When the crypto market turns bearish, most traders panic… but short sellers see an opportunity. Shorting lets you make gains while coins crash, turning volatility into an advantage. This beginner’s guide explains how shorting crypto works, how to manage the risks, and how to use it smartly when the trend is against you.

What Is Shorting in Crypto?

Shorting in crypto, or short selling, is a trading method that allows you to profit when the price of a digital asset goes down. In simple terms, you sell a cryptocurrency you don’t actually own and then buy it back later—ideally at a lower price.

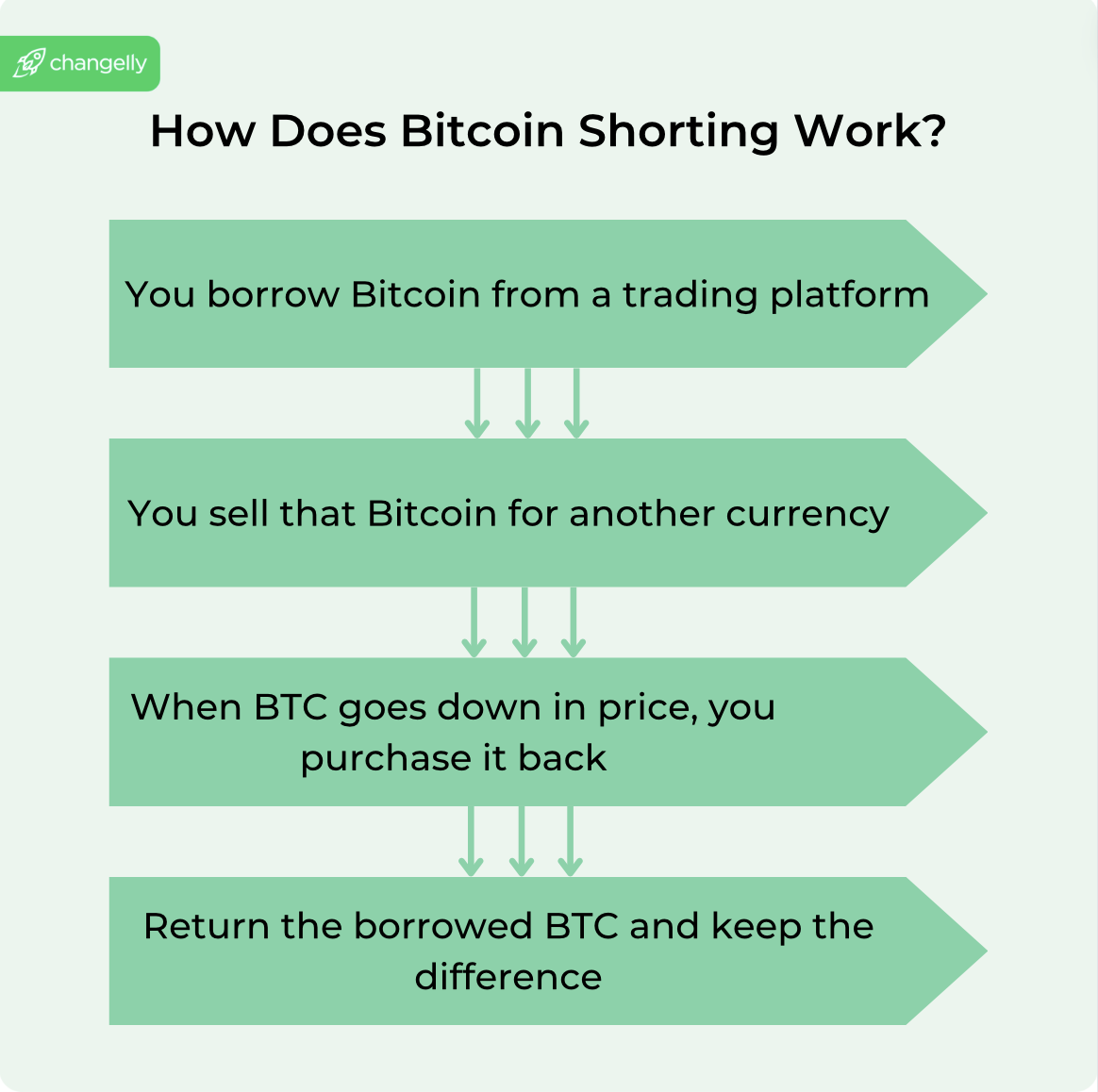

Here’s the basic explanation of the process:

- You borrow a cryptocurrency (for example, Bitcoin) from an exchange or broker.

- You sell it at the current market price.

- When the price drops, you buy it back and return the borrowed amount.

- The difference between your sell price and buy price becomes your profit.

Just like in traditional markets, shorting in crypto means betting that an asset’s value will decline. For instance, imagine you expect Bitcoin’s price to fall soon. You borrow 1 BTC from an exchange and sell it for $60,000. A week later, Bitcoin drops to $40,000. You buy back 1 BTC for $40,000, return it, and keep the $20,000 difference as profit.

That’s the essence of shorting: earning from a market downturn instead of a rally.

Read more: Crypto Trading 101.

Why Traders Short Bitcoin and Altcoins

Traders short Bitcoin and altcoins to take advantage of falling prices or to manage risk during volatile market conditions. In a market where prices can swing dramatically within hours, shorting becomes a tool not just for speculation but also for protection.

Some traders short crypto to profit from downturns. If they believe a coin is overvalued or a correction is due, they open short positions to capitalize on the decline. Others use shorting as a hedging strategy, offsetting potential losses from long-term holdings when the market turns bearish.

Shorting also plays a role in market efficiency. It helps balance extreme optimism by allowing traders to express negative sentiment, which can stabilize prices and reduce bubbles. In short, traders short Bitcoin and altcoins to make money when prices drop, protect their portfolios from downside risk, and maintain flexibility no matter which way the market moves.

