Image source: Games Workshop plc

For much of the last two years, growth stocks have taken a back seat. High inflation, rising interest rates, and nervous investors drove a shift towards value and defensive sectors. But with inflation now easing and rate hikes likely near their peak, are UK growth stocks finally staging a comeback?

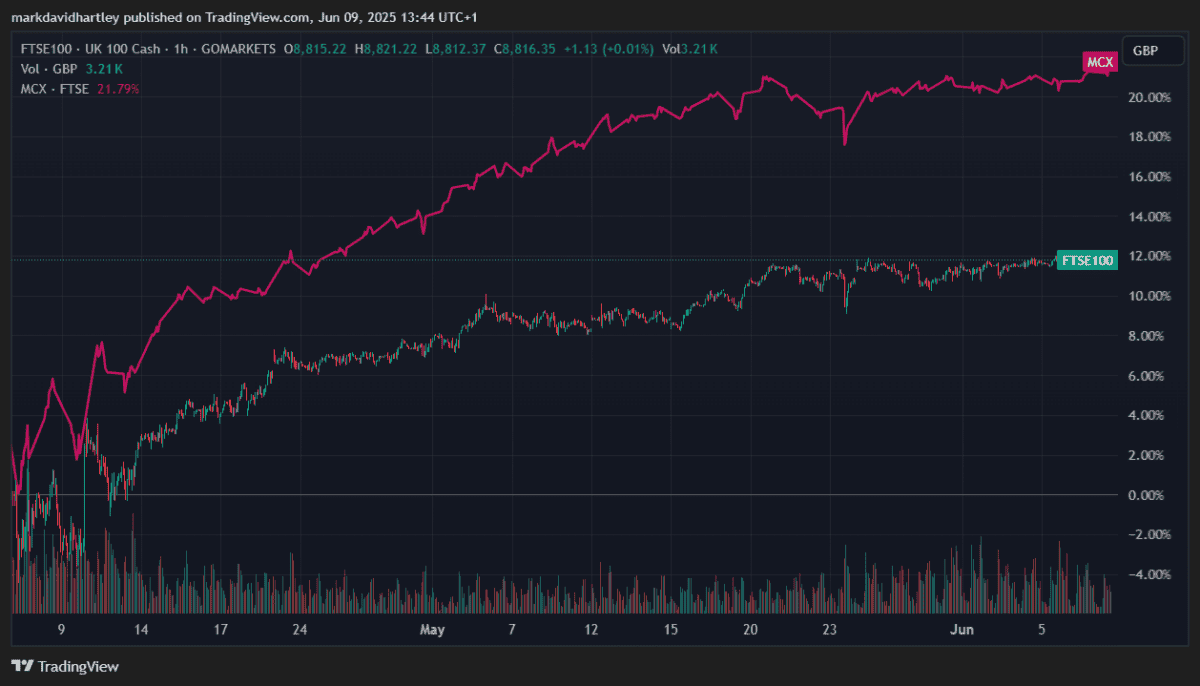

It’s still early days, but the signs are encouraging. The FTSE 250, home to many of Britain’s best growth names, has begun to outperform the FTSE 100 in recent months. That’s typically a sign that investors are starting to favour riskier, faster-growing businesses again.

Why growth stocks struggled

Growth stocks often promise strong future earnings, but much of that value’s tied up in projections. When interest rates rise, those future profits are discounted more heavily, making growth shares look less attractive compared to steady, dividend-paying alternatives. That’s a key reason why tech and consumer discretionary firms underperformed during 2022 and 2023.

But now UK inflation’s dropped to under 3%, and the Bank of England’s expected to further cut rates later this year. If borrowing becomes cheaper, growth companies may find it easier to raise capital, invest, and deliver on those long-term forecasts.

Signs of recovery

Recent results from several high-growth UK businesses have been solid. For example, the hugely popular FTSE 250 company Games Workshop (LSE: GAW) reported record-breaking revenue and profit in its latest update, with international expansion continuing to drive momentum. Its shares are up over 20% year to date.

With complete control over intellectual property, product development and licensing of the increasingly popular Warhammer franchise, its future looks promising.

Revenue’s grown steadily, supported by a loyal fan base, new product releases and expanding retail and online channels. Recent results showed double-digit profit growth, with royalty income from media deals adding a lucrative revenue stream. Despite its niche market, international demand continues to rise.

However, there are risks. The shares trade at a price-to-earnings (P/E) ratio of 30, leaving little room for growth. If results fail to impress, it could lead to short-term losses. Growth’s also tied to consumer spending, which can fluctuate in downturns.

Still, with a cash-rich balance sheet and rising global appeal, the stock’s worth considering for long-term growth.

Another FTSE 250 stock that’s seen renewed growth lately is high street tech retailer Currys. The stock’s surged 30% this year after a strong performance led by sales of artificial intelligence (AI)-integrated laptops. Last month, the company raised its profit forecast for the third time this year after its share price hit a four-year high. And with a P/E ratio of only 7.5, it looks like it still has lots of room to grow.

Opportunity ahead

The tide may be turning for UK growth stocks. Falling inflation and a possible shift in monetary policy have created more favourable conditions for long-term capital appreciation. But selectivity remains key.

While the FTSE 100 tends to favour income and stability, there are still plenty of exciting opportunities for growth in the FTSE 250 and AIM markets. For investors willing to do their homework — and stomach a little volatility — now could be the right time to reintroduce some growth exposure into a balanced portfolio.