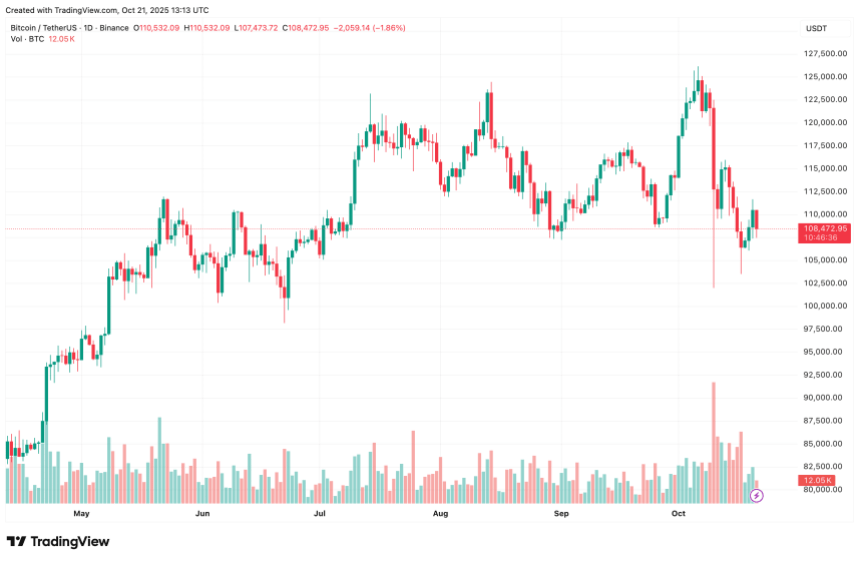

While Bitcoin (BTC) has declined more than 13% from its fresh all-time high (ATH) of $126,199 recorded earlier this month on October 6, CryptoQuant contributor PelinayPA is confident that there is a 55% chance that the BTC top for this market cycle is not in yet.

Bitcoin Top Not In Yet – More Upside Ahead?

According to a CryptoQuant Quicktake post by contributor PelinayPA, there is a 55% probability that the Bitcoin top for the ongoing market cycle is not in yet. The analyst highlighted BTC’s recent on-chain flows to support their claim.

Related Reading

In their analysis, PelinayPA noted that although BTC’s price has tumbled from more than $126,000 to around $109,000 in the second half of 2025, there has been a noticeable increase in 0-1 day BTC inflows to exchanges.

A rise in 0-1 days BTC inflows to exchange typically has two implications – short-term traders are taking profits, and there is a temporary phase of repositioning of liquidity as traders transfer their holdings to exchanges, anticipating price volatility.

The analyst added that BTC held for more than six months is largely inactive, indicating that long-term holders are likely not selling despite the recent market crash. This signals market confidence among long-term holders, minimizing the possibility of another major sell-off in the near term.

PelinayPA remarked that such behavior typically occurs in the mid or maturing stages of a bull cycle, where any dip in price is seen as an opportunity to accumulate instead of a trend reversal.

Currently, the Bitcoin market is in a natural consolidation phase within an ongoing uptrend. The analyst added:

In the short term, Bitcoin could revisit the $102K region as short term traders continue to take profits. However, since this selling pressure originates mainly from newer holders, it is unlikely to disrupt the broader bullish structure. These dips may offer attractive entry opportunities.

Concluding, Pelinay commented that the lack of selling activity among BTC holders in the 6-months to 10-year time-band range shows that there is a 55% probability that the bull market top has not yet formed.

BTC Could Dip To $102,000

The CryptoQuant contributor noted that, although it is likely that the BTC bull market top is not in yet, it does not mean that the top cryptocurrency would not see further temporary decline. If selling persists, BTC could once again test the $102,000 support level.

Related Reading

Similarly, crypto analyst Elliot Waves Academy remarked that BTC has likely finished the bullish leg of the ongoing market cycle. The analyst added that BTC is likely to consolidate around its current levels.

That said, a fellow CryptoQuant contributor noted that BTC has entered the ‘disbelief phase,’ and may take the bears by surprise with a sharp surge in price. At press time, BTC trades at $108,472, down 2% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com