When Does Shorting Crypto Make Sense?

Shorting crypto is most practical during clear downtrends or when a correction seems likely after rapid price gains. It can also be useful around major news events or economic shifts that could trigger sell-offs. In calm or bullish markets, however, shorting usually carries more risk than reward.

Stay Safe in the Crypto World

Learn how to spot scams and protect your crypto with our free checklist.

What Are the Factors to Consider for Short Selling?

Short selling Bitcoin and other cryptocurrencies can be profitable, but it carries significant risks. Before deciding if it’s right for you, ask yourself the following questions:

Can you handle volatility?

Crypto markets are highly unpredictable and volatile. Prices can move sharply within minutes. Be honest about whether you can handle the financial and emotional stress of sudden swings.

Do you have a risk management plan?

A solid strategy should include stop-loss and take-profit levels to protect your capital. Always plan your exits before entering a trade.

Read more: Risk Management in Crypto Trading.

Do you use technical analysis?

Indicators like RSI, MACD, and moving averages help identify overbought or oversold conditions. They’re essential tools for timing short entries.

Are you comfortable with leverage?

Leverage lets you control a larger position with borrowed funds, but it also magnifies losses. Only use leverage if you fully understand the risks.

Do you stay informed about the market?

Crypto prices react quickly to news, regulations, and sentiment shifts. Keep up with developments that could impact your short positions.

Have you accounted for fees and borrowing costs?

Shorting often involves interest, funding rates, and trading fees. Always include these in your profit calculations.

Do you understand the legal environment?

Short selling rules and derivative regulations differ by country. Check what’s allowed in your jurisdiction before trading.

How Shorting Works in Crypto

In short (no pun intended): You borrow → sell high → wait for a dip → buy low → return the asset → and keep the profit.

That’s the basic flow of how shorting works in crypto—simple in concept, but risky in practice, especially in fast-moving markets. Here is the same process in a little bit more detail.

