Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A Bitcoin price prediction made exactly one month ago by popular crypto analyst Doctor Profit on social media platform X has unfolded with interesting accuracy. On March 21, Doctor Profit outlined a detailed price trajectory for Bitcoin, predicting specific price movements, resistance and support zones, and the influence of the M2 money supply. Fast forward to April 21, Bitcoin’s price movements have closely mirrored the analyst’s forecast, lending credibility to the remaining parts of his prediction.

How Bitcoin Followed Doctor Profit’s March Forecast

Doctor Profit’s analysis is based on Bitcoin’s response to changes in the M2 money supply, which he identified as a misunderstood indicator. He argued that although the market experienced an increase in liquidity starting in February, Bitcoin’s significant bullish rally from September 2024 onwards had already factored in this liquidity expansion, contrary to what most investors had expected.

Related Reading

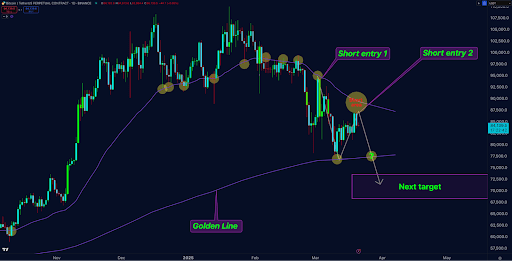

Notably, Doctor Profit had previously highlighted a key technical level, the weekly EMA 50, also known as the Golden Line, at approximately $76,000. He expected a bounce from this level, projecting a move to the $87,000 to $88,000 region before another correction.

Bitcoin followed this script almost exactly, crashing in the first few days of April before rebounding from around $76,000 on April 9. Now, Bitcoin has rallied back above $87,000, coinciding precisely with Doctor Profit’s prediction.

Next Phase: Bitcoin Heading For Support Zone At $70,000 To $74,000

Now that Bitcoin has bounced and is trading above $87,000 again, Doctor Profit’s immediate next target is a potential crash towards $74,000 to $70,000, which is slightly below the highlighted Golden Line. According to the analyst, the market’s behavior at this support zone will be decisive. It is at this zone that the Bitcoin price will reveal its next major directional bias.

Related Reading

Doctor Profit laid out two clear scenarios based on Bitcoin’s reaction within the $74,000 to $70,000 price range. If Bitcoin experiences only a temporary wick into this range and manages a strong daily or weekly close back above the Golden Line, this would signal a reversal, and it would be prudent to close short positions and begin accumulating long positions. However, if Bitcoin closes below this crucial area, it could trigger a deeper bearish move, leading its price to significantly lower levels, possibly revisiting the $50,000 region under a worst-case Black Swan scenario.

Notably, whichever bearish scenario plays out, it is expected to occur by April and likely into early May. Despite the current short-term bearish outlook, Doctor Profit maintained a bullish long-term view. He confidently predicted that the Bitcoin bull run would resume around May or June, eventually driving the price towards new all-time highs in the range of $120,000 to $140,000.

At the time of writing, Bitcoin is trading at $87,526, up by 3.28% in the past 24 hours. The bearish outlook towards $74,000 would only be invalidated if Bitcoin successfully closes a weekly candle above the $100,000 level.

Featured image from Adobe Stock, chart from Tradingview.com