Binance, the world’s largest crypto exchange, has moved to dismiss a $1.76 billion clawback lawsuit filed by the estate of the now-defunct FTX exchange.

In court documents filed on Friday (May 16), Binance argues that the claim lacks merit and states that the court has zero jurisdiction over the case.

🚨 BREAKING: Binance moves to dismiss FTX’s $1.76B lawsuit, calling it “legally deficient.”

FTX accused of deflecting from its collapse due to fraud. CZ’s FTT liquidation blamed!

Will the court agree? 🤔#Binance #FTX #CryptoNews

— Glowing AxolHodl (@GlowingAxo) May 20, 2025

Binance believes FTX Legal Team is attempting To Shift Responsibility Away From FTX Founder Sam Bankman-Fried

In the court filings from last week, Binance states that the legal team representing FTX is wrongly portraying Binance and its co-founder, Changpeng Zhao, as the masterminds of a scheme to undermine the now-defunct exchange.

Binance filed the court documents with a Delaware judge late last week. In them, the exchange claims that FTX is merely attempting to pass responsibility for its collapse onto another party.

Binance believes that the FTX legal team is taking this route to avoid holding former CEO Sam Bankman-Fried accountable as the chief conspirator. Bankman-Fried was sentenced to 25 years in federal prison last year during a long-standing case that prosecutors described as ‘one of the largest corporate frauds in history’.

The $1.76 billion clawback dispute has a lot of history behind it. It began with a 2021 transaction in which FTX repurchased a 20% stake that Binance held in the company.

That buyback was complex as it involved a mix of digital assets, including BNB, BUSD, and FTX’s native token, FTT. Around November 2022, with rumours swirling of financial instability within FTX at that time, CZ took to X, stating that Binance would be offloading its FTT holdings.

Binance just decided to exit #FTX & #FTT!!!

🚨🚨🚨🚨🚨🚨 pic.twitter.com/dW9bwDBYir

— Duo Nine ⚡ YCC (@DU09BTC) November 6, 2022

DISCOVER: Top 20 Crypto to Buy in May 2025

FTX Estate Believes CZ’s Public Comments Caused Its Downfall

This is where the FTX estate claims that Binance and CZ were instrumental in the collapse of FTX, as they argue the public comments from CZ caused a cascade of withdrawals that put the nail in the coffin for the exchange.

The counterclaim from Binance states that FTX continued to operate for more than 16 months after that 2021 buyback transaction, and the lawsuit failed to prove that statements made by CZ were false.

As a final point, Binance’s legal team argues that the court lacks personal jurisdiction, stating that Binance is headquartered outside of the US and CZ was not directly involved in the buyback sale.

This longstanding legal battle is part of the broader efforts by the FTX estate to recover funds for its creditors. Over $11 billion is owed to victims of the FTX collapse. There are strong reports that the recovery estate plan will begin significant creditor distributions on May 30.

The entire crypto community will be watching for the market reaction on May 30. After a multi-year legal debacle, many investors will finally be reimbursed, which could lead to billions of fresh liquidity being injected back into the markets.

Many of the creditors being reimbursed going into June are seasoned traders and investors unlucky enough to have their funds caught up in the FTX collapse.

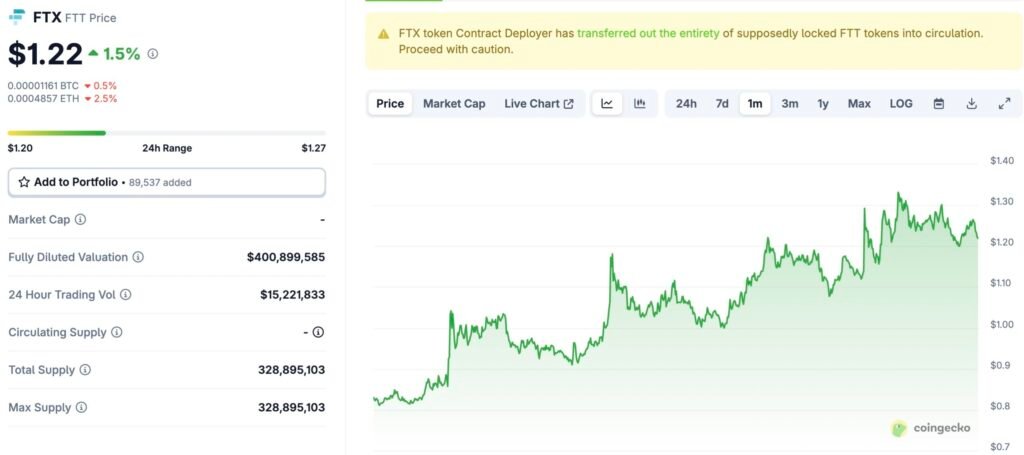

Surprisingly, the FTT token is up 1.5% daily, currently trading for $1.22. Per CoinGecko, it still has a market cap of $400 million while having zero use. Even more surprising is its trading volume, processing over $15 million in the past 24 hours alone.

EXPLORE: Top Solana Meme Coins To Buy In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Binance Files Motion To Drop FTX’s $1.76 Billion Clawback Lawsuit appeared first on 99Bitcoins.