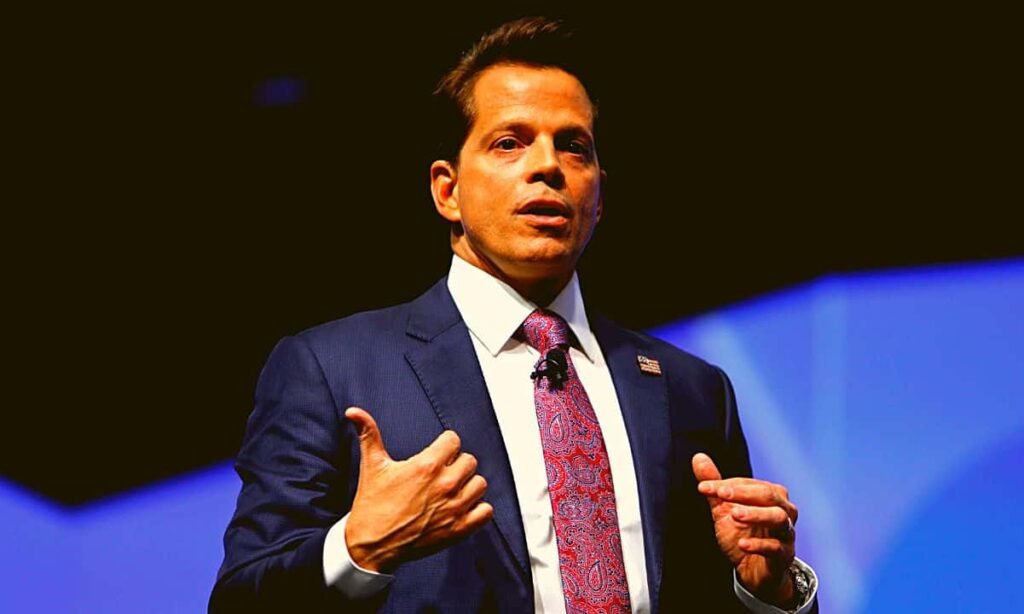

Anthony Scaramucci, American financier and founder of the alternative investment firm SkyBridge Capital, has slammed the New York State Attorney General’s (NYAG) office for coming after Galaxy Digital, a blockchain financial services company owned by his friend, Mike Novogratz.

In a Friday tweet, Scaramucci insisted that the NYAG’s lawsuit against Galaxy Digital is a misuse of law due to the Martin Act. The Martin Act is a New York law that grants the Attorney General the power to take legal action against financial fraud cases without proving intent.

NYAG’s Case Against Galaxy Digital

On March 28, the NYAG unveiled documents that alleged Galaxy Digital promoted the now-collapsed cryptocurrency Luna (LUNA), which was issued by Terraform Labs, the developer behind the beleaguered ecosystem Terra.

The NYAG claimed that Galaxy bought 18.5 million LUNA at a 30% discount, promoted and sold them without appropriate disclosures. While promoting LUNA, Novogratz even got a Luna tattoo after the cryptocurrency’s price reached $100 in December 2021. Although Galaxy purchased LUNA at $0.31 in October 2020, the company profited hundreds of millions of dollars from selling the tokens before Terra’s eventual collapse in May 2022.

“Galaxy’s conduct, including its misrepresentations and omissions about Luna while simultaneously selling Luna and failing to disclose its then-present intent to sell, constituted violations of the Martin Act and violations of New York Executive Law Section 63(12),” the NYAG stated.

In an attempt to settle the case, Galaxy has agreed to pay the State of New York $200 million in disgorgement over three years. The firm will pay $40 million within the first fifteen days, $40 million within one year, $60 million within two years, and $60 million within three years.

Opening the Door for Abuse of Law

Reacting to the NYAG’s actions, Scaramucci insists that everything Galaxy and Novogratz ever said about Luna was based on the deception perpetrated by Terraform Labs and its founder, Do Kwon, whom he tagged the “real bad actors.”

The SkyBridge Capital founder said the lawsuit made no sense because it is completely at odds with the United States Securities and Exchange Commission and the Department of Justice, which are engaged in a legal battle against Kwon and Terraform Labs.

Scaramucci further argued that the Martin Act, which the NYAG alleges Galaxy violated, creates a low standard of proof that can lead to an abuse of the law, as seen in the case of Galaxy Digital.

“It shouldn’t exist,” the financier asserted.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!