dip-buying opportunity to consider.

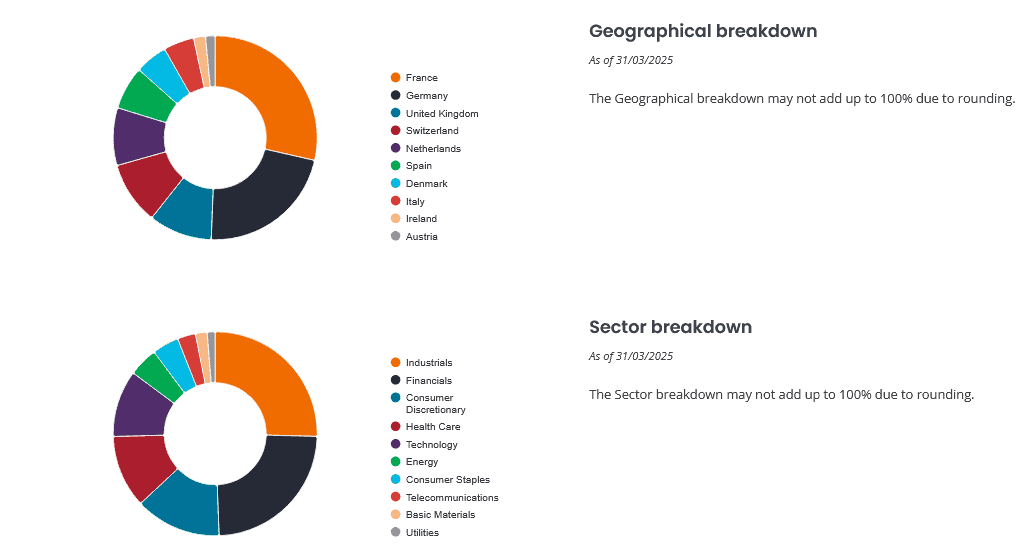

I like this Henderson fund because of its wide diversification by both geography and sector. This doesn’t eliminate the very real threat posed by a eurozone-wide slowdown. But it helps to limit the risk to investors’ funds.

This exceptional diversification hasn’t impacted its ability to deliver a healthy return so far. Its average annual return since 2015 stands at a tasty 7.8%.

WisdomTree Physical Gold

Global gold-backed ETFs are enjoying spectacular demand as macroeconomic fears linger and the US dollar weakens. Both of these are classic drivers of the safe-haven asset, and encouragingly for gold investors, both phenomena look set to continue.

According to latest World Gold Council (WGC) data, bullion-backed ETFs enjoyed their strongest inflows since March 2022 last month. Total assets under management (AUMs) now stand at record highs of $379bn.

Weak jewellery sales and cooling central bank purchases pose a threat to gold prices. But on balance, I’m expecting bullion to surpass last month’s record peaks of $3,500 an ounce due to strong retail investor demand in the short term.

Against this backdrop, I think the WisdomTree Physical Gold (LSE:PHAU) fund is worth serious attention. A fund like this saves investors the hassle of having to buy and store physical gold.

And unlike gold miner stocks, it doesn’t expose investors to the volatile business of metals mining.