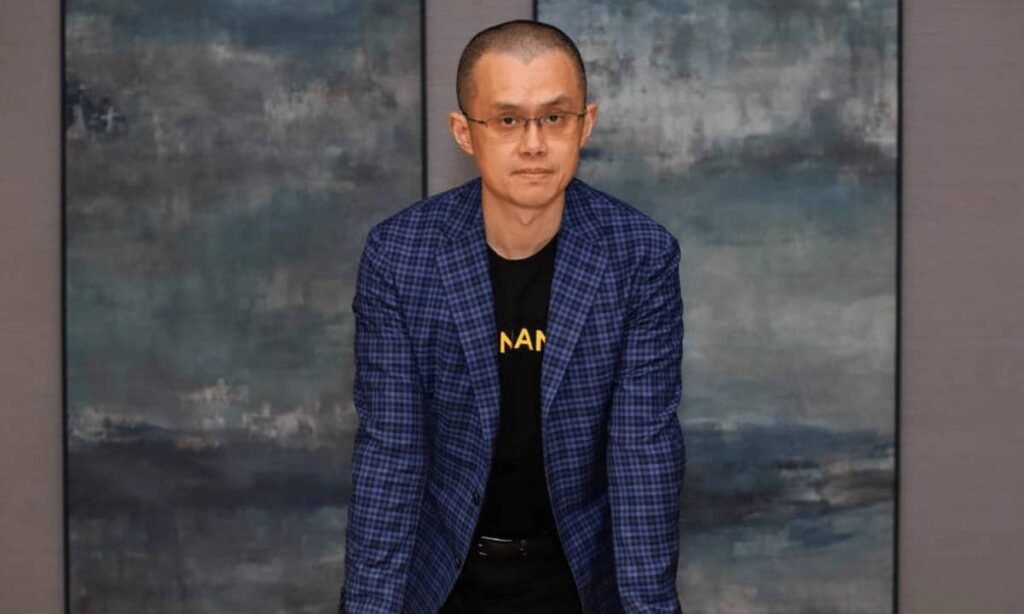

Changpeng Zhao (CZ) has filed a motion to dismiss a $1.76 billion lawsuit brought against him by the FTX bankruptcy trust.

He says the court has no legal authority over him because he lives in the United Arab Emirates (UAE).

CZ’s Defence

According to a Bloomberg report, his legal team submitted the motion on Monday to the U.S. Bankruptcy Court for the District of Delaware, asserting that the accusations fall outside the court’s reach.

“The claims are so far removed from Delaware and even the United States that the statutes at issue, which lack extraterritorial application, do not even apply,” his lawyers wrote in the filing.

Lodged in November 2024, the lawsuit accuses Zhao, Binance, and several former executives of receiving billions of dollars in funds that were wrongfully moved by FTX founder Sam Bankman-Fried (SBF). It focuses on a July 2021 deal where the exchange sold back its equity in FTX’s international and US-based entities. According to the trust, Binance held a 20% stake in FTX’s international unit and 18.4% in the U.S. arm.

Court records show that Alameda Ltd, a company registered in the British Virgin Islands, transferred the funds for FTX. On the other hand, the Binance entities involved were registered in Ireland, the Cayman Islands, and the British Virgin Islands. CZ’s legal team argues this makes the transaction foreign and outside the reach of U.S. bankruptcy laws. They also claim he was a “nominal counterparty” in the deal, meaning he was not deeply involved in the process.

Zhao’s submission also described the relationship between FTX and Binance as only temporary. They ended their partnership due to personal disagreements, after which Binance’s equity in Bankman-Fried’s business was exchanged for cryptocurrency.

The crypto entrepreneur claims the lawsuit unfairly blames him and Binance for the collapse of FTX, which he described came about as a result of SBF’s misconduct. He also argued that serving legal papers through U.S.-based lawyers is not valid under bankruptcy law when the defendant lives abroad. His team says the trust is trying to stretch its claims beyond U.S. borders in ways that are not supported by the law. They say the fraud claims do not meet the standards required for protection under federal rules tied to securities contracts.

Former Binance Executives Also Seeking Dismissal

This development follows similar motions filed last month by former Binance executives Samuel Wenjun Lim and Dinghua Xiao, who are also named in the FTX suit and are seeking to be removed from the case.

CZ completed a four-month prison sentence in September last year after pleading guilty to U.S. anti-money-laundering violations. Meanwhile, Sam Bankman-Fried is serving 25 years for fraud and conspiracy.

Elsewhere, the defunct exchange announced it will start distributing the next batch of creditor claims on September 30. As of August 2025, it has returned approximately $6.2 billion to former customers across two major rounds.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!