Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After an eventful start to the week marked by a sharp downward swing below $100,000, the Bitcoin price has recovered excellently, returning above the $107,000 mark to close the week. In spite of Bitcoin’s recent recovery, there seems to be a different sentiment in the market which, interestingly, has been growing over time. Here’s how the current growing sentiment could affect the premier cryptocurrency’s future trajectory.

Short Positions Surge Over The Past 7 Days — What This Means

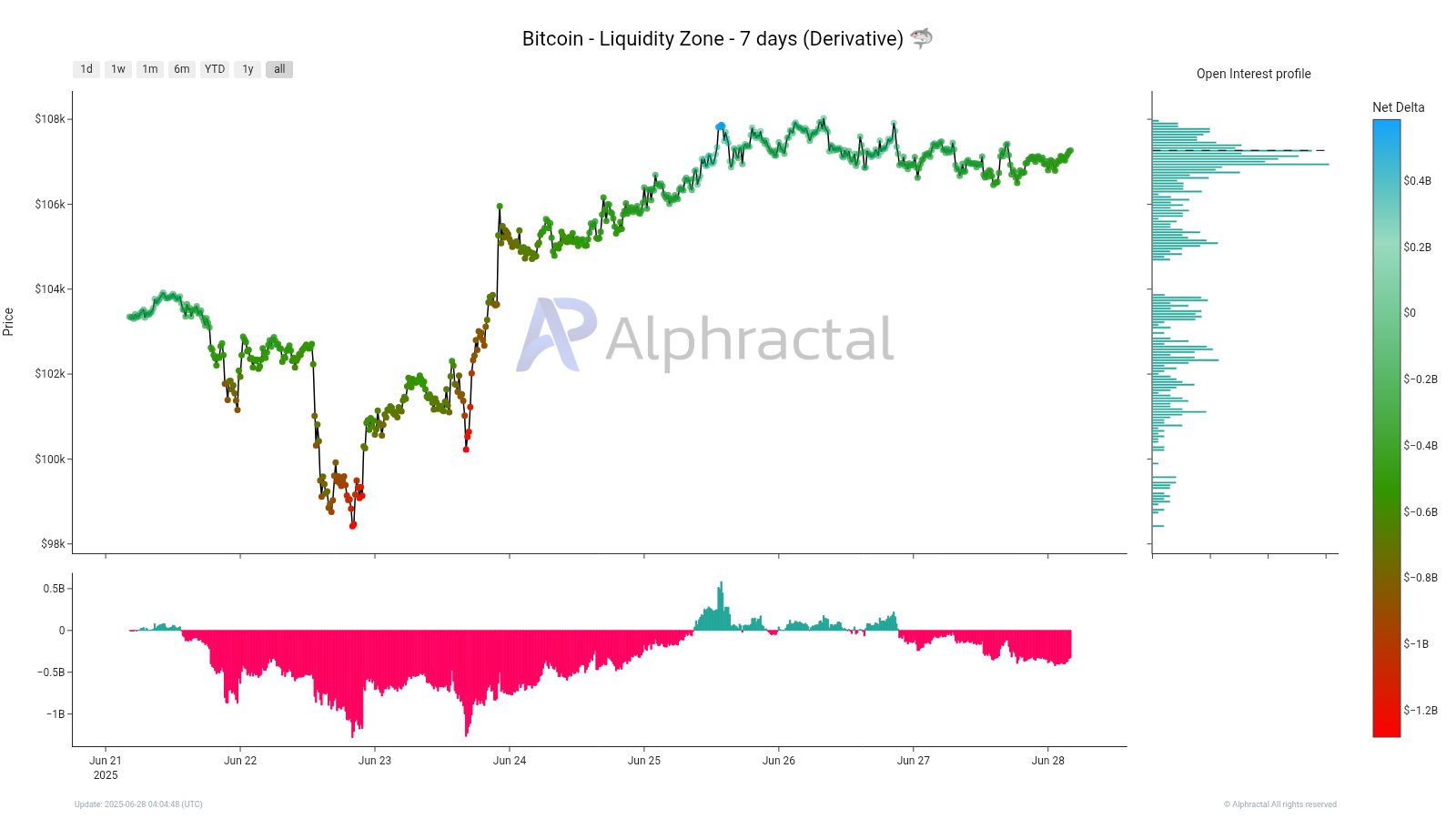

In a June 28th post on social media platform X, cryptocurrency analytics firm Alphractal shared an interesting on-chain development in the Bitcoin market.

Related Reading

This on-chain observation is based on the Liquidity Zone (7 Days) indicator, which measures three important data: on one hand, it is used to monitor the price movement of Bitcoin; on another, the Net Delta of open interest or positions; and, lastly, it shows the distribution of open interest at various price levels.

For a little context, the open interest Net Delta measures the difference between long and short open positions in the market. If the Net Delta reads positive, it means the buyers populate the market more. On the other hand, a negative reading means there are more short positions open than longs.

In the post on X, Alphractal pointed out that, over the span of seven days, more positions have been opened in a bet against the price of BTC. From the chart below, the red bars represent a negative Net Delta. As has been formerly explained, what this means is that the short traders currently dominate the market.

Interestingly, the shorts-dominated market does not exactly guarantee that we will experience a sell-off in the near future. This is because the high negative Net Delta was recorded at a time when Bitcoin’s price is still at a stable level, even with little growth.

When sell positions are opened in a stable but bullish market, this usually indicates that the bears might be getting trapped. If, eventually, the Bitcoin price overcomes the sell resistance, a phenomenon known as a short squeeze will occur.

In this scenario, sellers will be forced to buy back at higher prices, thereby pushing the Bitcoin price to the upside. This upward momentum will then further liquidate short positions.

What’s Next For Bitcoin?

There are uncertainties as to whether the Bitcoin market might break the sell resistance, or go in favour of the sellers. For this reason, Alphractal warns that those with bearish sentiment should be cautious about their next move.

Related Reading

As of this writing, Bitcoin seems stuck within a choppy range over the past day and is currently valued at $107,309. The flagship cryptocurrency’s measly growth of 0.2% in the past 24 hours pales in comparison to its seven-day rise of 5.2%.

Featured image from IStock, chart from TradingView