Step 1: Borrow the Cryptocurrency

To start shorting, you borrow a cryptocurrency from an exchange or broker. This usually happens through a futures or margin trading account, where the platform lends you the asset in exchange for collateral. The borrowed coins remain on loan until you close your position.

Please note that to open a leveraged short, you must deposit collateral, also called the initial margin. It acts as a security deposit to cover potential losses. The exchange will track your margin balance throughout the trade to ensure you can meet obligations if the market moves against you.

Step 2: Sell the Coins at the Current Price

Once borrowed, you sell the cryptocurrency at the current market price. This converts your position into cash or stablecoins. For example, if Bitcoin trades at $100,000, you sell the 1 BTC you borrowed for that amount, expecting the price to decline soon.

Step 3: Wait for the Price to Drop

After selling, you wait for the market to move in your favor. If your prediction is correct and the asset’s price falls, your short position becomes profitable. During this time, traders often monitor technical indicators—like RSI, MACD, and moving averages—to gauge momentum and potential reversals.

Step 4: Buy Back the Coins at a Lower Price

When the price drops to your target level (for example, from $60,000 to $40,000) you buy back the same amount of crypto you initially sold. This step closes your position and locks in the price difference as potential profit.

Step 5: Return the Coins and Keep the Profit

Finally, you return the borrowed cryptocurrency to the exchange or lender. The profit equals the difference between your selling and buying prices, minus any fees, funding rates, or interest charged on the borrowed funds.

Ways to Short Crypto: Full Breakdown

There’s more than one way to bet against the market in crypto. Some traders prefer direct methods like margin or futures trading, while others use contracts or prediction platforms to profit from falling prices without holding the coins themselves. Each method works a bit differently, with its own mix of risk, complexity, and reward potential.

Shorting with Margin Trading

One of the easiest ways to short Bitcoin, the margin trading strategy allows you to use leverage, meaning you can borrow more money from the exchange than you have deposited in your account. While this opens up doors for higher profits, it is naturally riskier, too—your position may close sooner than you expected if you’re engaging in leveraged shorting.

Read more: Margin Trading in Crypto

There are two main ways to manage margin: cross margin and isolated margin. With cross margin, all available funds in your account back every open position, spreading both risk and collateral across trades. In contrast, isolated margin keeps collateral locked to one position only—protecting the rest of your account if that trade fails. Beginners often prefer isolated margin because it limits potential losses to a single trade.

Shorting with Futures and Perpetual Contracts

Just like other assets, Bitcoin has a futures market. In a futures trade, you essentially agree to buy crypto online—in our case, BTC—on the condition that it will be sold later at a predetermined price. This agreement is called a futures contract.

However, it’s also possible to sell futures contracts. In this case, you’ll be able to benefit from the asset’s price dropping, unlike when buying the contracts.

Shorting with Binary Options

Binary options trading allows you to bet on “yes or no” scenarios. This financial product provides buyers with the option but not the obligation to complete the deal. You basically bet on whether an asset’s price will go up or down. To short sell crypto using this method, you purchase put options.

Binary options trading offers great flexibility and higher-than-usual leverage. We would advise against engaging in it unless you’re an expert trader.

Shorting with CFDs (Contract for Difference)

Contracts for difference, or CFDs, let traders speculate on crypto price movements without owning the asset itself. When you open a CFD short position, you’re agreeing to pay the difference between the opening and closing price of the trade. If the price drops, you profit from the decline, and if it rises, you incur a loss.

CFDs are widely used on traditional trading platforms and are popular for shorting crypto because they’re simple to execute and don’t require direct borrowing. However, they often involve overnight financing fees and are not available in all jurisdictions, including the US.

