Bitcoin has soared past the $98,000 on Thursday, fueling intense debate among traders over whether the $100K milestone is again within reach or if the current rally is vulnerable to a swift correction. Behind the scenes, market observers point to surging open interest (OI) and increased leverage, spotlighting the possibility of a leverage-driven push.

Bitcoin Rally Or Trap?

CryptoQuant community analyst Maartunn (@JA_Maartun) warned of a “leverage driven pump,” noting a $2.4B jump in Bitcoin’s OI within 24 hours. Via X, he wrote: “Leverage Driven Pump: $2.4B (7.2%) increase in Open Interest in Bitcoin over the past 24 hours.”

Confirming these observations, well-known crypto commentator Byzantine General (@ByzGeneral) highlighted the significant role of fresh long positions in propelling prices higher: “Lots of fresh longs coming in here on BTC which is shoving price higher. Kinda funny that the entire market is getting lifted right now off the back of these degen longs here.”

Analysts from alpha dojo (@alphadojo_net) echoed sentiments of caution, underscoring a notable gap between futures-based open interest and spot-driven purchases: “BTC continues to grind upwards, while the OI rises steadily, but there is little spot buying. BTC is now approaching the upper end of the range again. It seems that some market participants have tried to frontrun Saylor‘s planned $2 billion bid.”

Though the prospect of a large buy could propel the market, they warn that without fresh catalysts like a “short-term narrative or positive news, it currently looks like BTC will struggle to sustainably pump above the $100k mark.”

Renowned crypto analyst Bob Loukas provided a cyclical framework for interpreting Bitcoin’s price movements, noting that the market may be approaching the end of one multi-week cycle and the start of another: “We’re on verge of completing a Bitcoin Weekly Cycle, as I’ve been sharing last 6 weeks. For context, there have been just 5 weekly Cycles since the 2022 bear market lows. (Avg 6month events). 4 of these cycles had 90-105% moves. One failed to do much (June-Sept 23).”

When asked if this signals an imminent market top, Loukas clarified:“I’m saying we’re about to begin a new one. Cycles always begin from the lows.” His comments suggest that while a cycle transition is imminent, it does not necessarily equate to a market peak—rather, it could mark the start of a new uptrend.

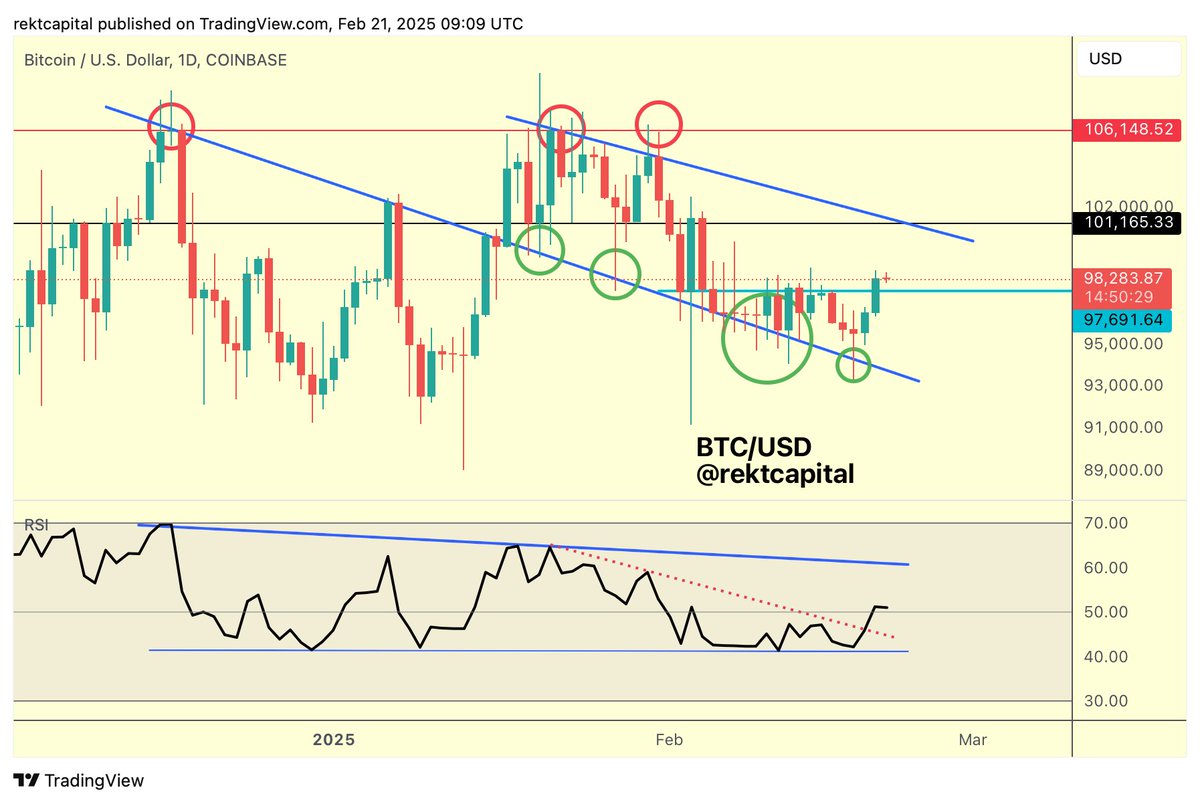

Technical analyst Rekt Capital (@rektcapital) emphasized the significance of Bitcoin’s daily close above the $97,700 threshold, suggesting that a successful retest of this zone could pave the way for a move beyond $100,000: “The early-stage momentum generated by the Bullish Divergence has translated itself into this recent breakout move. And with the recent Daily Close above ~$97700, Bitcoin will now try to retest said level as support to enable trend continuation.”

He further elaborated on Bitcoin’s relative strength index (RSI) channel, implying that the break above a series of lower highs may signal the next leg up: “Over time, Bitcoin’s price continued to retest the blue trendline as support. And the RSI continued to hold its Channel Bottom. Lately, the RSI broke its series of Lower Highs, indicating that the RSI may be ready to uptrend to the Channel Top.”

Looking ahead, a clear retest of $97,700 as support could confirm Rekt Capital’s bullish outlook: “Daily Close above $97700 has been successful (light blue). Any dips into $97700 would constitute a retest attempt. A post-breakout retest of $97700 into new support would fully confirm the breakout to position BTC for a rally to $101k resistance.”

At press time, BTC traded at $98,645.