Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

According to a CryptoQuant Quicktake post published earlier today, Bitcoin (BTC) may not have reached the peak of the current market cycle just yet. A key on-chain metric suggests that there could be one final leg up for the leading cryptocurrency before this bull market concludes.

Bitcoin To Hit New Peak Soon?

Data from CoinGecko shows that Bitcoin has dropped more than 23% since reaching its most recent all-time high (ATH) of $108,786, on January 8. The top digital asset has largely been affected by ongoing global macroeconomic uncertainties, particularly those related to US President Donald Trump’s new tariff policies.

Related Reading

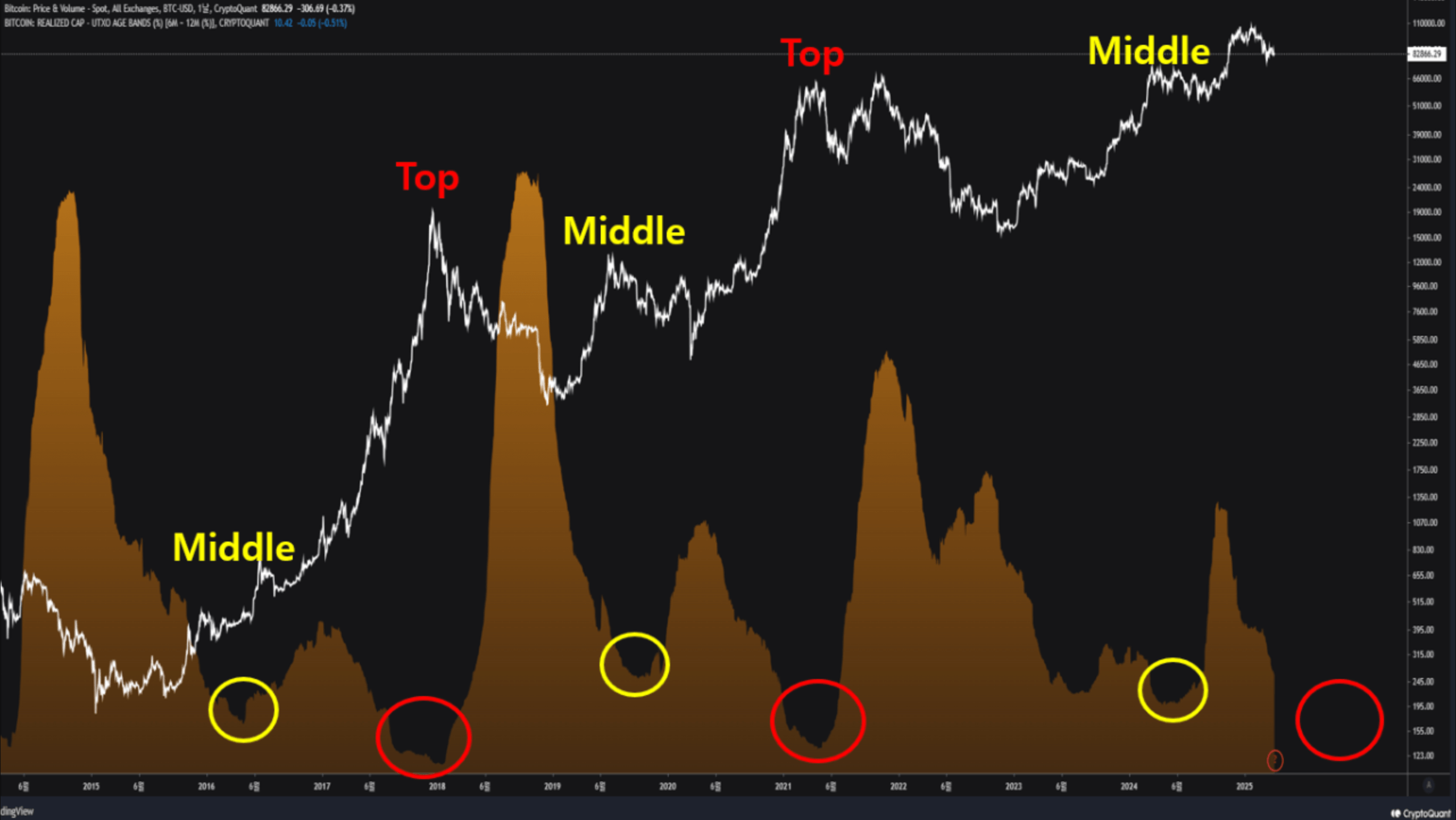

Despite the pullback, CryptoQuant contributor Crypto Dan believes Bitcoin may still have room to run. In a recent Quicktake post, he pointed to the ratio of BTC volume traded over a six to 12-month period as a crucial indicator of the current market cycle’s progression.

This ratio reflects the amount of new capital entering the crypto market during the cycle and has historically been tightly correlated with market movements. According to Crypto Dan:

Typically, this ratio first declines, signalling the end of the early phase of the bull cycle. After some time, it declines again, reaching a lower level than the first drop, marking the end of the bull cycle.

Following the first decline in the ratio, the market often regains bullish momentum. Subsequently, the second leg of the rally tends to attract latecomers and retail investors whose participation sends BTC to new highs.

Finally, as market euphoria begins to peak and distribution phase begins, the volume ratio experiences a second, sharper decline. Finally, the second drop in the ratio marks the end of the bull cycle and precedes a significant market correction.

According to the following chart, BTC hit a critical midpoint in March 2024, when the six to 12-month volume ratio experienced its first notable decline – consistent with patterns observed in previous cycles. The ratio now appears to be entering its second and final dip, potentially leading Bitcoin toward this cycle’s ultimate peak.

BTC Holders Seeing Current Pullback As Temporary

Multiple indicators suggest that Bitcoin holders see the ongoing market correction as short-term. For example, recent analysis by CryptoQuant contributor Onchained revealed that short-term BTC holders are continuing to hold their coins despite being in a loss – possibly in anticipation of an upcoming bullish reversal.

Related Reading

Additionally, exchange net flow data points toward a potential price rally, indicating reduced selling pressure. At press time, BTC is trading at $82,086, down 1.5% in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com