Shorting with Prediction Markets

Prediction markets are similar to sports betting agencies. Such platforms haven’t been around in the crypto industry for a long time, but they present a good way to short Bitcoin. They allow you to make a wager on a specific outcome, such as “Bitcoin is going to fall by 10% next week.” If somebody takes you up on the bet, you can make quite a hefty profit.

Risks of Shorting Cryptocurrency

When you short, you’re betting against the underlying asset, hoping its price will fall. But if the market moves upwards instead, your losses can grow fast, especially in a market known for extreme price volatility. Add leverage, exchange risks, and unpredictable news events, and shorting becomes a strategy that demands strict discipline and awareness.

Liquidation Explained

Liquidation happens when the value of your collateral drops too low to cover your open short position. The point at which this occurs is called the liquidation price. Exchanges use a mark price—a fair value derived from the average of major markets—to decide when a liquidation should trigger, helping prevent unfair closures caused by short-term price spikes. The mark price is usually based on an index price, which tracks real-time data from multiple exchanges to reflect the asset’s true market value.

In leveraged trading, exchanges automatically close your trade to prevent further losses. For example, if Bitcoin’s price jumps sharply after you short it, your position might be liquidated at a higher price, leaving you with nothing but the loss of your margin. Understanding how liquidation thresholds work is key to managing risk.

Margin Calls and How They Work

Exchanges use a maintenance margin requirement to define the minimum balance you must keep to hold an open position. When your account value drops below that threshold, you’ll receive a margin call. If you don’t add more collateral, the platform can close your trade automatically to prevent further losses.

A margin call is a warning that your account no longer holds enough collateral to support your trade. When this happens, the exchange asks you to deposit more funds to keep your short position open. If you don’t top up your margin in time, the platform may liquidate your assets automatically. Staying above the required margin level is essential to avoid forced losses during sudden market moves.

How Leverage Multiplies Risk

Leverage allows traders to borrow funds and control positions larger than their initial deposit. While this boosts potential profits, it also amplifies losses. A small price increase in the underlying asset can erase your margin entirely. For instance, with 10x leverage, a 10% move against you results in a total loss. Beginners should use minimal or no leverage until they fully understand how it impacts short trades.

Read more: Crypto Leverage Trading

Market Volatility and News Events

Crypto markets are famously unpredictable. News about regulations, exchange hacks, ETF approvals, or even a single tweet can send prices soaring or crashing within minutes. Because shorting relies on price direction, unexpected events can quickly turn a profitable trade into a major loss. Always set stop-loss orders and stay alert to market-moving headlines.

Short Squeeze

A short squeeze happens when heavily shorted assets suddenly rise in price, forcing traders to close positions by buying back the asset. This rush to cover drives the price even higher, amplifying losses for remaining shorts. In crypto, squeezes often occur during sudden rallies or low-liquidity periods, making risk control and stop-loss orders even more important.

Exchange Risk (Hacks, Outages, Regulations)

Even if you predict the market correctly, external risks can derail your trade. Exchanges can suffer hacks, technical outages, or sudden regulatory actions that freeze accounts or liquidate positions. To reduce this risk, trade only on reputable platforms with strong security, transparent policies, and a solid track record. Keeping funds on the exchange for the shortest time possible also limits exposure.

Best Shorting Strategies for Beginners

Shorting can be intimidating at first, but a few simple strategies can make it safer and more manageable. The goal is to control risk, trade with the trend, and stay disciplined—especially in volatile markets.

- Start small with low leverage. Use minimal leverage (1–3x) and small positions until you’re confident with short setups.

- Trade with the trend. Focus on assets already showing clear downwards momentum instead of trying to catch the top.

- Wait for confirmation. Enter only after bearish signals, like a break below support or rejection at resistance.

- Set stop-loss and take-profit levels. When entering a short, you can use a limit order to set the exact price where you want to sell. This helps you avoid entering at a worse price during volatile market moves. Always plan exits in advance to protect your capital and lock in gains.*

- Watch funding rates and fees. Borrowing costs and perpetual funding can reduce profits; factor them into every trade.

