Litecoin (LTC) ripped as much as 11% to $129–$131, outpacing Bitcoin and Ethereum during a market pullback as fresh spot ETF momentum stoked bids. Trading volume exploded 143% to $1.66B, while futures open interest jumped 25% to $1.21B, signaling new leverage and renewed directional conviction.

Related Reading

The catalyst is linked to the growing confidence that a U.S.-listed spot Litecoin ETF could be near the finish line. Canary Capital’s updated S-1 now includes ticker LTCC and a 0.95% fee, the kind of last-mile filing detail ETF watchers say typically appears “before go-time.”

With Grayscale and CoinShares also in the hunt, analysts argue LTC’s commodity-like profile and long proof-of-work history make it one of the cleaner alt candidates for regulated fund access once the SEC resumes normal operations.

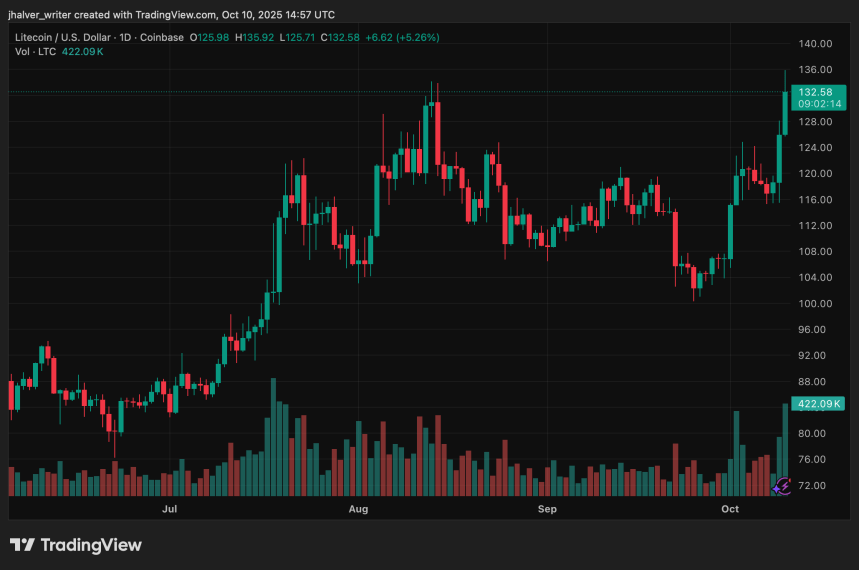

Litecoin Technical setup: $130 reclaim tees up $135–$138

On the charts, Litecoin blasted through the $127.45 swing high and reclaimed stacked moving averages (7- and 30-day SMAs), turning the multi-month range from ceiling to potential floor. RSI (68) shows strong momentum without a blow-off, and MACD remains firmly positive.

Immediate resistance sits at $130–$131; a daily close above opens a path to $134–$135, then $138 and $150. Should FOMO follow an ETF headline, bulls point to a broader vacuum up to the $150–$160 zone, Litecoin’s highest region since early 2022.

On higher time frames, some technicians note a breakout from a year-long diagonal that, if confirmed, preserves a stretch target toward $275 over the coming months; that scenario likely requires sustained ETF-driven inflows.

LTC's price trends to the upside on the daily chart. Source: LTCUSD on Tradingview

LTC Levels That Matter, And What Could Invalidate

For momentum traders, the line in the sand is $125: lose it decisively and swift profit-taking could drag LTC back into $122–$125 support, with $115–$118 as a deeper retest.

Hold above $125 and reclaim $130 with volume, and bulls keep control into $135–$138. Macro remains a swing factor; government shutdown timing, SEC throughput, and broader crypto risk appetite can still inject volatility.

Related Reading

As long as $125 holds and $130 flips to support, the $135–$138 breakout looks within reach, while a green light for LTCC could be the spark that extends the move toward $150–$160 next. For searchers tracking the Litecoin price, keep your eyes on $130: it’s the path to the next leg.

Cover image from ChatGPT, LTCUSD chart from Tradingview