Binance has pinpointed a market maker for the MOVE token. The company claims it dumped 66 million tokens post-Movement launch, securing $38 million in profit as a result.

Surprisingly, the Movement Network Foundation said that it was unaware of the market makers’ activity. But the foundation will use the recovered funds for a buyback program named “Movement Strategic Reserve.”

Once Binance made them aware of market maker’s activity, the Movement Network Foundation claimed it cut all relationships with the entity. The foundation has since collaborated with Binance to recover the funds. Furthermore, the foundation has committed to using the funds to buy back MOVE from the public markets.

NEW: BINANCE OFFBOARDED AND FORBID ANY FURTHER MARKET MAKING ACTIVITIES BY A MARKET MAKER OF THE PROJECT MOVEMENT (MOVE) ON BINANCE pic.twitter.com/r18MVpMUrS

— DEGEN NEWS (@DegenerateNews) March 25, 2025

Binance Plans To Keep The Markets Transparent, With $38 Million Freeze Of Movement Crypto Market Maker

Leading crypto exchange Binance identified a market maker for Movement crypto (MOVE) that allegedly dumped millions of tokens following launch. Binance has since frozen the market maker’s profits.

Binance released a statement today (March 25), stating the actor was associated with another market maker it had off-boarded on March 9, forbidden from further activities on the platform due to misconduct.

The crypto exchange claimed that one day after MOVE was listed on December 10, around 66 million MOVE tokens were sold by the market maker, with “little buy orders.” The user made a net profit of 38 million USDT before being banned from Binance a week ago today, on March 18.

EXPLORE: Top Solana Meme Coins to Buy in March 2025

In a rare win for crypto projects and investors, Binance said it had informed the Movement Labs and Movement Foundation teams of the irregularities with their market maker. Binance froze the proceeds “for the purpose of compensating users.”

Binance made it clear that a projects authorized market makers on its platform must place orders for both bid and ask. They must also ensure sufficient order size within the specified depth levels, maintain a healthy and stable spread for market activity and retain orders for a certain amount of time.

DISCOVER: Why is Crypto Up Today? Is Cronos (CRO) The Best Crypto To Buy?

Movement Network Foundation Respond To Binance’s Asset Recovery Efforts

In its own statement, the Movement Network Foundation confirmed that Binance had informed it of an ongoing investigation into market-making activities involving MOVE on 11 March 2025.

Distancing itself from the unsavoury activity, the foundation said, “Movement Network Foundation and Movement Labs had absolutely no knowledge that this was happening.”

“We chose to work with this market maker as they had already supported projects in the Movement ecosystem,” the company said.

The MOVE team went on to thank Binance for its investigation. The foundation added that the market maker had acted against the project’s wishes, without consent, and was in breach of its agreement that required it to provide liquidity on both sides of the MOVE/USDT pair.

Per the company statement, all proceeds will be used by the Movement Network Foundation to establish the “Movement Strategic Reserve.” It will act as a 38 million USDT buyback program to with the goal to “purchase MOVE for long-term use and to return the USDT liquidity to the Movement ecosystem.”

Working alongside Binance, the buyback program will take place over the next three months.

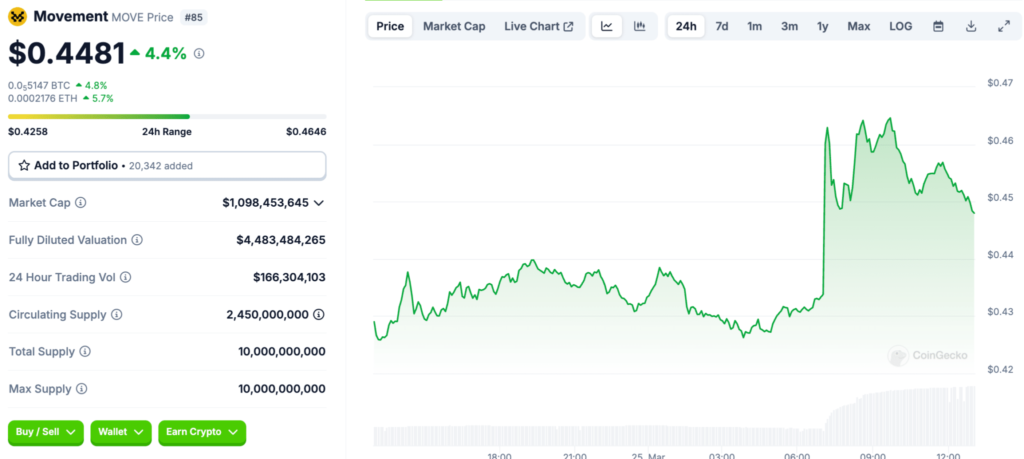

On the back of this news, MOVE is up over 4% on the day, having processed $144 million in trading volume within the same time frame. Movement crypto was originally developed at Meta (formerly Facebook) by a team of people from Facebook’s now-defunct ‘Diem’ stablecoin project.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Binance freeze $38 million USDT from Movement (MOVE) market maker that dumped tokens post-launch

- The market maker was found to be linked to a previously banned market maker by Binance

- Movement have thanked Binance for the recovery of the funds and claim they had no knowledge of its market maker’s activity

- The Movement Network Foundation promise to use the funds to create a buyback program to enrich its ecosystem

The post Binance Identifies Movement Crypto Market Maker That Dumped $38 Million MOVE Tokens appeared first on 99Bitcoins.