Image source: Getty Images

During the week ended 28 March, Aston Martin Lagonda (LSE:AML) was the worst-performing FTSE 250 stock. Its share price fell 14% after Donald Trump announced plans to impose a 25% tariff on all car imports into the US.

This new tax is due to take effect from tomorrow (3 April). Admittedly, there’s never a good time to have to deal with tariffs but the timing for the group is particularly unfortunate given that it’s currently loss-making. Since 2 April 2024, its share price has tanked 58%. Over the past five years, it’s down 88%.

A review of the evidence

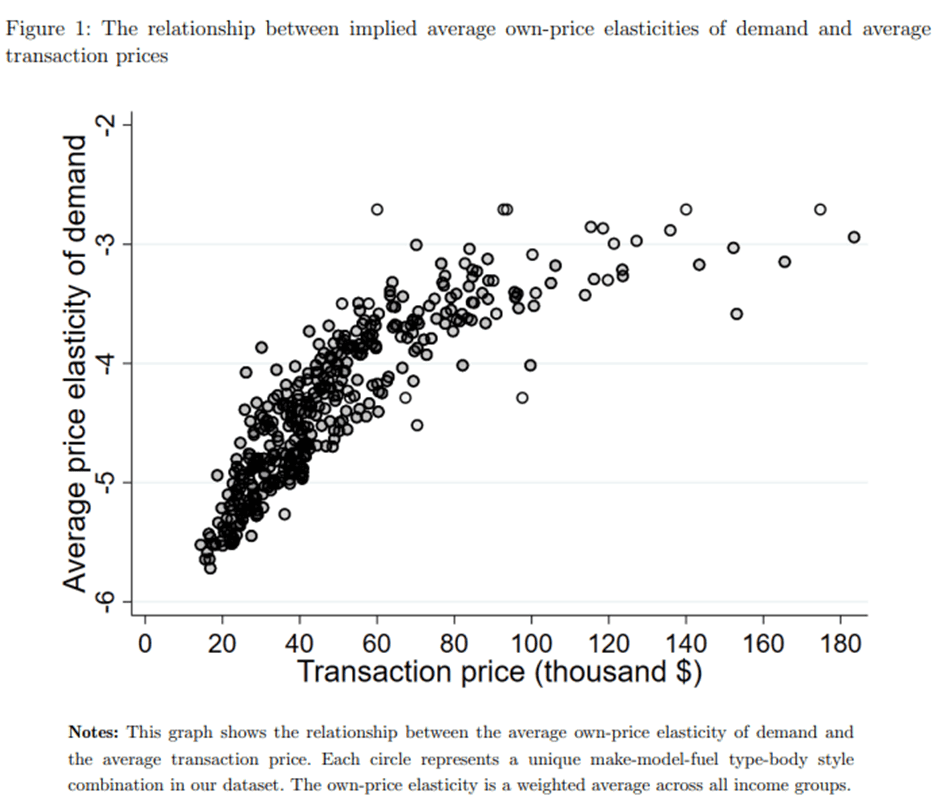

Although price changes affect the sales of luxury goods less than cheaper alternatives, they’re not immune. Economists measure the impact using the price elasticity of demand (PED). Not surprisingly, for most products, there’s a negative relationship between the amount a consumer has to pay for something and the number sold.

In August 2023, an academic paper specifically looked at the impact of prices on car sales. As the chart below shows, across all vehicle types, the PED was negative, albeit less pronounced for more expensive cars.

In 2024, to try and reduce its losses, Aston Martin increased the prices of its cars. Compared to the previous year, its average selling price went up by 5.9% to £245,091. The result was an 8.9% drop in the number sold.

Don’t get me wrong, I’m not suggesting that the fall in vehicle sales of 590 was entirely due to the price increase. Undoubtedly, global economic uncertainty played a part. Sales in China were weaker than anticipated and there was also some supply chain disruption. But I’m certain charging more for its cars was also a contributory factor.

Car-mageddon?

That’s why I’m sure shareholders will be anxious about the impact of Trump’s tariffs. Of concern, the company’s biggest market is the Americas. In 2024, through its network of 45 dealers, the group sold 1,928 cars to the territory, with a value of £629m. Although this isn’t broken down by country, I think it’s reasonable to assume that the US accounted for most of the revenue.

Nobody knows for sure how the company’s top (and bottom) line will be affected but it’s highly unlikely to be good news.

| Region | Cars sold 2024 | % |

|---|---|---|

| The Americas | 1,928 | 32.0 |

| Europe, Middle East and Africa | 1,796 | 29.8 |

| Asia Pacific | 1,220 | 20.2 |

| UK | 1,086 | 18.0 |

| Total | 6,030 | 100.0 |

Mitigation

To strengthen its balance sheet, the company has announced that its major shareholder, headed by its current chairman, is to invest another £52.5m in the company. This will take the Yew Tree Consortium’s interest to 33%. Normally, increasing a shareholding above 30% would require a formal takeover bid to be launched. However, in this case, a waiver is being sought.

The group’s also selling its minority stake in the Aston Martin Aramco Formula One racing team.

But I suspect there will be some difficult times ahead.

In addition to tariffs, the company has to navigate its way through to full electrification of its vehicle range. And it’s a long way from being profitable at a post-tax level.

Of course, Trump could quickly realise that a trade war is in nobody’s interests. And the group still retains an iconic brand with its badge affixed to some beautiful sports cars.

However, with all this uncertainty surrounding the group, making an investment now would be too risky for me.