October 10 was no ordinary day in crypto. Yes, Donald Trump “retaliated” after China announced new plans curbing rare earth metal exports. Truth Social, X, that’s classic Trump. The president won’t hesitate to show how mighty the United States is.

The truth of the matter is: News of new tariffs on China was not expected to force a mega drawdown on that thin Friday evening. A -10% drop in Bitcoin would be extreme. However, things quickly went south on that October 10, and after what could be a comparatively “small” trigger, the world’s most valuable coin crashed from over $120,000 to below $105,000 in 15 short minutes.

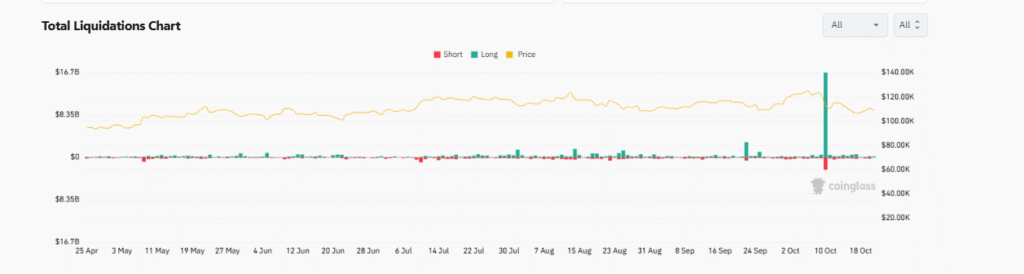

According to Coinglass, over $16Bn of leveraged positions, long and short, were liquidated on October 10. The sheer size of this liquidation makes October 10 the largest single-day liquidation event in history; a true crypto black swan event.

(Source: Coinglass)

DISCOVER: 10+ Next Crypto to 100X In 2025

What Happened? Why Did Crypto Fail? Manipulation or System Failure?

On the surface, it is easy to blame Trump.

However, digging deeper, Trump had nothing to do with the “other” slump outside of a mild correction that would ordinarily see BTC USD and some of the best cryptos to buy drop -10% max.

There have been theories. Some blame Binance, the world’s largest crypto exchange, and others think this was nothing more than insider trading.

For those who believe the sell-off was due to insider activity, they cite the huge shorts on Bitcoin and Ethereum placed less than an hour on Hyperliquid before the drop.

As 99Bitcoins reported, the trader, allegedly linked to the Trump family, denied all associations and said funds belong to clients.

Others, however, squarely blame Binance. In their view, the exchange exacerbated the drop by reportedly withdrawing liquidity and (un)intentionally amplifying volatility on what is usually a thin Friday evening when traders are preparing for the weekend.

Whether it was a systemic failure or not, traders and market makers, including Wintermute, were wrecked.

> Binance internal oracles cause $400B in liquidations in flash crash

> Binance offers $40M in “recovery airdrop”> Founders claim Binance charges $5M+ in predatory token listing fees

> Binance threatens legal actionAre we noticing a pattern here?

Get your funds off Binance.— curb.sol (@CryptoCurb) October 14, 2025

An anonymous whale on Binance lost over $450M when his BTC USDT long position was closed. Wintermute lost over $300M. Another hedge fund from China lost over $180M. The list goes on and on.

A Market‑Maker Friend Speaks Out: What Exactly Happened on the Night of 10/11 at Binance | Let Data and Facts Speak

I used to do spot–futures arbitrage, I have quite a few market‑maker friends. Many of them knew, directly or indirectly, that I suffered heavy losses. Ironically,… pic.twitter.com/gUbH4LFaO9— 812.eth

(@GammaPure) October 20, 2025

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Lawsuits Are Coming: Wintermute CEO

To calm down traders and hedge funds, Binance dished out goodies, airdropping BNB to meme coin traders on the Binance Smart Chain.

However, this is not enough. Experts are now expecting a new wave of class action suits that would target market manipulators, exchanges, and even liquidity providers.

On X, Arthur Cheong, the CIO of DeFiance Capital, is already asking victims to message him should they want to sue any CEX they feel should have done something to cap losses.

PSA to my friends:

If you suffered material losses on CEX during the flash crash of 10th October and would like to get advice on pursuing this further, feel free to dm me.

Have built up significant high-stakes commercial litigation experience so can give an informed view on it.

— Arthur (@Arthur_0x) October 19, 2025

Binance would likely become the target of potential litigation.

In a recent podcast, Evgeny Gaevoy, the CEO of Wintermute, said they are already evaluating their legal options and would sue Binance due to the malfunction of their auto-deleveraging (ADL) systems. Gaevoy said their ADLs were executed at completely ridiculous prices.

Wintermute CEO @EvgenyGaevoy on how they got ADL’d on Binance and predicts lawsuits and challenges from trading firms. pic.twitter.com/d2hGXoOOHc

— cryptotesters (@cryptotesters) October 20, 2025

Typically, centralized exchanges would ADL positions during periods of extreme volatility to manage risks. While it is the “last resort,” Gaevoy said Wintermute had to absorb positions at ridiculous and unreasonable prices that didn’t reflect market reality.

He notes a notification where a short position was closed at 5X the actual market price, leading to what he said was an instant and unhedgeable loss.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Wintermute CEO: Wave of Lawsuits After October 10 Crypto Flash Crash

- Crypto crashed on October 10, wiping over $16Bn of leveraged positions

- Donald Trump triggered the sell-off

- Big whales lost hundreds of millions

- Wintermute CEO now says exchanges should expect a wave of lawsuits

The post After the October 10 Crypto Flash Crash, Expect A Wave of Lawsuits: Wintermute CEO appeared first on 99Bitcoins.