Yesterday, Bitcoin (BTC) once again faced rejection around the $120,000 resistance level after briefly reaching a high of $119,760. At the time of writing, the top cryptocurrency is trading slightly lower at $118,900. However, a sharp increase in whale inflows to Binance threatens to trigger further downside pressure for the digital asset.

Binance Whales Ramp Up Bitcoin Deposits

According to a recent CryptoQuant Quicktake post by contributor BorisVest, Bitcoin whale activity on Binance has increased significantly in recent days. In particular, the Binance Whale Inflow metric recorded a notable spike on July 25, signalling rising institutional participation in exchange deposits.

Related Reading

On that day alone, the 30-day cumulative inflow to Binance surged by $1.2 billion, fuelling short-term selling pressure across the market. Data from CoinGlass shows that between July 24 and July 25, roughly $141 million worth of BTC long positions were liquidated as a result.

It’s worth noting that alongside this spike in whale deposits, retail investors have also been moving their holdings to exchanges. However, their participation remains relatively low in comparison, hinting that recent selling pressure is predominantly whale-driven.

The following chart illustrates that while retail inflows have been trending upward for weeks, the sudden increase in whale deposits has introduced additional fragility into Bitcoin’s price structure.

The surge in Binance whale inflows came just before Bitcoin was rejected at the critical $120,000 level. Following this rejection, BTC retraced to the $115,000–$116,000 range, which is now acting as short-term support. The analyst noted:

This area is now acting as a short-term support zone. If it fails to hold, a move toward the $110K level becomes increasingly likely. On the other hand, if Bitcoin can bounce strongly from this region, there is still potential to retest $121K and even attempt a new all-time high.

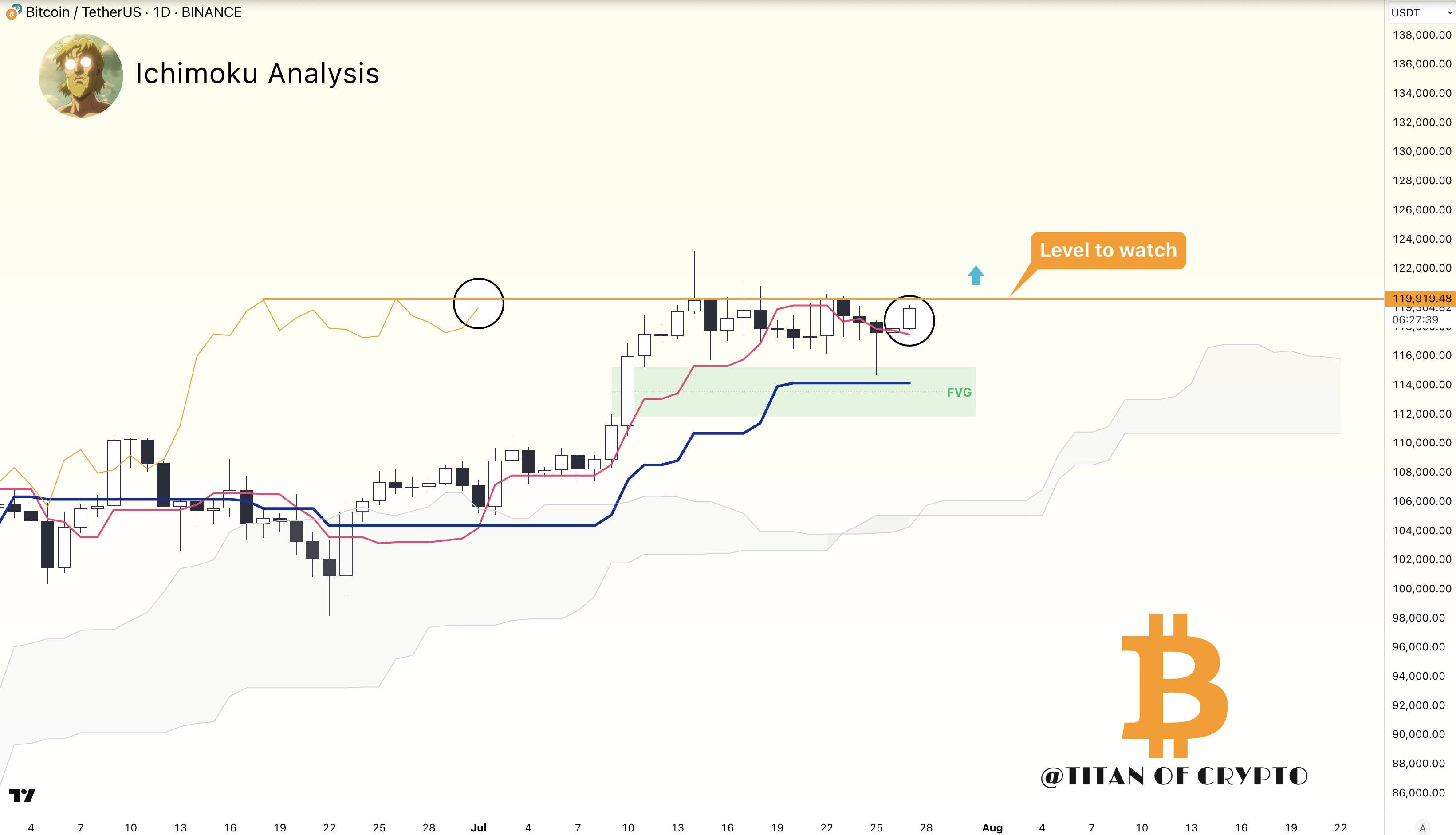

BorisVest concluded that BTC’s near-term price trajectory will be determined by how well the market absorbs whale sell-off. Meanwhile, fellow crypto analyst Titan of Crypto remarked that if BTC decisively breaks through the $119,900 level, then it could eye new all-time highs (ATH).

What Else Does Exchange Data Suggest?

Whale inflows aren’t the only factor spooking investors. BTC reserves on centralized exchanges also recently reached a one-month high, suggesting that some holders may be anticipating a temporary pullback or consolidation phase before resuming the uptrend.

Related Reading

That said, Binance’s share of BTC spot trading volume recently saw a sharp rise, suggesting that a rally may be on the horizon for the world’s leading cryptocurrency. At press time, BTC trades at $118,926, up 0.4% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com