XRP fell below $2.30 this week, wiping out all the gains registered in last week’s short-lived rally. The cryptocurrency, which had risen 8% from $2.06 to $2.28 last week, has now lost 3.5% from Monday’s opening price and 7% from its weekly high of $2.36.

Market Expert Forecasts Potential 30% Fall To $1.55

A cryptocurrency analyst, Block Bull, forecasts that XRP might drop much deeper in the near future. From the analyst’s April 29 X post, XRP could not break the resistance level at the top of a bull flag pattern on the daily charts.

This technical failure may push the price to $1.55, which would be “annoying as hell”, according to Block Bull – a 30% fall from the high of the pattern – and 28.6% from current levels.

Block Bull informed followers this possible price fall would be brief and could prove to be the perfect entry point for investors. The analyst intimated big money players tend to use such downturns in markets to accumulate holdings at bargain rates.

Likely $XRP is going to fall 30% along with $XLM that Ive just posted.

bottom of bull flag and fib level will be a great entry

$1.55 (annoying as hell)

bleeding the average guy and this is why the rich get richer cos theyre the only ones able to afford to HODL pic.twitter.com/pG3h30Swks

— BLOCK BULL

(@TheBlockBull) April 29, 2025

XRP Not Alone As Bitcoin And Ethereum Also Struggle

The decline pressure on XRP is in line with weaker trends in major cryptocurrencies overall. Bitcoin is struggling to remain above the $95,000 threshold while Ethereum has fallen below $1,800. That this is a market-wide correction and not a specific XRP problem is indicated.

Competing Analysis Provides More Optimistic Forecast

Not everyone who watches the market sees the dismal outlook. Others noted that while declining 6% in two days from $2.28 to $2.14, XRP has been able to remain above important support levels on shorter timeframes.

They said that if XRP can hold support at $2.14, the price may bounce back to $2.24 or higher in short order. More positive predictions even indicate that XRP could hit $5 in a month, a new all-time high for the cryptocurrency.

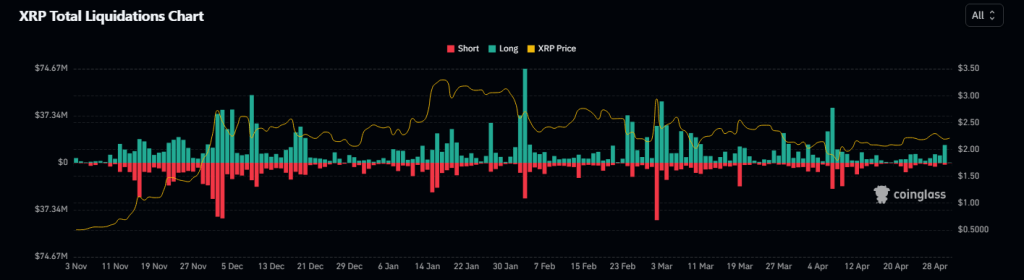

Liquidation Data Shows Market Imbalance

Meanwhile, latest trading statistics by Coinglass indicate a shocking disparity in market positions. Within 24 hours, nearly $14 million of long positions (bets on the price going up) were liquidated, while just $1.48 million worth of short positions were sold.

This almost 1000% gap indicates the majority of traders were placing bets on price rises when the market started going into decline.

The sudden sell-off of such a large number of long positions had a cascade effect, dropping prices even quicker. Open interest also declined by 4%, indicating traders were closing out as uncertainty mounts.

As of the most recent trading figures, XRP stands at $2.20, down 1.14% since the beginning of the day. Investors now have conflicting messages regarding whether to anticipate further declines or perhaps a possible rebound in the coming days.

Featured image from Unsplash, chart from TradingView