Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid the market retrace, Aptos (APT) has seen an 8% decline in the past 24 hours, falling below a key support zone for the second time this week. Despite the correction, some analysts consider that the cryptocurrency could be poised for a breakout soon.

Related Reading

Aptos Loses Macro Range Lows

During the March retraces, Aptos fell below a crucial support level for the first time since August 2024 but recovered 24% near the end of the month. However, APT followed the rest of the market and dumped 11% to close the March below key levels.

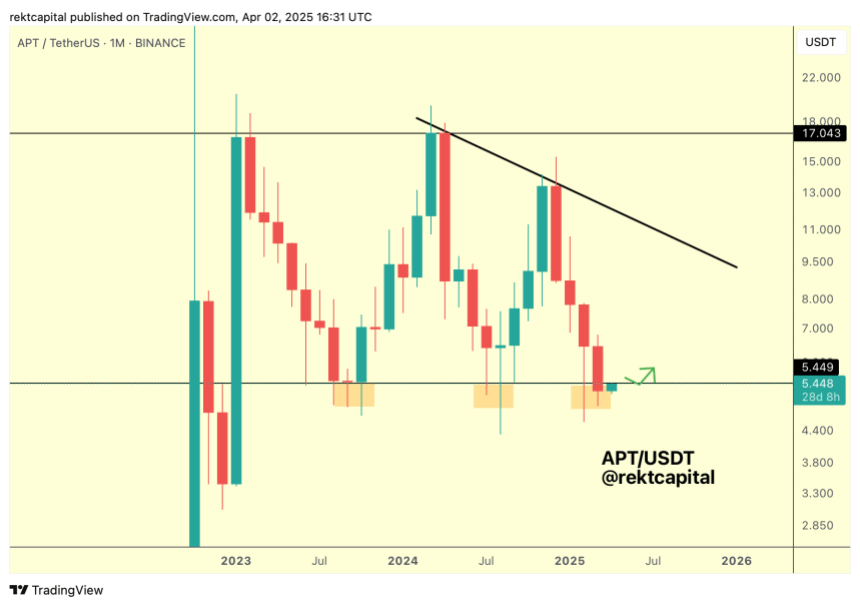

Analyst Rekt Capital noted that APT closed last month below its Macro Range Low of $5.44 for the first time. The cryptocurrency has been trading within the $5.45-$17 price range since 2023, retesting the range lows two times before.

Historically, “APT tends to develop bases here in the form of downside wicks for three-month periods,” he explained, adding that the cryptocurrency seems to be developing a third three-month base, with the difference that it has closed below this range for the first time in the monthly timeframe.

Following this performance, Aptos will need to reclaim the $5.44 level as support “to end this Monthly close as a downside deviation” and “avoid a bearish retest here.”

Previously, the analyst suggested that holding this level could reverse ATP’s price action in the coming months, as it has done with the other clusters. Additionally, he pointed out the previous consolidations included a “downside wicking below support.”

In his recent analysis, Rekt Capital considers that APT’s daily bullish divergence “is still something worth watching” as the cryptocurrency’s Relative Strength Index (RSI) continues to form Higher Lows despite the recent downside deviation, and its price “is trying to transition away from Lower Lows into a new Higher Low.”

According to the analyst, “a clear market structure is developing here, and a breakout from it would validate the Bull Div and set APT up for a reclaim of the Macro Range Low of $5.44,” which is key for a bullish rally.

APT To Reclaim $6.5 Resistance?

Analyst Sjuul from AltCryptoGems highlighted Aptos’ strength amid the market volatility, which saw Bitcoin (BTC) drop from $88,000 to $81,000 in the past 24 hours. APT dropped from the $5.40 mark to the $4.95 support.

The analyst considers that a retest of the local range lows could be necessary before the cryptocurrency aims for the next crucial level, as the current price zone has been tested many times.

Related Reading

Moreover, a reclaim of the $5.44 range could see the APT surge another 20% to the $6.5 resistance lost two months ago. Another market watcher suggested that Aptos is “showing potential for a bullish breakout as it trades within a descending channel.”

Per the chart, the cryptocurrency has been trading within a descending channel since early February, testing the channel’s lower and upper boundaries throughout March. “After testing the lower trendline, it may be finding support, and a break above the upper resistance will signal a significant rally,” the analyst concluded.

As of this writing, Aptos trades at $5.02, a 16.1% decline in the weekly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com