Asia-Pacific (APAC) offers massive growth potential for businesses but is a highly fragmented region with each country operating under its own regulations, currencies, and preferred payment methods.

According to Checkout.com, success in APAC requires a localized approach, including working with local acquirers, offering preferred payment options, and adapting to individual regulatory frameworks, rather than relying on a one-size-fits-all strategy.

In a recent post, the London-based paytech firm outlines how to navigate APAC’s complex payments landscape, highlighting the region’s opportunities and challenges, emerging payment trends, and the critical role of localization in a highly diverse market.

A major digital commerce market

APAC is one of the world’s fastest-growing digital commerce markets, with 95% of APAC consumers shopping online or via apps regularly, and more than one-quarter shopping at least weekly, according to a consumer survey. For most consumers, online marketplaces have even become their primary purchasing channel, with 70% shopping most frequently through these platforms.

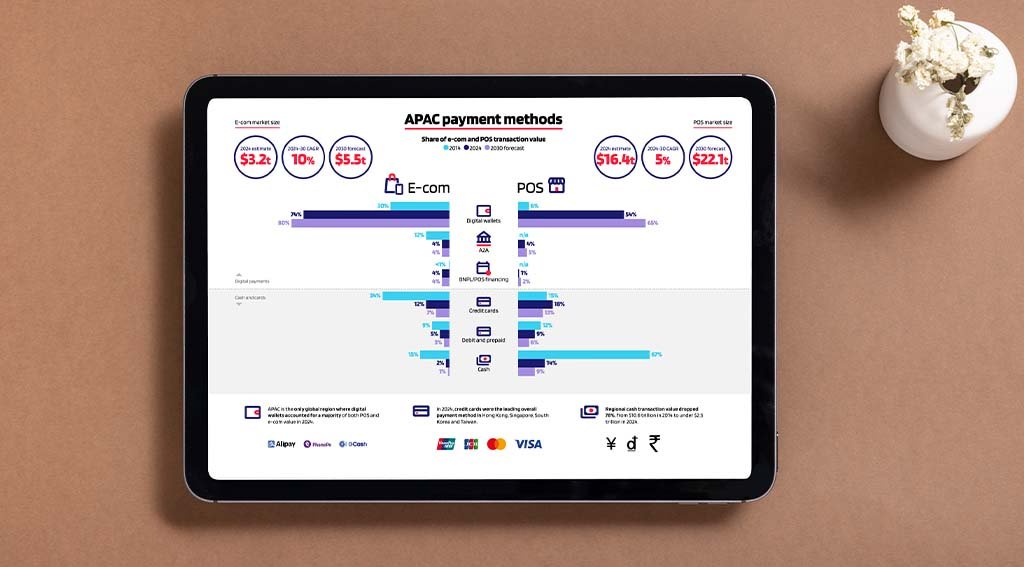

APAC’s e-commerce sector is showing no signs of slowing down. Worldpay’s Global Payments Report 2025 projects that the market will grow by about 10% annually through 2030, reaching US $5.5 trillion. In 2024, APAC’s e-commerce market was already valued at an estimated US$3.2 trillion.

This rapid growth is reshaping the region’s payment landscape, driving the adoption of digital payments, expanding alternative payment methods, and accelerating the shift away from cash.

In 2014, digital payments already accounted for 42% of e-commerce and 6% of point-of-sale (POS) value, largely skewed by China’s high adoption. Today, the trend is more balanced, with digital wallets leading online payment methods in eight of the 14 APAC markets covered in Worldpay’s Global Payments Report 2025.

Regionally, digital payments have overtaken cash and cards for both e-commerce and POS transactions across APAC, and continue to gain ground as card and cash usage declines.

A fragmented market

Despite these opportunities, APAC is marked by heterogeneity. Unlike Europe, APAC lacks a unified “single market” and spans 30 to 40 countries with different rules, currencies, languages, and payment preferences.

This means that operating across the region often requires businesses to set up separate legal entities, local bank accounts, and tailored payment capabilities.

Some markets, including Singapore and Hong Kong, are relatively easier for foreign businesses to establish a local presence due to clearer regulations and favorable tax environments, making them favored entry points for companies expanding into APAC. On the other hand, jurisdictions such as Japan and Pakistans, present more complex and unique regulatory challenges, Checkout.com warns.

Adoption of security protocols such as 3D Secure also varies, with countries like Japan mandating it explicitly, while others just encourage it.

3D Secure is an online payment security protocol that adds an extra layer of authentication for card-not-present transactions, such as online shopping. It helps prevent fraud and protect both merchants and cardholders from unauthorized transactions, requesting users to verify their identity via, for example, a password, SMS code, banking app, or biometric verification, before the payment is approved.

Across APAC, rising fraud risks have accompanied the rapid adoption of digital payments. Recent research by Visa shows that fraudsters are increasingly targeting popular payment methods, including digital wallets (74%), cards (69%), and buy now, pay later (BNPL) (68%).

Globally, the payment firm estimates that nearly 3.3% of total annual e-commerce revenue is lost to payment fraud. In APAC, for every US$1,000 of accepted e-commerce orders, about US$36 turns out to be fraudulent, while an additional US$55 is rejected due to suspected fraud.

The importance of localization

Checkout.com stresses that localization is essential for building sustainable growth in APAC. By focusing on localized experiences, businesses can improve customer satisfaction and achieve cost efficiency.

In particular, local acquiring, where payments are processed through an acquirer in the same country as the transaction, is generally far more cost-effective than cross-border settlements, which can cost up to three times more per transaction. It also improves approval rates because local issuers are more likely to trust local acquirers.

Checkout.com also emphasizes the need to offer customers their preferred payment methods. According to Adyen, over half of consumers in key APAC markets will abandon an in-store purchase if they do not have a variety of payment options.

Payment preferences, however, can vary greatly from one location to another. In markets like China, India, and Indonesia, for example, digital wallets and local bank transfers dominate e-commerce transactions, while in locations like South Korea and Taiwan, card payments remain preferred.

Meanwhile, some markets, including the Philippines, Japan, and Vietnam, still rely heavily on cash for POS transactions.

The rise of Click to Pay

Another key trend in APAC is the rise of Click to Pay. Click to Pay is a secure, standardized online checkout service that lets consumers pay using stored payment credentials without manually entering card details. This payment method is designed to improve card checkout conversion where cards are used frequently. According to Visa, Click to Pay transactions improve security and boost payment success rates by an average of 2.5%.

In APAC, the adoption of Click to Pay is being driven by network partnerships with payment service providers.

In August 2025, Visa announced a regional expansion of Click to Pay through partnerships with the likes of 2C2P, Adyen, AsiaPay, and Worldpay, making it easier for merchants to implement the service.

This follows Visa’s earlier launch with ZA Bank in Hong Kong, the first issuer in APAC to enable Click to Pay as a standard feature for cardholders. Click to Pay is also live in Vietnam for Techcombank and VPBank Visa cardholders.

Meanwhile, Mastercard has offered Click to Pay programs in APAC since at least 2020 and continues to enhance the service with capabilities, including passkeys and biometric authentication to reduce one-time password (OTP) friction.

As APAC’s payment landscape continues to evolve, Fintech News Singapore will be hosting a webinar on September 24, 2025 at 3:00PM to explore the regional trends shaping the future of the industry. The session will dive into the potential of Click to Pay, as well as the latest innovations in passwordless authentication, and will feature top industry executives and experts from leading organizations, including Worldpay, Visa, and Thales.