Backbase, a digital banking software provider, has launched its AI-powered Banking Platform, following the introduction of its Intelligence Fabric in September 2024.

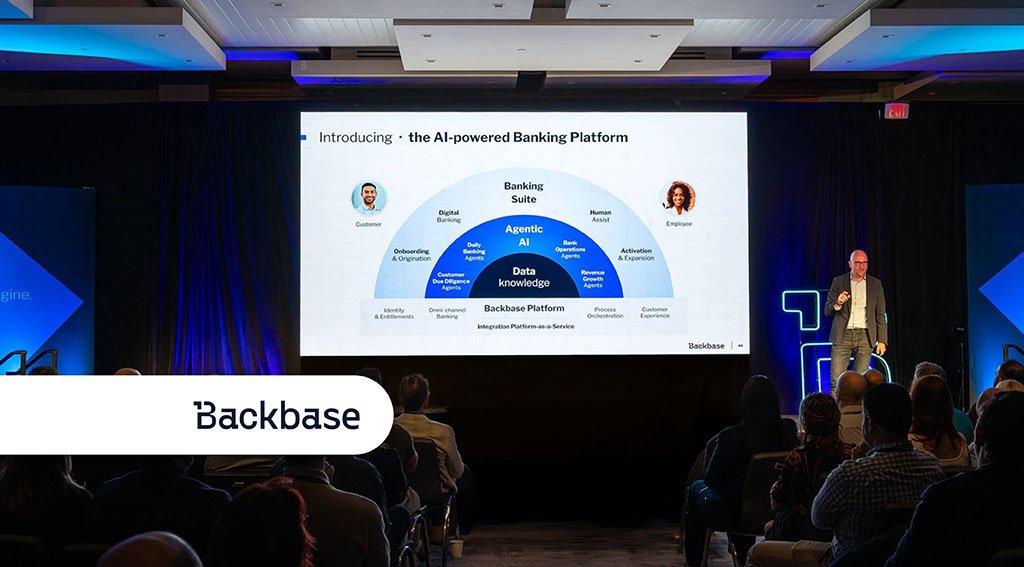

The platform is designed to embed AI into core banking operations by unifying customer service and digital sales—two areas Backbase calls mission-critical for growth and efficiency.

It uses the Intelligence Fabric, a unified data foundation that converts behavioural, transactional, and operational data into real-time, actionable insights.

A key feature is Agentic AI, a set of modular agents built for specific banking tasks.

These agents operate within controlled parameters and are embedded into sales and service workflows to automate tasks, suggest next steps, and improve productivity.

The platform includes security, transparency, and compliance features to support responsible AI deployment.

To help banks implement the platform, Backbase also introduced the AI Factory, a delivery model that embeds its experts within client teams to develop use cases and bridge the industry’s AI talent gap.

According to the company, the platform supports AI-powered self-service, real-time support, automated sales, and personalised customer engagement journeys.

It said banks must now move beyond legacy systems to remain competitive as fintechs continue to advance.

The AI-powered Banking Platform is now globally available.

“Banks do not need more pilots – they need outcomes. With our AI-powered Banking Platform, we’re going all-in on the AI opportunity and empower banks to boost productivity, automate intelligently, and unlock unprecedented growth faster than ever.

This isn’t proof-of-concept AI. This is a packaged, production-ready operating model to move banks from experimentation to execution, fast. AI waits for no bank. It’s not a wait-and-see – it’s here, now, and it’s rewriting the rules of the industry. The time to act is now.”

said Jouk Pleiter, CEO & Founder of Backbase.