- Avoid major news events. Sudden headlines can trigger sharp reversals that wipe out short positions.

*A market order, on the other hand, executes instantly at the best available price. It’s faster but can expose you to higher costs during sudden price swings. The difference between the price you expect and the price you actually get is called slippage. It tends to increase in low-liquidity or fast-moving markets.

Common Mistakes to Avoid

Shorting in the cryptocurrency market can be rewarding, but small errors can lead to big losses, especially when trading derivatives or using leverage. Avoid these common pitfalls to protect your capital and trade smarter.

Using Too Much Leverage

High leverage magnifies both gains and losses. A small move against your position can trigger liquidation. Start with low leverage and focus on consistency, not quick wins.

Ignoring Stop-Loss Orders

Skipping stop-loss orders is one of the fastest ways to drain an account. Always set stops to define risk and prevent emotional decision-making during volatile swings.

Shorting in a Bull Market

Shorting against strong upwards momentum is risky. When trading volume and sentiment are bullish, prices can surge higher before correcting, wiping out short positions.

Choosing the Wrong Platform

Not all exchanges handle short trades equally. Pick a platform with high liquidity, strong security, and transparent funding terms to ensure smooth execution and fair pricing.

Not Understanding Fees and Funding Rates

When shorting derivatives, costs add up: Borrowing fees, funding rates, and trading commissions can eat into profits. Always calculate these expenses before opening a long or short position.

Legal and Regulatory Considerations

Crypto regulation moves fast, especially now that authorities pay even closer attention to the market. There have been many efforts to make trading safer and more transparent. Before opening a short, it’s worth knowing which rules apply and how they might affect where and what you can trade.

- Federal legislation is advancing. The GENIUS Act provides the first major US law regulating stablecoins, setting clear reserve-backing and audit standards.

- Regulatory authorities are clarifying oversight. The Commodity Futures Trading Commission (CFTC) issued a “Request for Comment” on perpetual futures—a key derivative vehicle for shorting crypto.

- Industry participation must meet compliance standards. Platforms offering trading derivatives on digital assets must contend with overlapping scrutiny from both the Securities and Exchange Commission (SEC) and CFTC, depending on asset classification.

- Global and platform-specific rules matter. Prediction markets, margin trading, and other models of shorting crypto may be subject to local licensing, anti-fraud, and platform registration requirements.

So what should you do?

- Verify that any exchange or broker you use is licensed for derivatives in your jurisdiction.

- Understand how your trade (futures, perpetual, CFD) is regulated and what protections apply.

- Be aware that regulatory changes can affect fees, eligible users, or the very ability to open short positions.

Final Thoughts

Shorting crypto can be powerful when used with discipline and clear risk controls. Start small, learn how different instruments work, and treat every trade as a chance to understand market behavior. As you gain experience, you’ll see that successful shorting isn’t just about predicting a drop. It’s about reading momentum, managing leverage, and staying calm when the market turns.

FAQ

How much money should I start with when trying my first short trade?

Start small, with just enough crypto to test your strategy and manage risk comfortably. Many traders begin with an amount they can afford to lose while learning how short and long positions react to Bitcoin price swings.

Is it better to short Bitcoin or altcoins as a beginner?

Bitcoin is generally more liquid and less volatile than most altcoins, making it easier for beginners to understand how traders bet on market trends. Altcoins can offer bigger moves but also carry higher risk.

Can I lose more than I invest when shorting crypto?

Yes. Because a coin’s price can rise indefinitely, losses on a short position are theoretically unlimited. Always use stop-loss orders and low leverage to control potential downside.

What indicators or signals do traders use to decide when to short?

Traders watch market trends and technical signals such as RSI, MACD, and moving averages to spot overbought conditions. These indicators help them time entries when momentum shows a potential reversal in bitcoin price or other assets.

Read more: The Best Indicators for Crypto Trading

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.